Goldman Spots A Historic Reversal In The Commodities Market: “China No Longer World’s Marginal Buyer”

China’s recent aggressive crackdown on soaring commodity prices (going as far as dragging the PBOC’s monetary regime into it, with the central bank stating this morning that the surging yuan is in no way a response to explosive commodity prices, honestly), has provided the world’s deflationists with some hope that the recent huge spike in commodity prices may be coming to an end. To others, like Goldman’s extremely bullish commodities team, China’s intervention has led to a rather unpleasant hit to its thesis, and in response today’s Goldman’s head of commodities, Jeffrey Currie drafted a note saying that the pullback in commodities after China’s warnings over onshore speculation is a “clear buying opportunity,” as the “bullish commodity thesis is neither about Chinese speculators nor Chinese demand growth.”

As Currie adds, while commodity prices retraced ~3% after Chinese warnings over onshore commodity speculation, “the fundamental path in key commodities such as oil, copper and soybeans remains orientated towards incremental tightness in H2, with scant evidence of a supply response sufficient to derail this bull market.”

And just as some are worried that the Fed has lost control over inflation, with many openly mocking its repetitive pleadings that inflation is “transitory”, Goldman makes a similarly bold claim, namely that “China has lost pricing power“:

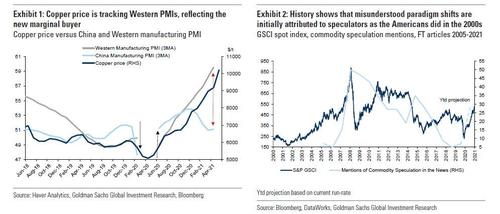

China is no longer the center of commodities. However, the most critical reason for viewing this China led dip as a buying opportunity is the mounting evidence that commodities are no longer China-centric. The velocity of the DM demand recovery means that China is no longer the marginal buyer dictating pricing, as it is crowded out by the Western consumer. The market is beginning to reflect this, as copper prices are increasingly driven by Western manufacturing data rather their Chinese counterparts (Exhibit 1).

This is a huge role reversal from the bull market of the 2000’s, with China now the incumbent consumer as the US was when emerging Chinese demand squeezed out marginal US consumers. Here is some more on this critical hypothesis which would have profound consequences on global commodity prices if it is borne out:

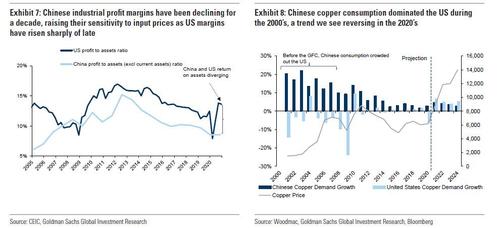

The Chinese consumer is crowded out. Today, a similar event is happening, but in reverse. 1) China is losing its derived demand as supply chains – exposed as fragile after two years of trade wars and a global pandemic – begin to turn local; 2) China is now focused on reducing environmental costs of production; and 3) not only are Chinese labor costs rising towards the West, labor’s share of costs is declining sharply with a global surge in automation. Moreover, after nearly two decades of high investment and now razor thin margins, as commodity prices rise, the less profitable downstream commodity consumers in China begin to complain of excessive input cost inflation. Just like in the US in the 2000’s, this raises concern among Chinese regulators that speculation is driving commodity price inflation. Rather than undermining the strength of this bull market, we see this downstream demand destruction as validating it, with strong Western demand squeezing China out of the market – just like the Americans were nearly two decades ago.

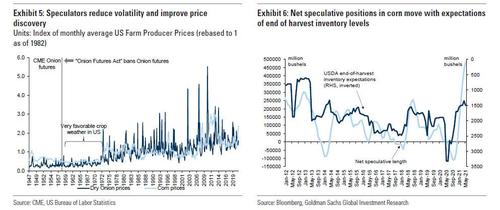

Goldman then slams the latest episode of blaming speculators, pointing to a long and distinguished history “of attributing paradigm shifts in prices to speculation” and noting that “China’s current crackdown on commodity speculation mirrors similar moves by the US in the mid-2000’s. When commentators are unable to understand what is driving such a paradigm shift in prices, they attribute it to speculators – a common pattern throughout history which has never solved fundamental tightness.“

In reality, Goldman argues that speculators merely reflect fundamentals and reduce volatility, with data showing that “net-specs track fundamentals as the specs simply translate fundamental information into price discovery.”

