JPMorgan Sees 4 Scenarios Ahead On Infrastructure

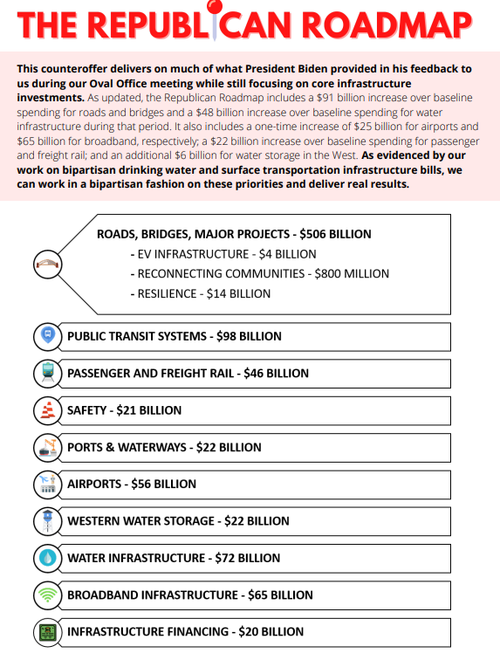

As was leaked previously, this morning we got confirmation that the GOP will increase its “infrastructure” bid from $568bn to almost $1TN ($928BN to be exact), still well short of Biden’s downward revised $1.7TN ask. This includes $506 billion for roads, bridges and major prodjects as part of a bi-partisan $300BN surface transportation bill.

As expected, this GOP bid does not contain any changes to the US tax code.

What happens next? According to JPMorgan, investors must now consider which outcome is most likely:

- A bi-partisan bill passed of ~$1T with no tax code changes.

- A bi-partisan bill passes and then Dems pursue Reconciliation to achieve the balance of their package

- Dems forego a bi-partisan package to pass some or all of their initiatives via Reconciliation.

- Nothing passes ahead of mid-term elections.

JPM’s view is that if an infra bill passes, it goes through Reconciliation. The differences in what could vs. what should be included fall on party lines and, at this stage in America politics, seems a chasm too wide to be traversed.

Look for details on a potential bill to be release later in June or July for a September passage.

Tyler Durden

Thu, 05/27/2021 – 09:41

via ZeroHedge News https://ift.tt/2R2eWSY Tyler Durden