The Ten “Peaks” Behind BofA’s Call For A Second Half Crash

Having been bearish for much of the past 3 months, BofA’s Chief Investment Officer looks at the chaos unleashed by surging bond yields in the past week, and extrapolates a period of much greater pain across all markets, driven by a flood of what he calls the “contrarian Ps” which include:

- pandemic (vaccine winning),

- prices (bond crash),

- positioning (bullish),

- policy (excessive & impotent),

- profits (peaking Q2)

… which leads Hartnett to an “absolute” call that the first half od 2021 will mark the top in stocks & credit, leading to a substantial market correction, while relative value call is inflation hedges, with Hartnett calling “energy the new BTD trade” (something we have been saying since last fall), while growth defensives such as staples the barbell partner to this core trade.

And just to round off the increasingly dismal picture, Hartnett then lays out ten “peaks” that underscore his pre-crash outlook:

Peak pandemic: global vaccines (219mn) outpacing global virus (113mn – Chart 3); anticipation of vaccine > virus has already been Q4/Q1 catalyst for reopening>lockdown, cyclicals>defensives, small>large, value>growth…sell-the-vaccine = risk>return.

Peak prices I: bond sell-off hitting speculative froth, ghosts of 1999, ARKK look ominously like Invesco (Chart 5).

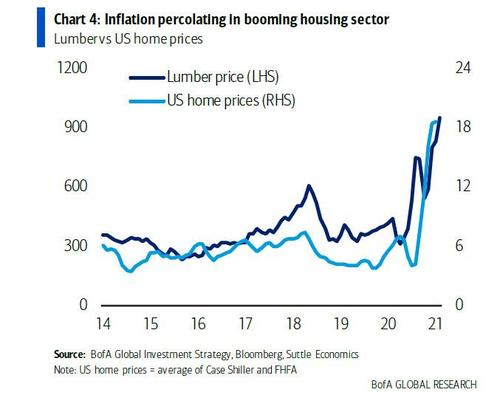

Peak prices II: bond sell-off eroding bull leadership of i) Housing (past three months US house prices annualizing 19% gain, lumber prices have doubled – Chart 4), ii) Credit (LQD <$133, EMB <110 & HYG rolling), iii) Tech (Amazon down since Aug, NDX & KOSDAQ down YTD).

Peak prices III: bond sell-off…next risk big levels fail, e.g. Dow Jones 30k, Nikkei 30k, SOX 3k, KOSPI 3k, ChiNext 3k. bond sell-off has been wonderful for high yield, small cap, banks, energy, EM…when these reverse as bond yield rise = rate rise flips from good to bad (Chart 6); most imp triggers for bonds = cyclicals selloff…HYG <$85 (bond cyclicals breaking down), CNY >6.55 (China no longer tolerating FX appreciation).

Peak positioning: only reason to be bearish is there is no reason to be bearish…record, stunning $414bn inflow to stocks past 16 weeks (Chart 7), and yet stocks struggling; unlike ‘13 & ’18 bond losses in ’21 yet to incite bond fund outflows.

Peak policy I: rate cuts in 2020 = 191; rate cuts in 2021 = 3; no Fed YCC before >2% GT10 yields or <3400 SPX.

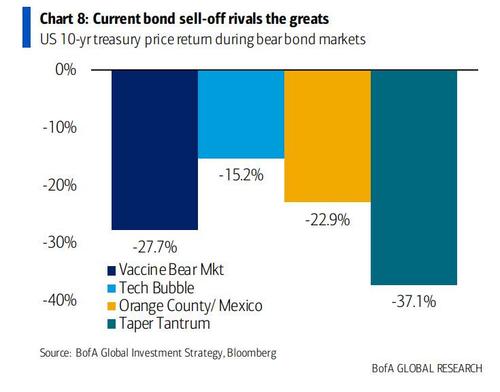

Peak policy II: monetary impotence or fiscal impotence inducing bond sell-off that exceeds on annualized basis 1994, 1999, but not quite taper tantrum of 2013 (Chart 8); bond busts (don’t forget 2018) lead to contagion, illiquidity, busts, bankruptcies…volatility & hedges against inflation & currency debasement set to outperform in 2021.

Peak policy III: 3Rs of Rates, Regulation, Redistribution historic catalysts end bull markets & bubbles…we say all ’21 events, not ’22, all spell lower/volatile coming quarters; 2020 = secular low for rates/inflation = “buy humiliation, sell hubris” = inflation assets to beat deflation in coming years.

Peak profits I: BofA Global EPS model says peak profits 20-25% YoY in Q2; could be >10% nominal GDP growth, surge in labor participation rates quashing wage growth, inflation peaks Q2 not EPS, productivity on up as COVID-19 inspires tech innovation means we wrong, but….

Peak profits II: a. even during stagflationary ‘70s, equities obeyed PMIs and today’s PMI levels rarely get higher;

… b. past 9 months…Asian exports…”V”, global PMIs…”V”, US housing…”V”, US retail sales…”V”, global capital goods orders “V”… yet no one believes global inflation will “V” despite epic stock market & housing inflation, US politicians about to spend another $2tn, TIPS breakevens highest since ’11…

… maybe a straw that will break the camel’s back…watch March 30th Alabama vote on unionization at Amazon; trough labor unionization & peak corporate equity valuation not a good combo.

Tyler Durden

Fri, 02/26/2021 – 18:40

via ZeroHedge News https://ift.tt/3uyxedk Tyler Durden