Bitcoin Un-‘Tether’-ed

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

Did you happen to notice the big news in Bitcoin the other day?

It wasn’t the sound of the top forming at $59,000 or Janet Yellen’s comments about its ‘inefficiency.’

It was settling, once and for all, the argument that central planners and oligarchs aren’t omnipotent.

The State of New York’s pathetic slap on the wrist of Tether marked the moment Bitcoin joined the ranks of the ‘Too Big to Fail.’

Somewhere Peter Schiff is sad.

This lawsuit was supposed to be the nuclear bomb goldbugs thought would finally blow up bitcoin and return the world to their vision.

Too bad that multi-megaton nuke was more like an M-80 going off in my neighbor’s backyard.

“Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie,” James said in a statement.

“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines,” she further said, adding:

“These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

This is a face-saving statement for the press by NY Attorney General Laetitia James. Because if there really was a Ponzi scheme at the heart of Tether’s business in 2018-19 then she would have gotten them to cough up a helluva lot more than $18.5 million.

If the powers that be could destroy bitcoin at this point they would have pressed further charges against Tether, undermining the structure of the entire bitcoin market which is increasingly becoming a function of Tether liquidity.

But they didn’t.

In fact they gave Tether and Bitfinex the same treatment they gave J.P. Morgan for gold and silver market manipulation and the entire mortgage industry for fraudulently robosigning legal documents.

In other words, ‘We fined some folks.’

Most, if not all of the anti-bitcoin arguments come down to “the government hates it they will ban it.” But what happens when the government admits it can’t?

So while, Murray Rothbard was right, the establishment hates a free market more than anything else, Murray was also right that their is a limit to their power.

This statement is proving prescient for how many in the establishment are reacting to the first truly free market in currencies we have seen in a long time, as #BTC is proving harder to control with unallocated paper derivatives than “freegold” has been.https://t.co/otarcQeTLW pic.twitter.com/wKFi02ZUFJ

— Luke Gromen (@LukeGromen) February 25, 2021

Um, someone tell Janet Yellen and Bill Gates running the anti-environment talking point that Bitcoin uses a lot of electricity isn’t working.

It’s the oligarchs’ latest talking point. And it’s pathetic.

Someone tell Laetitia James to get back in there and fight.

Meanwhile Bitfinex and Tether agree to quarterly monitoring of their books as a gesture of “transparency” and add $18.5 million to the failing tax coffers of New York State.

Whatever hinckey stuff they do they will now — like the major primary dealer banks — settle up at the end of the quarter to present the face to meet the regulators that they meet (with apologies to T.S. Eliot).

And, make no mistake, I think Bitfinex and Tether are sketchy as all get out. In fact, I think 95% of the entire crypto market is sketchy.

But, that doesn’t make it unreal or becoming something unstoppable. Because it doesn’t matter what purists want. The market, in the aggregate, is smarter than any one person.

And the market wants what bitcoin and Tether are selling… right now.

It may want something different in the future. The market is nothing if not fickle…. and gods bless it for this.

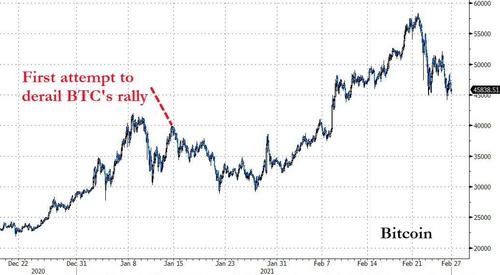

Which brings me to why this lawsuit is so important. There was a recent uptick in anti-tether noise out there, doomsdaying the latest bitcoin rally.

This article “The Bit Short: Inside Crypto’s Doomsday Machine“ (very long, and reasonably well researched) from January outlines a strong argument as to why Tether could be a scam.

And I want to point out how well-timed it was, published January 14th, coinciding with the first attempt to derail bitcoin’s rise.

He goes into a lot about Tether, staking his entire argument on their responding to this lawsuit as the proximate cause for their cashing out of their scam.

He does a forensic analysis of the Bahamanian banking system, lays out the mechanisms for startup company scam, the whole nine yards. Kudos to the writer, it’s a good tale you should read it.

He also didn’t sign his work, but, you know, details.

That doesn’t mean however:

-

He’s right.

-

Things can’t evolve or change.

-

Tether isn’t performing a valuable service

-

Demand for bitcoin liquidity outstrips available supply

In the end, this is just another great piece of writing that misses the bigger picture.

The market decides what it wants not you or me.

In short, it doesn’t mean Tether was intended to be a scam but could simply have been, like bitcoin itself, a service so needed by the market that demand for it far outstripped its ability to perform within its operating parameters, i.e. 100% dollar reserves 100% of the time.

That’s the main reason why Laetitia James settled out of court and Tether admitted no wrongdoing. The market was simply moving faster than the money pouring in and out of the crypto-space could clear and they shuffled some money around to, in the end, protect their clients and their business.

