Q1 GDP Stuck At 6.4% After Revision As Core PCE Comes In Hotter Than Expected

While few will care what Q1 GDP did in the last quarter according to the BEA’s 2nd estimate of US economic output (when we already knew it came in superhot thanks to Biden’s trillions in stimmies) some were curious what the Fed’s preferred inflation metric, the core PCE would say, after the recent near-record prints in that “other” inflation dataset, the CPI.

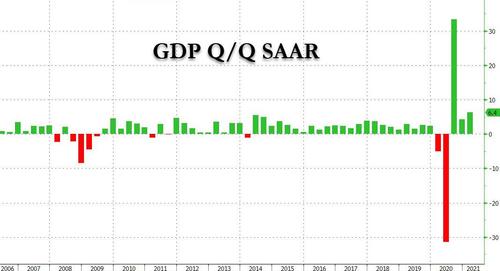

To answer any and all such questions, today the BEA revealed that according to its revised estimate, in Q1 the US economy grew 6.4% SAAR, unchanged from its first estimate and missing Wall Street consensus expectations of 6.5% by the smallest possible fraction.

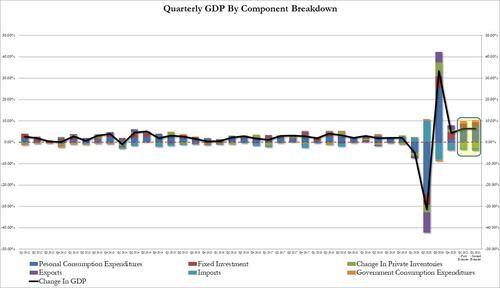

The composition of the GDP growth was roughly in line with the first estimate, with the bulk of the move driven by personal consumption, which rose 11.3% in 1Q, higher than the 11.0% initial estimate after rising 2.3% prior quarter. Fixed investment was also revised modestly higher, accounting for 1.96% of the bottom line GDP print, up from 1.77%. Offsetting these increases, were declines in Private Inventories (where the change subtracted 2.78% vs 2.64% initially), while net trade was hit more aggressively reducing the GDP print by 1.2%, compared to 0.87% previously. Finally, government contributed 1.02% to Q1 GDP, down from the 1.12% initial estimate.

Some more highlights from the report:

- The increase in consumer spending reflected increases in goods (led by motor vehicles and parts) and services (led by food services and accommodations).

- The increase in business investment reflected increases in intellectual property products (led by software) and equipment (led by information processing equipment).

- The increase in government spending primarily reflected an increase in federal spending related to payments made to banks for processing and administering the Paycheck Protection Program loan applications as well as purchases of COVID-19 vaccines for distribution to the public.

- The decrease in inventory investment primarily reflected a decrease in retail trade inventories.

The GDP report also noted that Corporate profits decreased less than 0.1 percent in the first quarter after decreasing 1.4 percent at a quarterly rate in the fourth quarter. Corporate profits increased 12.7% in the first quarter from one year ago, and were impacted by provisions from the Paycheck Protection Program.

- Profits of domestic nonfinancial corporations increased 0.9 percent after decreasing 3.4 percent.

- Profits of domestic financial corporations decreased 0.7 percent after increasing 3.7 percent.

- Profits from the rest of the world decreased 2.1 percent after decreasing 0.2 percent

Finally, on the all important question of inflation and the Fed’s preferred PCE metric, prices of goods and services purchased by U.S. residents increased 3.9% in the first quarter after increasing 1.7% in the fourth quarter, as energy prices increased 46.1% in the first quarter while food prices decreased 0.1%. As for the all-important core PCE, it rose 2.5% Q/Q in 1Q after rising 1.3% prior quarter. As we commented previously, core PCE is designed to skew lower than CPI (as the weights of both cars and shelter are much lower in the PCE which also excludes health insurance prices) which is precisely why the Fed prefers it.

Goldman’s core CPI year-end forecast is 3.5%, while core PCE is 2.3%. Why?

“the weights of both used cars and shelter are much bigger in the core CPI than in the core PCE, and because health insurance prices are not included in the PCE.”

Guess which one the Fed prefers

— zerohedge (@zerohedge) May 24, 2021

Tyler Durden

Thu, 05/27/2021 – 08:48

via ZeroHedge News https://ift.tt/3fnbqfg Tyler Durden