Charting 2020 – A Year Of Speculative Mania

Authored by Lance Roberts via RealInvestmentAdvice.com,

As we prepare to wrap up the year, 2020 will go down in the record books as a year of the “unexpected.” While no one expected the world to get besieged by a raging pandemic, equally, no one expected the year to end in a “speculative mania.”

In February, before the world recognized the pandemic, we updated our 2019 report on rising “recession” risks. At that time, the media and Wall Street analysts were cavalier that there was “no recession” on the horizon, and S&P earnings would rise to $170/share by the end of 2021.

As we noted then:

“The risk to the market, and the economy, is not “sick people.” It is the shutdown of the global supply chain.

The compilation of the data all suggests the risk of recession is markedly higher than what the media currently suggests. Yields and commodities are suggesting something quite different.”

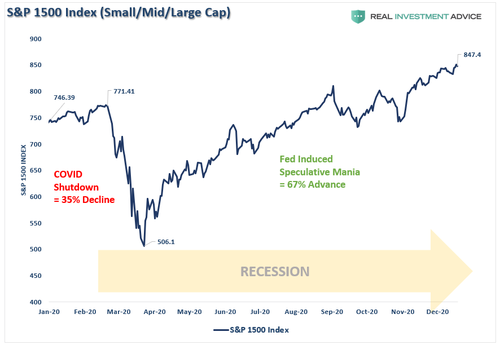

A month later, the world came to a standstill. Over the next month, the stock market fell 35% from all-time highs as the economy sank into the deepest recession since the “Great Depression.”

However, the decline in stock prices triggered the most massive financial response in history.

Enter The Fed

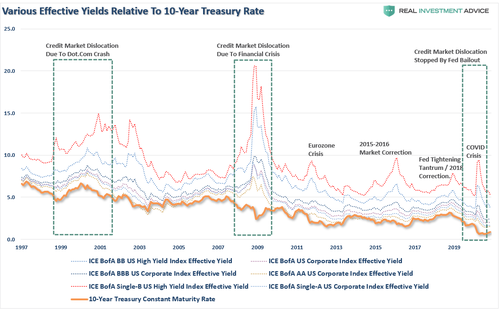

While the stock market rout was vicious, it was the blowout in credit spreads that worried the Federal Reserve the most. Wall Street routinely tells us the major banking institutions are well-capitalized. In reality, it only takes minor increases in rates to push them to the point of insolvency.

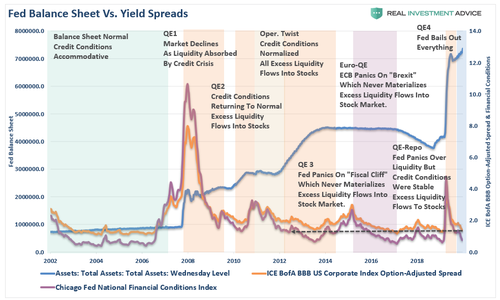

As the COVID-19 crisis accelerated and the economy shut down, the Federal Reserve intervened with a slew of monetary interventions. Those interventions led to the largest increase in their balance sheet on record.

The interventions immediately reversed the “yield reversion” and pushed “financial conditions” back to record lows to the Fed’s credit. Of course, with “super easy monetary conditions” and a decade of training, investors rushed into the markets to “buy everything.”

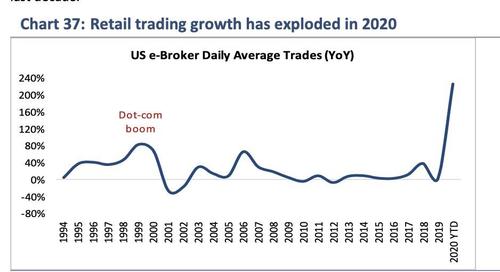

Of course, if investors don’t have any money with which to invest, you can’t have a bull market in stocks. With sports gambling shut down due to the pandemic, gamblers turned to the stock market to feed the addiction.