Here’s an aphorism which bears on this story, “It’s easier to beg for forgiveness than permission.”

$18.5 million and a negative headline is cheap to protect what is now a $35 billion business.

But, the premise of this article has been a standard refrain in the crypto-skeptic land for four years.

It boils down to, “You all know Tether’s a scam, right!?”

It’s a glaring bit of editorial bias. Because many of the arguments that people make about bitcoin and cryptocurrencies in general are built on the premise that everyone holding them wants to at some point “cash out and get back to dollars.”

Stupid is as stupid tweets.

Gold is blowing through support and Peter is shitposting about GBTC?

There’s a dollar short squeeze happening or didn’t you notice? https://t.co/w4sRAD9HhW

— Tom Luongo (@TFL1728) February 26, 2021

But what does the market look like when a critical mass of people make a psychological shift valuing their portfolios not in dollars but bitcoin?

One could argue we’re in the process of finding out the answer to that right now.

I’ve talked about the potential for this shift previously here, here and here for anyone who still isn’t listening.

And that scares the living daylights out of everyone who makes their money outside of the dollar, bull or bear, but especially the bears.

Because for a generation now those bears were sold by people like Peter Schiff and the writer of this article which was disseminated far and wide in gold circles that gold was the only alternative to the dollar.

But it’s not and they are bitter about it.

They created what I now call “Gold-Only Bugs.”

For four years I’ve listened patiently to every argument against bitcoin and tether. They aren’t completely wrong. But they do, I think, overstate the risks.

I continue to hedge my bets against monetary insanity. I’m one of the few people in this space that advocates de-risking across all cash-equivalent asset classes.

Smart enough to know he doesn’t know the future with any certainty. I own and advocate Gold,Silver, Bitcoin, altcoins and cash. It’s the only rational position to take.

— Tom Luongo (@TFL1728) February 25, 2021

With this lawsuit and the whole Tether Time Bomb removed from the market bitcoin is now part of the big time. It’s a multi-trillion industry. Those don’t just dry up and blow away without damaging the very people trying to defend against it.

When you owe the bank a thousand dollars it’s your problem. When you owe the bank a trillion dollars it’s their problem Bitcoin is a variation on that idea.

Blackrock’s buying bitcoin, folks.

Blackrock.

Coinbase is filing for an IPO. It’ll be at a valuation higher than Facebook’s.

In fact, it’ll be the biggest IPO in U.S. market history.

The bookrunning fees alone will make Goldman’s or Morgan’s next quarter a blowout.

They said the internet was a fad, too.

But yet you still think a troika of Participatory Medal Winners like Janet Yellen, Christine Lagarde and Jerome Powell are going to stop this train?

You think they can just wave their magic wands and make it all go poofta?

Why would Tether and Bitfinex run away with all the money now when they just won? Bigly.

They can pull massive yield in DeFi on their USDT and bitcoin. But they’re going to give up their first-mover advantage in the immensely important stablecoin space for a couple of billion which can be seized by any government?

The only central banker with a brain is Powell, as he properly identified the threat to their rule… and it’s not bitcoin.

It’s stablecoins like tether.

Because what is the dollar except a stablecoin backed by the confidence of the debtholders of Nancy Pelosi’s ability to extract wealth from Americans to pay the coupons?

If someone builds a better one than the dollar eventually it’s game over for the debt-based system.

Why would Tether run away with a few billion in depreciating dollars when they can literally bring down the entire monetary system and replace it with their product?

The reality is that the day the dollar becomes irrelevant is the day Tether folds up shop and completes their scam because no one will want dollars and a dollar-pegged stablecoin with dollar reserves will be redundant.

I’m not saying that day is here. No. We’re a long way off from that day.

But this lawsuit settling with such a whimper is a primal scream marking the next phase of the war between central banks and the people.

* * *

Join My Patreon if you truly want to understand what crypto represents

Donate via Crypto

BTC: 3GSkAe8PhENyMWQb7orjtnJK9VX8mMf7Zf

BCH: qq9pvwq26d8fjfk0f6k5mmnn09vzkmeh3sffxd6ryt

DCR: DsV2x4kJ4gWCPSpHmS4czbLz2fJNqms78oE

LTC: MWWdCHbMmn1yuyMSZX55ENJnQo8DXCFg5k

DASH: XjWQKXJuxYzaNV6WMC4zhuQ43uBw8mN4Va

XMR: 48Whbhyg8TNXiNV2LNkjeuJJU55CNt5m1XDtP3jWZK2xf5GNsbU2ZwHLDJTQ5oTU3uaJPN8oQooRpSQ2CPMJvX8pVTqthmu

Tyler Durden

Sat, 02/27/2021 – 09:20

via ZeroHedge News https://ift.tt/2ZVBdTb Tyler Durden