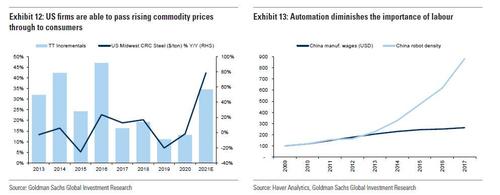

Furthermore, history shows that simply banning speculators leads to even more price volatility, while discouraging precautionary inventory building by consumers will leave China even more exposed to crowding out by US firms who are able to pass commodity inflation through to consumers, raising prices dollar for dollar with raw material costs:

Labor’s share of costs are declining. While Chinese labor costs have converged towards the West’s, they are still far lower. What really matters is labor’s share of costs which is declining across the world with increased automation. Not only does this make capital costs more important, which are far lower in the West than in China, but it also increases the relevancy of materials as a share of costs. Moreover, with China remaining far more cost competitive on labor, US manufacturing had to compete by increasing automation and productivity in technology intensive production sectors. This in turn is where the West’s efficiency in the use of energy and materials after the 2000s plays an important role. Combine this with the large fiscal stimulus, our US equity analysts for industrial firms point out that American manufactures are passing commodity price strength into end use consumers dollar for dollar. This higher level of pricing power by US firms enables them to more effectively weather commodity price rises. Moreover, some of the price insensitive Chinese demand in the 2000s was derived-demand from DM to begin with, which has migrated back to the US after a trade war and pandemic. As this focus on domestic production is expected to increase, given this increased focus on automation, the capex needed to replace Chinese production in the West will be even larger than the Chinese capital demand as the new western production will be a more capital-intensive, less labor intensive than what it replaces.

Ultimately, Currie sees weak Chinese demand as validating the bullish thesis:

The immediate reason for the greater US pricing power is the large US fiscal stimulus that is absent in China; however, we believe there are also structural factors that makes this a paradigm shift. China no longer benefits as much from its comparative advantage in low-cost labour, global trade and its previous apparent indifference to the environmental impact of GhG emissions. This ultimately creates a weaker margin setting onshore. With scarcity starting to generate shortages and higher prices, the Chinese are the first consumers to be priced out.

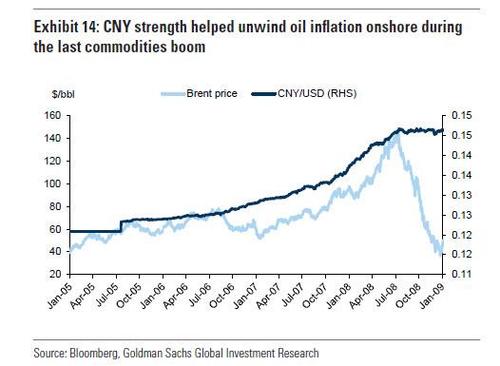

One final point, and one which ties “everything” together – from soaring commodity prices, to Chinese monetary and fiscal policy – is Goldman’s argument that CNY strength can provide a tactical tailwind. Although the bank’s commodity team sees the Chinese consumer being crowded out of commodities, their ability to retain some pricing power rests on an appreciating CNY: as the FX strength undoes some CNY-denominated commodity price inflation, the Chinese consumer can sustain a greater volume of demand. It is this additional volume that ultimately destocks inventories and drives up commodity prices – exactly as happened in oil in the 2000s.

While Goldman economists see yuan appreciation on the horizon (12m forecast is 6.2), upside is capped by the need for China to retain export competitiveness – a key driver of the Chinese mercantlist economy. Moreover, as the CNY accounts for c.15% of the US Dollars Trade Weighted basket, any appreciation reignites the dollar-commodities reflation cycle.

Tyler Durden

Thu, 05/27/2021 – 17:40

via ZeroHedge News https://ift.tt/3yFLino Tyler Durden