Stimulus Turns Gamblers To Traders

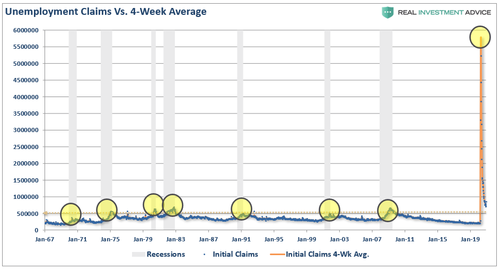

Throughout history, recessions have not been kind to stock markets. The COVID-driven recession should have been no different, with a record number of unemployed and levels of unemployment claims dwarfing any previous recessionary period.

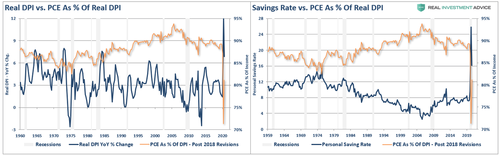

With the Government providing unemployed workers with more money in benefits than they earned previously, disposable income shot up. However, with the economy locked down, the money remained in savings.

Flush with Government “stimulus,” individuals shifted their bets from sports to stocks.

The Rise Of The Robinhood Trader

Such was a point we made in: Is it 1999 or 2007? Retail Investors Flood The Market:

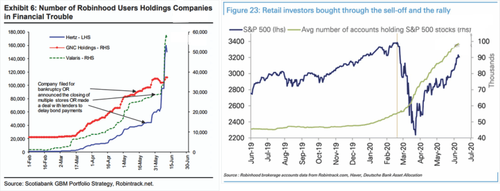

“Free trading app Robinhood has added more than three million retail accounts in 2020, and now has over 13 million. The median age of its retail customer is 31. The Covid-19 lockdowns and the plunge in markets in March persuaded millions of new investors to open accounts. Some of the action appears to be from people who would otherwise be gambling or betting on sports—both of which were shut down.” – Barron’s

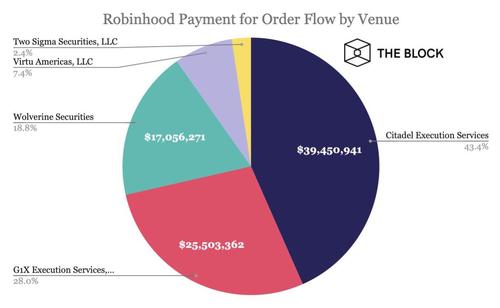

As we noted in that article, Robinhood, which provided “free trades” to retail investors, wasn’t doing it for free. To wit:

“The irony is that Robinhood really isn’t ‘stealing from the rich.’ In reality, they are ‘getting rich by stealing from the poor.’ As is always the case, there is no ‘free lunch,’ as Robinhood bundles orders and then ‘sells’ the flows to major hedge funds for profit.

Those hedge funds then ‘front run’ the ‘Robinhooders’ taking advantage of their trading. (If this wasn’t massively profitable for hedge funds they wouldn’t pay millions for the data.)”

Not surprisingly, Robinhood recently settled with the SEC for $65 Million for precisely that reason.

Vaccine & Election Spurs The Bulls

As the markets recovered from the March lows, investors turned their focus to hopes of more stimulus and a vaccine. Yet repeated disappointments left the markets trading mostly sideways during the seasonally weak summer months. As we noted in “Market Surges Post-Election:”

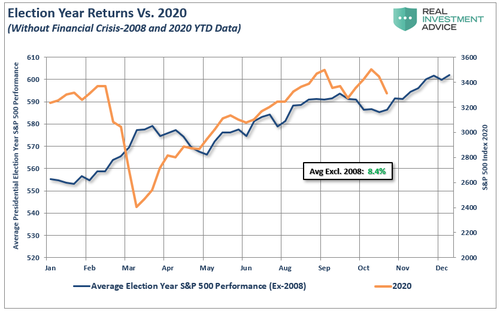

“Currently, the markets continue to trade in line with election year statistics. While the markets have certainly been under pressure over the last few weeks, the decline has remained orderly for the most part.

