“People Are Starting To Scramble”: 2020’s Newbie Traders Face A Lesson In Capital Gains Taxes

It was all fun and games for Robinhood traders during 2020 – the gains seemed to be unlimited after the market crash in March, anyone could trade stock options, FinTwit was abuzz. Many new traders cut their teeth and learned how to trade for the first time in 2020.

But now, as tax day 2021 rolls around, newbie traders are learning another lesson: how capital gains taxes work, and why “what you make” isn’t always “what you make”.

And the due diligence traders are interested in doing on paying taxes seems to be far less than the due diligence many are doing by reading r/WallStreetBets. One 19 year old trader, who made $5,000 last year, told Bloomberg: “I read up on it and everything that I saw didn’t lead me to believe that I had to pay, however I was at the grocery store or something so I didn’t dive into it as much as I needed to.”

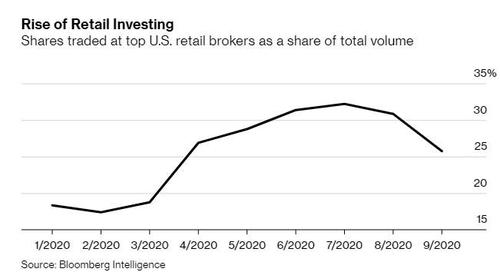

Retail traders now account for 20% of all stock volume in the U.S., according to Bloomberg. Many of those traders simply don’t yet understand the tax implications of trading.

20 year old trader Mac Coughlin said: “That’s a whole other process that I need to learn. Quite honestly I have no idea about any of it. I took a small loss over the whole course of the year so in terms of filing and tax returns I do not really understand the process.”

Ryan Marshall, a financial planner and partner at ELA Financial Group, said: “The biggest misconception most investors have is that they won’t be taxed as long as they don’t withdraw the money.”

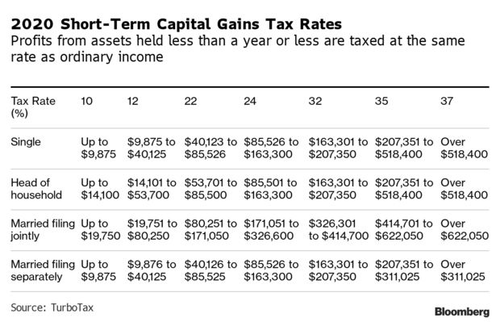

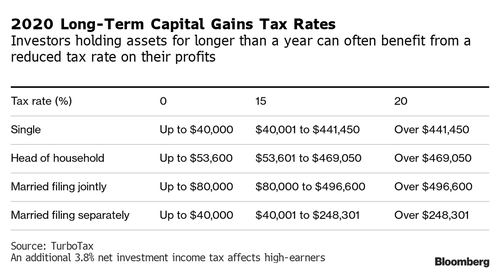

Most traders are learning for the first time that short-term capital gains are taxed at higher rates than long-term capital gains, which take affect after a year and a day. As Bloomberg points out, married couples who earn up to $80,000 pay nothing on long-term capital gains and qualified dividends. Most other middle class income groups pay 15% and the top rate is 23.8% for long term gains.

Matthew Savello, a certified public accountant, said: “Now that it’s actually coming time to file, people are starting to scramble a little bit. One of the key things is you have to budget it. Probably most of the people I talked with actually have losses, there’s not many who can actually pull this off successfully. And for the ones who do, budgeting has become quite an issue.”

Jordan Kendall, a partner at Marcum LLP, said: “It’s to your benefit to pay it off as quickly as you can. Many taxpayers don’t realize that if you’re delinquent in tax filings and you owe the government money, they could withhold your passport and stop you from traveling internationally. They could make your life difficult.”

For reference, here is a look at what 2020 short term capital gains taxes look like:

And 2020 long term capital gains taxes:

Tyler Durden

Fri, 01/29/2021 – 20:20

via ZeroHedge News https://ift.tt/39ybq9n Tyler Durden