Key Events In The Coming Action-Packed Week: Payrolls, PMIs, Politics And Tons Of Earnings

It’s another big week for earnings and data, with the PMIs for January (today and Wednesday) as well as the US jobs report (Friday) the main highlights. In terms of a peak week of earnings, Amazon and Alphabet tomorrow are going to see the main focus.

As DB’s Jim Reid adds, there’s also the Bank of England’s latest decision on Thursday, along with further political developments in Italy as consultations continue on forming a new government. Expect to hear more about the US stimulus package with the reconciliation process likely starting as a bipartisan approach is probably unlikely to work even if GOP lawmakers have offered a $600bn package over the weekend. Biden will meet with 10 Republican senators today to discuss.

A quick note on PMIs: overnight China’s Caixin manufacturing PMI disappointed after coming in at 51.5 (vs. 52.6 expected). Earlier, official Chinese PMIs also showed the same theme with manufacturing printing at 51.3 (vs. 51.6 expected) and services at 52.4 (vs. 55.0 expected). Japan’s final manufacturing PMI was at 49.8, +0.1pt better than flash. Manufacturing PMIs for other countries in the region remained relatively stable, with Vietnam at 51.3 (vs. 51.7 last month), Taiwan at 60.2 (vs. 59.4 last month), India at 57.7 (vs. 56.4 last month) and Indonesia at 52.2 (vs. 51.3 last month).

Looking at other data, DB economists expect a +100k increase in payrolls, which comes off the back of a -140k decline in December, and see the unemployment rate remaining at 6.7%. That decline in nonfarm payrolls in December marked the first time that the US economy had shed jobs since the height of the first wave of the pandemic back in March and April 2020, and it’s worth noting that the number of people in work still remains nearly 10m lower than its prepandemic peak back in February, so there’s still a long way to go before we get back to normality in the labor market. After last week one wonders how many of these unfortunately displaced were part of the r/wallstreetbets crew.

Meanwhile, earnings season continues in full flow over the week ahead, with a further 111 companies from the S&P 500 reporting and 71 Stoxx 600 companies. In terms of the highlights to look out for, today we’ll hear from Thermo Fisher Scientific, then tomorrow we’ll get results from Amazon, Alphabet, Pfizer, Exxon Mobil, Amgen, UPS, BP, Alibaba and Ferrari. Wednesday then brings releases from PayPal, AbbVie, Qualcomm, Novo Nordisk, Siemens, GlaxoSmithKline, Santander, Sony, Biogen, Volvo and Nomura. On Thursday, we’ll hear from Roche, Gilead, Merck & Co., T-Mobile US, Unilever, Royal Dutch Shell, Bristol Myers Squibb, Philip Morris International, Ford and Nokia. Finally on Friday there’s results from Linde, Sanofi and BNP Paribas.

At the midpoint of earnings season – 52% of the S&P has reported – the market has seen a record high number of beats (85%), with the size of those beats roughly in line with last quarter at 17% which is close to the highest on record. This reflects how estimates have continued to lag the macro data, however the market has not necessarily rewarded these beats. Equity positioning was relatively high coming into the earnings season, valuations high and investors may be looking ahead to further lockdowns in the coming quarter and worries over upcoming guidance.

Courtesy of DB, here is a day-by-day calendar of events

Monday February 1

- Data: January manufacturing PMIs from South Korea, Indonesia, Japan, India, Russia, Turkey, Italy, Germany, South Africa, Euro Area, UK, Brazil, Canada, US, Japan January vehicle sales, Italy preliminary December unemployment rate UK December mortgage approvals, Euro Area December unemployment rate, US December construction spending, US January ISM manufacturing

- Central Banks: Fed’s Bostic speaks

- Earnings: Thermo Fisher Scientific

Tuesday February 2

- Data: France preliminary January CPI, Italy Q4 GDP, Euro Area Q4 GDP

- Central Banks: Reserve Bank of Australia monetary policy decision, Fed’s Mester speaks