A look back at all election years since 1960 shows an average increase in the market of nearly 8.4% annually (excluding the 2008 ‘financial crisis and current 2020 performance.” –Selloff Overdone

Since we wrote that article, the market has continued to perform as expected, recently setting new all-time highs. The election of Joe Biden and deliveries of “vaccines” have pushed investor exuberance to extremes. Such was precisely the point in “Overly Bullish:”

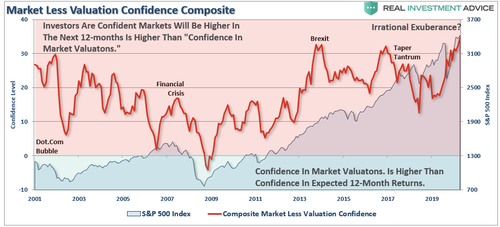

“The chart below shows the combined average of institutional and individual investor valuation confidence subtracted from future returns confidence. When the reading is positive, the confidence the market will be higher one year from now is more elevated than the confidence in the market’s valuation. The opposite is the case when the reading is in negative territory.

The key takeaway is that investors think simultaneously, the market is over-valued but likely to keep climbing.”

Such is the same phenomenon famously described by former Fed Chair Alan Greenspan in a December 1996 speech on “Irrational Exuberance.”

Signs Of A Mania

Finally, as the year-end of 2020 approaches, there are signs everywhere the markets have reached a “mania” phase.

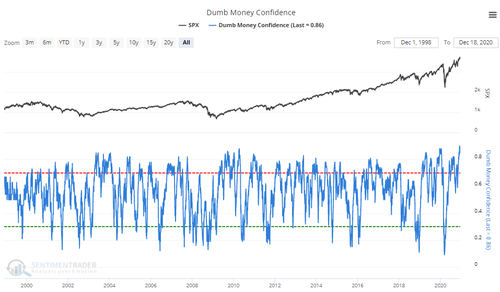

Currently, “retail investors” are more confident than ever before.

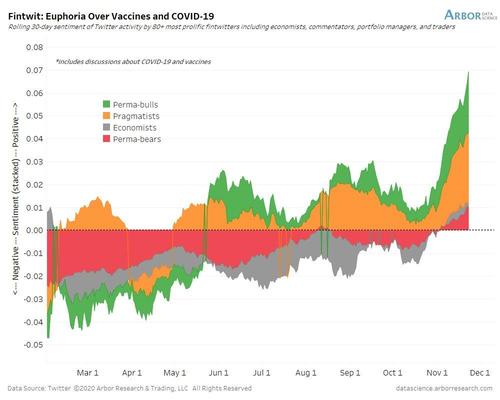

To more extreme levels of exuberance by almost everyone. As noted in “Irrational Exuberance:”

“You have to wonder precisely how much ‘gas is left in the tank’ when even ‘perma-bears’ are now bullish. Therefore, the question we should ask is ‘if everyone is in, who is left to buy?’”

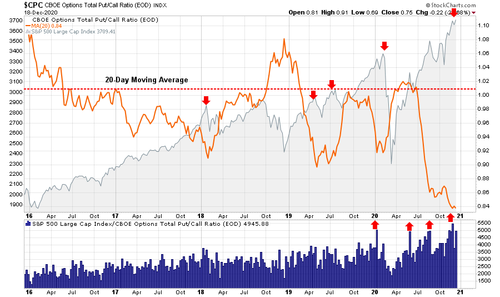

It is not just sentiment, but also the speculative positioning of investors. Currently, options traders are exceedingly confident the market will not crash.

