Fed’s Reverse Repo Hits All Time High $485BN As Reserves Flood System

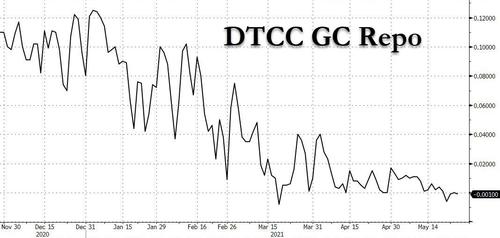

We knew it would be a crazy day for today’s reverse repo early this morning, when the overnight GCF repo rate traded at -0.01% and refused to rise, an indication that there was far too much money chasing good collateral.

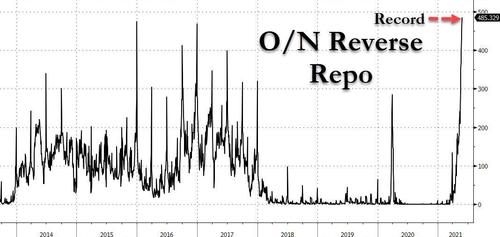

Looking at the scramble for repo, interbroker dealer Wrightson ICAP said on Thursday morning that it saw Reverse Repo volumes rising to around $470 billion Thursday, though the risks are “still tilted to the high side.”

They were, because moments ago the Fed announced that at 1:15pm some 50 counterparties (up from 46 on Wednesday) parked $485.329BN in reserves with the Fed (in exchange for the generous rate of 0.000%), which was up $35BN overnight, up $134BN in the past week, and the highest on record!

Why does this matter? Three reasons, all of which we explained in extensive detail in “Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs“, Repo Crisis Looms: Fed’s Reverse Repo Usage Soars To $351BN, Fifth Highest Ever, and Zoltan On The Coming QE Endgame: “Banks Have No More Space For Reserves“,

- The Fed is taking Treasurys out of the market through QE purchases and putting them right back in via the RRP as the central bank is now chasing its own tail as it monetizes so much US debt it has no place where to park the reserves it creates out of thin air

- The heavy use of the o/n RRP facility tells us that foreign banks too are now chock-full of reserves.

- Banks don’t have the balance sheet to warehouse any more reserves at current spread levels.

And now that everyone is once again a reverse repo expert…

we are weeks away from everyone turning into a reverse repo expert again

— zerohedge (@zerohedge) May 19, 2021

… Bloomberg writes that “the glut at the front-end has been spurred by the central bank’s ongoing asset-purchase program, commonly referred to as quantitative easing, as well the drawdown of the Treasury’s general account. The latter has been driven by the looming debt- ceiling reinstatement, which is due to take place at the end of July, and the flow of pandemic stimulus funds to taxpayers.” Additionally, Federal relief payments to state and local municipalities are also adding to the glut, and that is being exacerbated as regulatory constraints encourage banks to turn away deposits, directing that cash into money-market funds.

Also chiming in is JPM’s versatile multi-strat quant who tends to opine on everything from cryptos to retail call buying, writing yesterday that “perhaps motivated by the expiry of SLR exemptions, US banks have been pushing much of the $350bn of excess liquidity generated from the contraction in the TGA balance into MMFs. And the combination of increases in MMF AUM along with a contraction of outstanding Tbills appears to have induced MMFs towards heavier use of the Fed’s ON RRP facility.”

Better make that $485BN now.

Of course, when discussing repo one has to mention Zoltan Pozsar, and in a note published this morning, the Hungarian repo guru writes that as a result of the massive reserve glut, he expects three-month dollar Libor-OIS spreads to go “slightly negative” by mid-July. It only gets worse after:

By mid-July, we’ll have even more reserves to absorb due to the debt ceiling, and while a lot of that cash will go to the o/n RRP facility, some of it will chase higher yields in the FX swap market amid a lack of demand for U.S. dollars. Three-month cross-currency bases may flip positive by mid-July, and those implied yields may drag three-month U.S. dollar Libor-OIS slightly negative

As for the immediate market implications they are even more ominous: either the Fed will have to hike the IOER fast or rates will soon go negative. Worse, with the Fed still planning to do at least $1 trillion in QE even assuming a December taper, and potentially as much as $2 trillion based on the latest just released Fed “forecast”, there is simply no place to park all of these reserves.

It’s not just us concerned about how clogged up the market plumbing has become: in his daily Repo Market Commentary note from Monday, Curvature’s repo market guru Scott Skyrm wrote the following:

RRP Explosion

On March 17, a little over two months ago, there was no volume at the Fed’s RRP window. Nothing. Today, it was almost $400 billion! How do you go from zero to $400 billion in two months? Not only was today’s activity at the RRP one of the largest ever, it was also THE largest non-quarter-end, non-year-end print. There’s an incredible amount of cash in the Repo market right now! Clearly, the Fed took too much collateral out of the market – or – added too much cash.

The market is distorted from too much QE and hopefully QE tapering will be announced in June.

And while Powell & Co pretend that they can continue business as usual for years to come, the repo market is not only cracking but banks, full to the gills with inert reserves and which increase by $30 billion every week, are on the verge of pulling a Mr Creosote…

Tyler Durden

Thu, 05/27/2021 – 13:43

via ZeroHedge News https://ift.tt/3bYpSbi Tyler Durden