- Earnings: Amazon, Alphabet, Pfizer, Exxon Mobil, Amgen, UPS, BP, Alibaba, Ferrari

Wednesday February 3

- Data: January services and composite PMIs from Japan, China, India, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US, Italy preliminary January CPI, Euro Area January CPI estimate, US January ADP employment change, ISM services index

- Central Banks: Fed’s Bullard, Harker, Mester and Evans speak

- Earnings: PayPal, AbbVie, Qualcomm, Novo Nordisk, Siemens, GlaxoSmithKline, Santander, Sony, Biogen, Volvo, Nomura

Thursday February 4

- Data: Germany January construction PMI, UK January construction PMI, US weekly initial jobless claims, December factory orders, preliminary Q4 nonfarm productivity

- Central Banks: Bank of England monetary policy decision, ECB publishes Economic Bulletin, Fed’s Daly speaks

- Earnings: Roche, Gilead, Merck & Co., T-Mobile US, Unilever, Royal Dutch Shell, Bristol Myers Squibb, Philip Morris International, Ford, Nokia

Friday February 5

- Data: Japan preliminary December leading index, Germany December factory orders, Italy December retail sales, US January change in nonfarm payrolls, unemployment rate, December trade balance

- Central Banks: Reserve Bank of India monetary policy decision, BoE Governor Bailey and ECB Vice President de Guindos speak

- Earnings: Linde, Sanofi, BNP Paribas

* * *

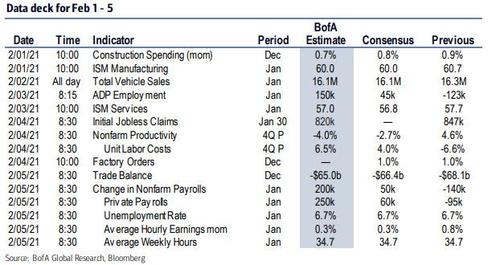

Finally looking at just the US, Goldman notes that the key economic data releases this week are the ISM manufacturing and non-manufacturing reports on Monday and Wednesday, jobless claims on Thursday, and the January employment report on Friday. There are several speaking engagements from regional Fed presidents this week.

Monday, February 1

- 09:45 AM Markit manufacturing PMI, January final (consensus 59.1, last 59.1)

- 10:00 AM Construction spending, December (GS +1.0%, consensus +0.8%, last +0.9%): We estimate a 1.0% increase in construction spending in December, with scope for an increase in private residential and a rebound in public construction spending.

- 10:00 AM ISM manufacturing index, January (GS 61.0, consensus 60.0, last 60.5): We expect the ISM manufacturing index to rise by 0.5pt to 61.0 in the January report, reflecting net improvement in the regional manufacturing surveys and the GSAI as well as our expectation of continued industrial resilience during the third wave.

- 12:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will speak on the economic outlook as part of a virtual event. Prepared text is not expected. Questions from the audience are expected.

- 01:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a virtual event hosted by the Chicago Council on Global Affairs.

- 02:00 PM Atlanta and Boston Fed Presidents Bostic (FOMC voter) and Rosengren (FOMC non-voter) speak: Atlanta Fed President Raphael Bostic and Boston Fed President Eric Rosengren will give remarks at the Atlanta Fed’s “Uneven Outcomes in the Labor Market” virtual conference.

Tuesday, February 2

- 01:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will discuss the economic and fiscal outlook in an event hosted by the Dallas/Fort Worth Association for Corporate Growth.

- 02:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will give remarks at the Atlanta Fed’s “Uneven Outcomes in the Labor Market” virtual conference.

- 05:00 PM Lightweight motor vehicle sales, January (GS 16.0mn, consensus 16.1mn, last 16.3mn)

Wednesday, February 3

- 08:15 AM ADP employment report, January (GS +25k, consensus +70k, last -123k): We expect a 25k rise in ADP payroll employment, reflecting an increase in jobless claims and the impact of declining December payrolls on the ADP model.