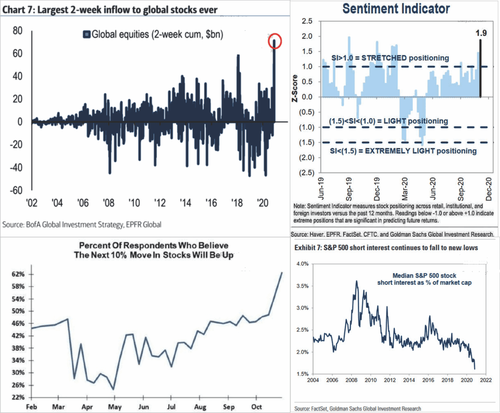

That confidence shows up in many indicators showing investor positioning into equity “risk” at a rather alarming rate. The 4-panel chart below shows investors have piled into equity funds, have a high level of confidence about the future, and complete evaporation of “short-interest” in the market. (Charts courtesy of The DailyShot)

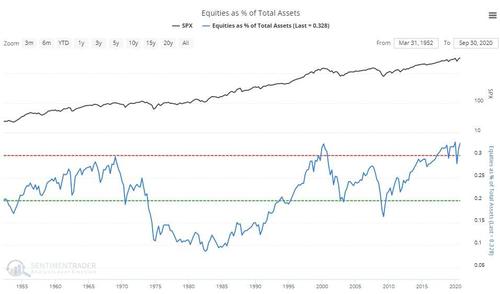

Such has led to the highest concentration into stocks by investors on record.

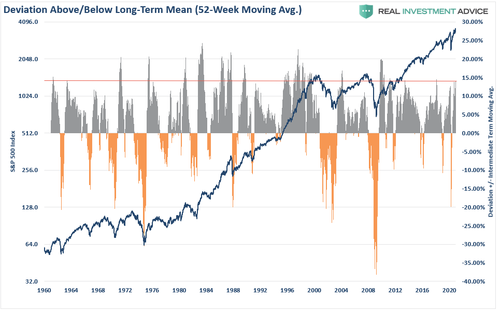

With some of the most extreme deviations from long-term means, investors are likely once again setting themselves up for disappointment. Such is not even to mention the long-term correlations to valuations.

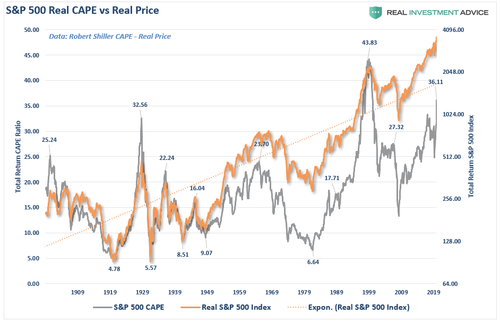

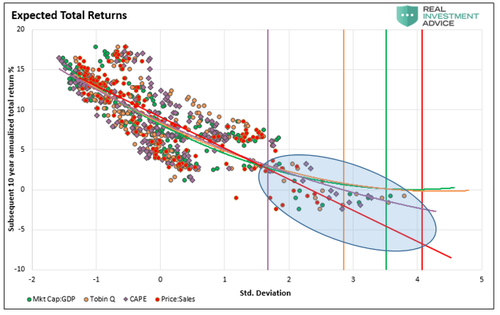

As noted in “Why This Isn’t 1920,” the highest correlation between stock prices and future returns comes from valuations.

Looking Ahead To 2021

Currently, analysts are rushing to pin the highest 2021 price target on the S&P 500.

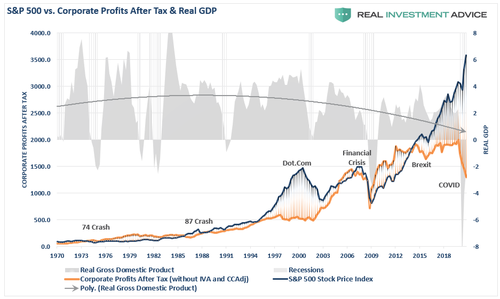

Will they be right? The question will come down to whether economic growth and, ultimately, corporate profitability will be strong enough to catch up with the market’s exuberance. The last two times the market was this detached from profits, the outcome was not terrific.

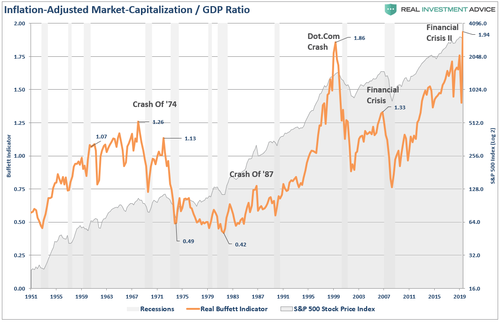

We find the same with investors giving a larger valuation to “equities” than the underlying “economy” from where corporate revenues are derived.

