How Do Stocks Perform When Yields And Inflation Are Both Rising

By Vishwanath Tirupattur, credit strategist at Morgan Stanley

The conversation over the last few weeks has been squarely on one thing – higher 10-year interest rates. They are up almost 45bp since the start of the month and about 55bp if you start counting from the beginning of the year. Considering the history of the last 12 months, this shift higher is indeed noteworthy. Combine tight valuations across risk assets, sprinkle in memories of the 2013 taper tantrum that have not entirely faded, and it is not surprising that the specter of spiking yields portends caution in some quarters as reflected in the equity markets this week. However, looking under the hood tells us a different story. Understanding why yields are rising is the more pertinent question which requires us to decompose nominal yields into inflation expectations and real yields. We argue that higher real yields along with rising inflation expectations create an environment where yields are rising for ‘good reasons’.

If we look back at what happened in 2020 in the immediate aftermath of the COVID-19 crisis – unprecedented policy stimulus (both fiscal and monetary) ensued, inflation expectations rose but only gradually, with front-end rates anchored at zero by the Fed, the nominal yield curve steepened and risk assets posted a strong rally – early stages of recovery were in place. Notably though, real yields remained depressed through 2020. This has begun to change since early in 2021 and the next leg of the reflation trade will be different than what we saw play out in 2020.

If we examine the composition of the roughly 55bp pick-up in 10-year yields since the beginning of 2021, only about 20bp is from higher inflation expectations and 35bp is from higher real yields.

In this leg of the economic recovery, our economists expect to see growing evidence of strength in economic data. Real yields and inflation expectations rise together when investors expect a stronger, more sustained economic recovery. As our macro strategists Guneet Dhingra and Matthew Hornbach argue, the process has already begun and an improvement in economic data would encourage real yields to participate in the move to higher nominal yields.

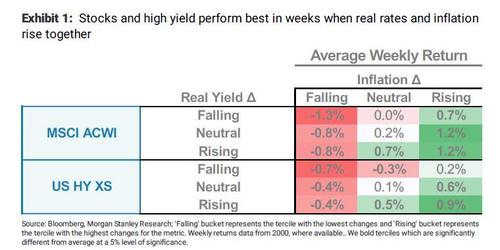

How did risk assets do when rates are rising along with inflation expectations? There have been multiple episodes during 1997-99, 2004-06 and 2016-18 when real yields went up and so did equities. As our chief cross-asset strategist Andrew Sheets notes, historical equity and credit performance have been better when rates are rising than falling, especially when rates are rising along with inflation expectations, as they are now. He reviews multiple recent episodes of higher rates when risk assets fell sharply and notes that they were all in the context of actual or feared policy tightening and/or late in the economic cycle.

In contrast, we are clearly in the early part of the economic cycle. Our economists think that the first Fed hike is still 2.5 years away and, as reaffirmed by Fed Chair Powell in his testimony to the Senate Banking Committee on Tuesday, the Fed will remain accommodative and continue its current pace of balance sheet expansion. Credit market performance in the face of higher rates, particularly high real rates, is interesting. Excess returns tend to underperform in investment grade credit with higher real rates while outperforming in high yield credit, which syncs up well with the views of our credit strategists Srikanth Sankaran and Vishwas Patkar, who remain comfortable with a down-in-quality view, with high yield credit benefiting from lower duration exposure and higher spread cushions.

Where could we be wrong?

Higher real yields with declining inflation expectations would be associated with weaker performance of risk assets, as would spikes in real yields driven by fears about the removal of Fed accommodation. To be clear, nothing in our expectations of the economic recovery or the Fed policy suggest any such outcomes. Thus, our conviction remains that real yields are set to rise, gradually, leaving the reflation trade largely intact.

Tyler Durden

Sun, 02/28/2021 – 15:59

via ZeroHedge News https://ift.tt/3q1ud1F Tyler Durden