- 08:30 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a discussion on the economic outlook as part of an event hosted by the Northside Economic Opportunity Network.

- 09:45 AM Markit services PMI, January final (last 58.0)

- 10:00 AM ISM services index, January (GS 56.2, consensus 56.7, last 57.2): We estimate the ISM services index declined by 1.0pt to 56.2 in January, reflecting the impact of the third wave as well as convergence towards our GS Non-Manufacturing Survey Tracker (at 52.9 in January). We also note scope for a pullback in the supplier deliveries component, following elevated holiday shipping trends in November and December.

- 01:00 PM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will speak on the economic and monetary policy outlook at an event hosted by the CFA Society of St. Louis.

- 02:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will speak at the Atlanta Fed’s “Uneven Outcomes in the Labor Market” virtual conference.

- 05:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will participate in a moderated discussion with a panel of former regional Fed presidents at an event hosted by the Council for Economic Education.

- 05:00 PM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will participate in a discussion on the economy and monetary policy as part of a virtual event.

Thursday, February 4

- 08:30 AM Nonfarm productivity, Q4 preliminary (GS -2.8%, consensus -3.0%, last +4.6%); Unit labor costs, Q4 preliminary (GS +4.2%, consensus +3.8%, last -6.6%); We estimate nonfarm productivity growth contracted by 2.8% in Q4 (qoq saar), reflecting a larger increase in hours worked than in business output. We expect Q4 unit labor costs—compensation per hour divided by output per hour—to increase by 4.2% qoq ar.

- 08:30 AM Initial jobless claims, week ended January 30 (GS 815k, consensus 830k, last 847k); Continuing jobless claims, week ended January 23 (last 4,771k): We estimate initial jobless claims declined to 815k in the week ended January 30.

- 10:00 AM Factory orders, December (GS +0.7%, consensus +0.7%, last +1.0%); Durable goods orders, December final (last +0.2%); Durable goods orders ex-transportation, December final (last +0.7%); Core capital goods orders, December final (last +0.6%); Core capital goods shipments, December final (last +0.5%): We estimate factory orders increased by 0.7% in December following a 1.0% increase in November. Durable goods orders rose by 0.7% in the December advance report, and core capital goods orders rose by 0.5%.

- 01:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a discussion hosted by the Urban Land Institute.

- 02:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will give remarks at the Atlanta Fed’s “Uneven Outcomes in the Labor Market” virtual conference.

Friday, February 5

- 08:30 AM Nonfarm payroll employment, January (GS +125k, consensus +58k, last -140k); Private payroll employment, January (GS +100k, consensus +40k, last -95k) ;Average hourly earnings (mom), January (GS +0.3%, consensus +0.3%, last +0.8%); Average hourly earnings (yoy), January (GS +5.1%, consensus +5.1%, last +5.1%); Unemployment rate, January (GS 6.7%, consensus 6.7%, last 6.7%): We estimate nonfarm payrolls rose 125k and private payrolls rose 100k in January. The coronavirus resurgence weighed on the December report, but we note subsequent stabilization in dining activity and in the severity of business restrictions in January. Big Data employment signals were mixed in the month, but generally showed stabilization or improvement relative to December. Despite higher jobless claims, we also expect fewer seasonal layoffs of retail, leisure, and temp help workers, reflecting already depressed employment levels in those industries. We estimate an unchanged unemployment rate (6.7%) and a 0.3% increase in average hourly earnings (mom sa), the latter reflecting positive calendar effects.

- 08:30 AM Trade balance, December (GS -$65.1bn, consensus -$65.8bn, last -$68.1bn): We estimate the trade deficit decreased by $3.0bn in November, reflecting a decline in the goods trade deficit. Goods imports have returned to their pre-pandemic level, and following a large increase in November, goods exports are now only slightly below their pre-pandemic level. Both imports and exports of services have recovered only slightly from their 2020Q2 troughs.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 02/01/2021 – 09:58

via ZeroHedge News https://ift.tt/3alaOD7 Tyler Durden