Reid: When Debt Doesn’t Matter…

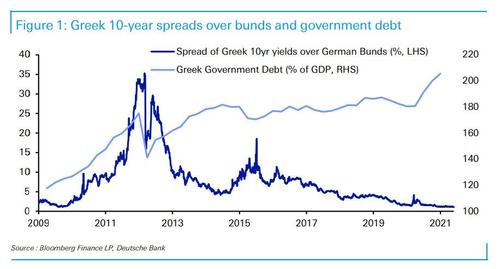

As Jim Reid advises readers of his daily Chart of the Day, yesterday saw the spread of Greek 10-year yields over bunds fall to its narrowest level since 2008, at just 107bps. That was a far cry from the peak in the early 2010s when the restructuring of debt and the European sovereign crisis saw spreads spiral.

What’s even more remarkable however, according to the top credit strategist at Europe’s largest bank, is that “this tightening has come in spite of the fact that Greece’s public debt has continued to climb since then, and now stands at more than 200% of GDP thanks to the pandemic.”

However, since much of this debt is held by the “official” sector – i.e., ECB – and is concessional, it makes traditional debt/GDP metrics much less relevant. Indeed, with central banks holding huge shares of other countries’ bonds this could also be argued to be the case in many highly indebted countries, according to Reid.

According to Reid, “this ‘official’ sector intervention in government bonds has changed the orthodoxy from the immediate post-GFC years. Back then, governments were forced into rapid austerity to ensure they didn’t see a disastrous sovereign crisis. Today, with debt much higher but with huge “official” sector involvement, no serious commentator is talking about short to medium-term sovereign risk.”

As the DB strategist concludes, “this likely makes it much easier for fiscal policy to stay much looser post pandemic than it did post-GFC with all the associated growth, inflation and long-term implications.”

Of course, in the “long-term” some other politician will be in control and as such it is irrelevant for those in control now. Which is why now debt no longer matters and it won’t matter until such time as central banks – which monetize it all – lose their last shred of credibility.

Tyler Durden

Thu, 05/27/2021 – 04:15

via ZeroHedge News https://ift.tt/3fS9YjS Tyler Durden