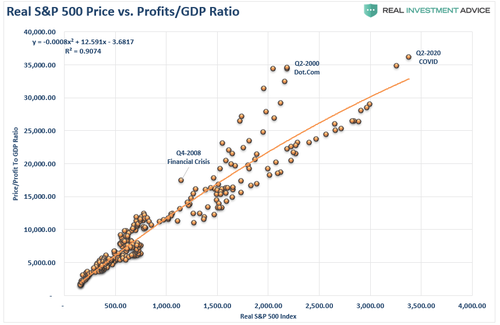

The indicator shows us that when “disconnects” between market participants and the underlying economy occur, a reversion ensues. The correlation is more evident when looking at the market versus the ratio of corporate profits to GDP. With a 90% correlation, investors should not dismiss these deviations.

Since corporate profits are a function of economic growth, the correlation is not unexpected. Hence, neither should the impending reversion in both series. It isn’t just market cap to GDP but every measure of valuation, all at once.

7-Impossible Trading Rules

So, that’s 2020, where the “unexpected” happened more than anyone could have expected. Therefore, as we head into 2021, it is reasonable to expect the “unexpected” could undoubtedly happen again, in either direction. As such, here are the 7-impossible trading rules to follow:

1) Sell Losers Short: Let Winners Run:

It seems like a simple thing to do, but the average investor sells their winners and keeps their losers, hoping they will eventually return to even.

2) Buy Cheap And Sell Expensive:

If an investment isn’t “cheap, – it isn’t. Don’t make excuses to justify overpaying for an investment. In the long run, overpaying always reduces returns.

3) This Time Is Never Different:

As much as our emotions and psychology always want to hope for the best – this time is never different. History may not repeat exactly, but it generally rhymes.

4) Be Patient:

There is never a rush to invest. There is also NOTHING WRONG with sitting on cash until a real opportunity comes along. Being patient is an excellent way to keep yourself out of trouble.

5) Turn Off The Television:

The only thing you achieve by watching the television from one minute to the next is increasing your blood pressure.

6) Risk Is Not Equal To Your Return:

Risk only relates to the loss of capital incurred when an investment goes wrong. Invest conservatively and grow your money over time with the least amount of risk possible.

7) Go Against The Herd:

When everyone agrees on the market’s direction due to any given set of reasons – generally, something else happens. Such also cedes to points 2) and 4). To buy something cheap or to sell expensive, you are buying when everyone is selling and selling when everyone is buying.

Conclusion

The markets are indeed currently exceedingly exuberant on many fronts. With margin debt back near peaks, stock prices at all-time highs, and “junk bond yields” near record lows, the bullish media continues to suggest there is no reason for concern.

Of course, such should not be a surprise. At market peaks – “everyone’s in the pool.”

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

Such brings up some essential investment guidelines as we head into year-end.

Investing is not a competition. There are no prizes for winning but there are severe penalties for losing.

Emotions have no place in investing.You are generally better off doing the opposite of what you “feel” you should be doing.

The ONLY investments that you can “buy and hold” are those that provide an income stream with a return of principal function.

Market valuations (except at extremes) are very poor market timing devices.

Fundamentals and Economics drive long-term investment decisions – “Greed and Fear” drive short-term trading. Knowing what type of investor you are determines the basis of your strategy.

“Market timing” is impossible– managing exposure to risk is both logical and possible.

Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

There is no value in daily media commentary– turn off the television and save yourself the mental capital.

Investing is no different than gambling– both are “guesses” about future outcomes based on probabilities. The winner is the one who knows when to “fold” and when to go “all in”.

No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

The one lesson you should have learned in 2020?

“The unexpected outcome occurs more often than you expect.”

Tyler Durden

Thu, 12/31/2020 – 16:25

via ZeroHedge News https://ift.tt/3hws0st Tyler Durden