Who Is The Sucker In The SPAC Market?

Authored by Irv Schlussel, Managing Director at IngleSea Capital,

The SPAC market has become frothy and is reminiscent of the 1999 .com Bubble. SPAC evangelists (Bankers, Sponsors & Hedge Funds), most of whom are gaining great wealth from the Bubble, will say: “This time is different”. The argument they make is that SPACs are an increasingly mainstream, speedier path to IPO with less required disclosure and are acquiring better-quality companies than they have in the past. I think the less stringent regulation of SPACs feeds the risks borne by the end purchaser who is paying as much as 2X the true value of the underlying asset. The quality of SPAC acquisitions is poorer today than it has ever been, and the valuations are inflated as sponsors have no incentive to have any price discipline, rather their sole motivation is to get the deals done.

When I think about the SPAC market, I see all the parties involved making money, including the sponsors, investors and acquired companies. I then ask myself the same question one is supposed to ask when entering a poker Game: Who is the SPAC sucker, and why is this Bubble happening?

SPAC 101

It is first important to start with an explanation of SPACs as the particulars are often misunderstood. If one invests in a SPAC (Special Purpose Acquisition Company), he/she typically buys a unit consisting of a share and a warrant. This unit can be split and traded separately into a share and the proportional amount of warrants typically 1/2-1/3 per share. The sponsors contribute cash (sponsor equity) to the trust to cover expenses and receive a promote which is a combination of shares and warrants that typically averages 20% of the value of the SPAC. This promote vests upon the consummation of the deal with a lockup on his/her shares for a period that is often reduced, depending on the prevailing price per share. This is a Key Problem as SPACs are incented to do poor deals. Profit realization for SPAC sponsors is based on getting a deal done, even if it the stock trades down substantially.

The investor can opt not to participate in the deal and instead redeem his share for the cash invested plus the yield on short term treasuries, aka “Cash-in-trust.” Upon the earlier of:

1. SPAC maturity (18-24 months) or

2. The SPAC announcing and closing on a prospective deal.

Alternatively, the investor can stay in the deal and be an investor in the new company through the “De-SPACing.”

I have been investing in SPACs for over ten years as an arbitrageur. I rarely have the intention of holding shares through the deal or “De-SPACing.” Prior to the second half of 2020, most deals ended up trading at or just below cash in trust, incenting a redemption for cash rather than the selling of shares on the open market. This phenomenon changed after NIKOLA and Virgin Galactic as investors started paying a premium for the hot deals. Today, almost all SPAC shares are trading at a substantial premium of 2-3% above their cash in trust. This is down from 8-9% a few weeks ago and could quickly go negative.

Historically, the sucker has been the guy who buys the SPAC and owns it on the back by rolling his shares into the newly merged company. Industry research shows that, for the SPACs that completed de-SPAC transactions between 2015 and July 2020, their shares delivered an average loss of 18.8%. That compares with the average after-market return from traditional IPOs of 37.2% since 2015. These days, most SPACs are doing bad deals and overpaying by a premium of say 20% to capture the sponsor economics (more on this later). That back-end investor is also giving up a 20% promote and is likely buying the stock post-IPO at a premium of say $0.50. So, in total, in he is overpaying by almost 50% for this stock.

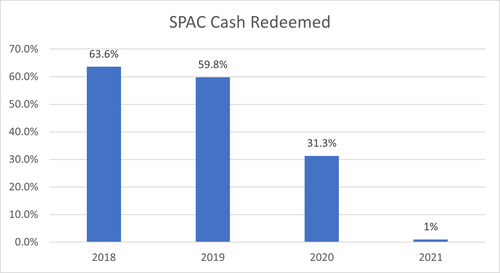

The Value Chain & Why This Will Go Away

Prior to the middle of last year, 60% of SPAC $ were redeemed. Today that is 0, as they all trade well above cash in trust. Once the bubble bursts, the SPACs will no longer trade at a premium to their value of “Cash in Trust.” Arbs will be the holder base and they will redeem for “Cash in Trust.” The value that the sponsors currently bring to the acquiree is the stupid cash that is rolling into the deal at an aggressive valuation. This value has been increasingly accessible given the bubble, as historically most SPAC money is redeemed. This is a retail/bubble driven phenomenon where investors opt to stay in deals at inflated values. When this goes away, the huge amount of SPAC equity capital contributed to recent raises may well end up being the loser. Those sponsors will have to do genuinely good deals to convince investors to participate rather than redeeming the shares.

I have seen an 11% number quoted for the % of SPACs liquidating over the past 10 years, but what that does not capture is the number of deals where the sponsor forfeits his upside to get the deal done, as historically, he has brought far less cash into the deal. At that point, the sponsor is only providing a shell. With the number of available SPAC shells increasing every day, their value declines, as does the liquidity profile for the shares on the back end, and thus the true exit value for the acquiree.

Some Signs of a SPAC bubble:

1. Dramatic increase in notional outstanding: Total Notional has increased by $84B over the past year to about $100B. At current pace, total outstanding notional SPAC is projected to get to $190B by June.

2. Increased Retail Participation: SPACs have gone from the arcane to the hottest mainstream discussion topic.

3. Increasing Institutional Leverage from PBs: 5 years ago it was 1X to 2X, one year ago it was 3X, now 4X is standard and the larger Multistrats are getting 10X with 6 months of term.

4. Sponsors Bringing Multiple deals: Chamath, Sternlicht.

5. Lower Quality of Sponsors/Celebrity SPACs: Billy Beane, Shaq, Arod, Colin Kaepernick, Serena Williams, Jay-Z, Paul Ryan. This is not that different than celebrities getting paid to promote crypto and there is some overlap here.

6. Recent SPAC Hedge Fund and ETF launches

Why will it pop?

-

Simple issue of Supply and Demand: In January, issuance was $63B. February is projected to be on Pace. If this continues, even with a moderate slowdown ($20B of net monthly issuance), I estimate total notional SPAC $ outstanding will be around $200B by mid-2021 and $320B at year-end.

-

The SPAC IPO narrative will break down: The view is that SPACS are now the preferred route to IPO: SPACS are now more mainstream, but the perceived speedy path to issuance for a lower quality company understates the hidden costs. The standard fee structure associated with SPACS is a 20% promote (paid in shares). This fee remains regardless of how poorly the SPAC trades on the backend and well exceeds costs of a traditional IPO. The lack of disclosure required for SPAC reverse mergers may cause SEC concern and potential changes. In the past few months, we have seen fraud and disclosure issues (Nikola, Clover Health) that may draw regulator attention. If the market cooled down, the appetite for newer issues would decline and we will be left with too many SPAC shells with lesser prospects.

Tyler Durden

Mon, 03/01/2021 – 06:10

via ZeroHedge News https://ift.tt/37ZE1Db Tyler Durden