Ireland Rejects US Plan For Global Minimum Tax, Will Keep 12.5% Rate

Following reports that an agreement between the G-7 and the White House on a global minimum corporate tax rate is almost ready, Ireland – which isn’t a G-7 member, but is a member of the OECD and the EU, and therefore must also assent to these changes – is speaking out against a new minimum level agreed to by the White House.

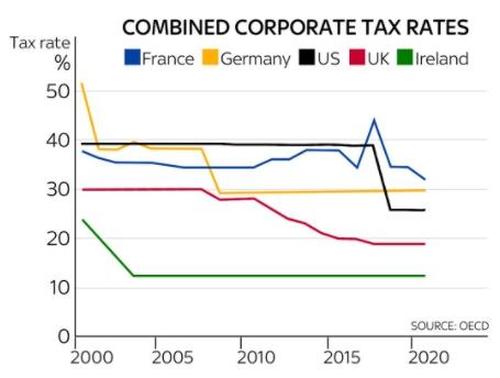

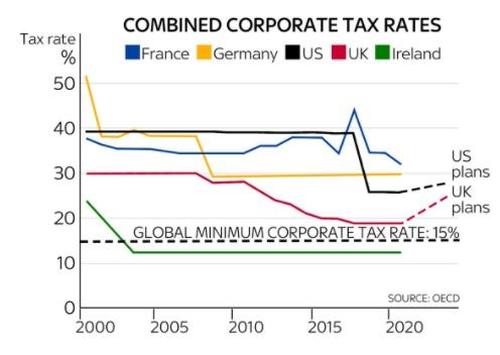

According to Sky News, Ireland has no plans to increase its 12.5% corporate tax rate, which is already one of the lowest in the developed world, and which has been a tremendous boon for its economy. The latest iteration of the agreement as envisioned by the US set the global minimum rate at more than 15%.

Source: Sky

While the OECD is supportive of proposals for a global minimum corporate tax, it has also pointed out that reforms should also include more clear treatment of where and how taxes are assessed.

Irish Finance Minister Paschal Donohoe said that he had “significant reservations” over American plans to encourage countries around the world to adopt a minimum corporate tax rate in order to prevent companies from shifting their profits and avoiding payments in future, especially as President Biden tries to engineer one of the biggest tax hikes in decades.

In an interview with Sky News, Donohoe said “we do have really significant reservations regarding a global minimum effective tax rate status at such a level that it means only certain countries, and certain size economies can benefit from that base – we have a really significant concern about that.”

The international agreement being hammered out by the US and the G-7 would be the biggest such overall in a century, when the current rules on international corporate taxes were hammered out. Back then, it was much more difficult for corporations to use accounting and legal loopholes to reduce their tax burden.

Today, it’s commonplace for companies to shift billions of dollars of profits around the world to countries with lower tax rates, something the Biden administration has vowed to combat. The US is planning on raising its own corporate tax rate to 28% from 21%, and is increasing the rates for American companies working overseas. And the UK has its own plans for tax hikes.

Donohoe’s comments will raise the stakes during negotiations at the upcoming G-7 summit in England. The OECD has been pushing for corporate taxation reform for many years, and the US proposal for a global accord is building off of that.

Of course, if Ireland refuses to lower its tax rate, that will make it extremely difficult for the UK to agree to the US plan, since British firms are already seeing unprecedented pressure to move across the border and back into the EU single market.

“I absolutely support and will be making the case for our 12.5% tax rate,” Donohoe said. “I believe a rate like that – a low rate – should be a feature of an agreement in the future. “Our friends and partners in the United States understand our concerns in these matters, but the best kinds of partnerships – the best kinds of friendships – are ones in which you can talk about these matters openly and engage with each other, professionally, and that’s what we’re going to be doing.”

The US has already pitched concessions like surrendering more tax revenue from American tech giants that operate internationally. Apparently, whatever they’re offering, it’s not going to be good enough for Ireland, which essentially holds the power to scuttle a global agreement simply by making its neighbors unwilling to tolerate Ireland’s notoriously low tax rates.

In other words, just when US diplomats were proclaiming to the press that a deal was as good as done, it looks like talks have a long way to go.

Tyler Durden

Wed, 05/26/2021 – 21:20

via ZeroHedge News https://ift.tt/3yGSDDe Tyler Durden