Marcus Mauling: Head Of Goldman’s Consumer Bank Leaving For Walmart

Back in 2015, when Goldman stunned Wall Street with the taxpayer-backed hedge fund’s decision to roll out a consumer-facing commercial bank – Marcus – which offered “high yield” deposit accounts (of 1.25%) and consumer loans, at least Goldman had rising rates to fall back on: after all that was a period when Janet Yellen had decided that it was time to shrink the Fed’s balance sheet and proceed with hiking rates, waking the infamous “ghost of 1937” (and culminating with the minicrash of 2018, and eventually the biggest liquidity injection of all time in March 2020).

In any case, rising rates made it easier to sell a consumer-facing commercial bank to Goldman investors. Yes, the revenue stream would be limited (after all Goldman would have to steal market share from such established banks as JPM, BofA, Citi and Wells), but if rates rose enough the Net Interest Margin would provide for a generally risk-free source of income.

All that ended last March when the Fed made it clear that ZIRP would be with us for years, and instead of an asset, any net interest margin exposure became a liability (especially when accounting for a potential surge in bad loans once the forebearance moratorium ends), and suddenly Goldman’s Marcus doesn’t look like such a hot idea.

It also explains why Bloomberg reports this morning that Omer Ismail, the head of Goldman’s consumer bank, has made a “surprise exit” and is headed for WalMart as the retail giant muscles into the banking business.

The world’s largest retailer made a splash last month after disclosing plans to offer financial services with an independent venture in a tie-up with investment firm Ribbit Capital without offering much detail. And now, it has sent shockwaves with the decision to poach Goldman’s top consumer bankers: in addition to Ismail, Bloomberg reports that Walmart is also hiring David Stark, one of his top lieutenants at Goldman, who will join him in the new venture.

Walmart’s move, which deprives a top Wall Street firm of the talent atop its own foray into online banking, “underscores the seriousness of the retailer’s intent to intertwine itself in the financial lives of its customers.”

The audacious poaching punctuates years of warnings by bank leaders that their industry faces tough new challengers, after regulators smoothed the way for corporate giants and Silicon Valley to expand into payments and other services

Ismail is credited as one of the key architects behind Goldman’s push into Main Street, seeing through the growth of Marcus into a billion-dollar business in five years. But, as noted above, in a time of ZIRP (and perhaps NIRP), the allure of a fintech commercial bank rollout has faded.

The departures are a setback for Goldman, which had just entrusted Ismail and Stark with bigger roles. Ismail formally assumed control of the consumer bank at the start of the year. But he’s been tied to it ever since Goldman’s merchant bank set up the side project several years ago.

As part of Goldman’s attempt to expand beyond its traditional investment bank strengths, Ismail helped formulate the plan for Marcus – the biggest strategy refresh the firm has seen in three decades. The company ultimately resolved to make itself a serious force in digital banking.

Meanwhile, stark played a key role in Goldman’s partnership with Apple on a credit card, for which the bank provides the financial backbone. Weeks ago, Goldman named Stark as the head of large partnerships, which was supposed to serve as a key peg for Marcus’s growth, which had recently struck deals with Amazon, JetBlue and – yes – even Walmart. However, Walmart appears to have decided to go it alone and rollout its own fintech division, offering customers low-cost products by avoiding physical branches, and instead using online portals or phones to provide loans, savings accounts or investment options.

Walmart said in January it aims to combine its “retail knowledge and scale with Ribbit’s fintech expertise” to serve shoppers and associates. Walmart will own a majority of the new venture, but in Ribbit, it has a partner that’s made big bets in the fintech space including backing Robinhood, the scandalous brokerage which sells its retail orderflow to the likes of Citadel.

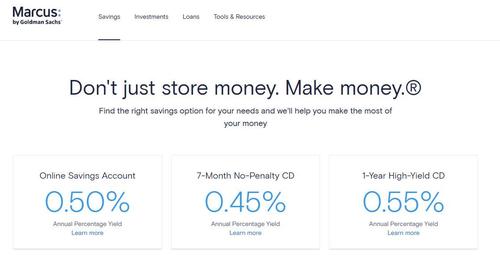

As for Goldman, in a world where its “high-yield” savings account is now just a paltry 0.50%, the bank may find significant challenges as it hopes to poach clients away from existing commercial bank relationships.

Making matters worse for Goldman, it is about to see even greater competition: in December, the FDIC approved a final rule governing so-called industrial loan companies that would make it easier for major businesses to seek banking charters while escaping capital and liquidity demands faced by dedicated financial firms. That’s a worrying prospect for banks facing the risk of going up against against corporate behemoths that could lean on their huge customer base to eat into the banking wallet.

Ismail’s predecessor Harit Talwar is still a chairman at Marcus and will probably continue to play a key role with the division after Ismail’s exit. The unit also hired a former Stripe executive Swati Bhatia as the head of its direct-to-consumer business earlier this month. After the departure of Ismail and Stark, his tenure at Goldman may prove to be extremely short-lived.

Tyler Durden

Sun, 02/28/2021 – 19:40

via ZeroHedge News https://ift.tt/2OcrViR Tyler Durden