Retail Investors Storm Back Into The Market: This Is What They Are Buying

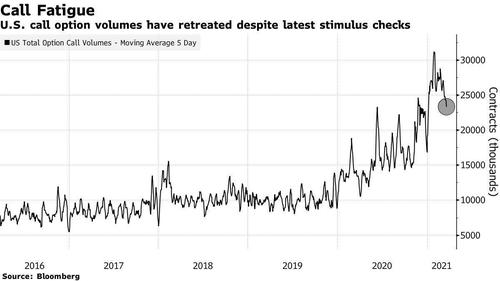

It was less than than three weeks ago when we first noted that retail participation in stock trading had seemingly collapsed after a wild start to the year, with JPMorgan reporting that US retail investors share in equity trading declined sharply in March after a strong January and February, and a record high share of 28% in December.

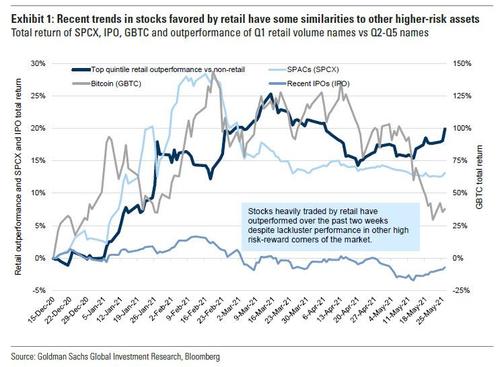

And while April and the start of May exhibited a similar continued decline in both retail participation and performance of “retail favorite” stocks, which underperformed the broader market by 8% since mid-March, things have changed dramatically in the past two weeks and as Goldman notes in a new piece discussing the “Recent performance of stocks with high levels of retail activity”, stocks with high retail trading volumes have outperformed by 5% since May 12th, with half of this outperformance occurring yesterday (Wednesday).

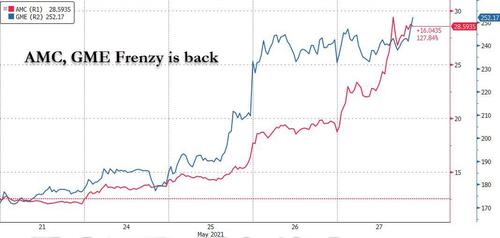

Echoing JPMorgan’s observations, Goldman then notes that while declines in daily trades at retail brokers showed significant declines last week (DARTs), leading to fresh concerns that retail trading activity was on the decline – with many going so far as to conclude that retail investors were no longer investing their stimmies – this too appears to have been the wrong conclusion, as the rise in retail stocks yesterday and especially today, when both GME and AMC have soared…

… suggesting it may be too early to call an end to elevated retail activity.

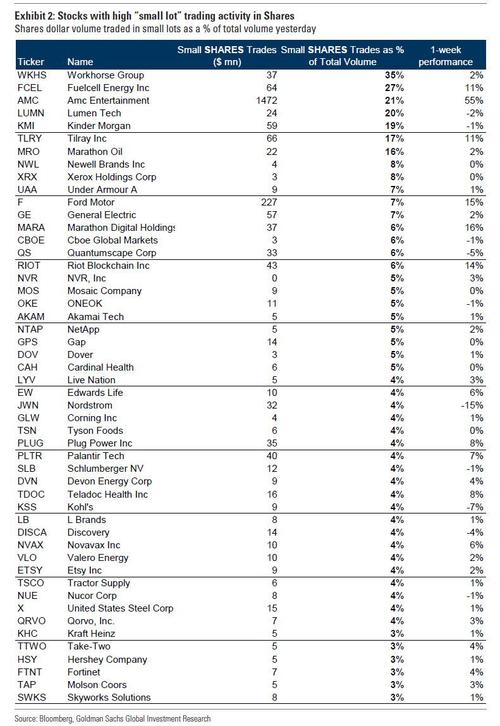

So what are retail investors buying? Based on Goldman’s “small-lot trading” analysis, these are the 50 stocks where retail was the most active yesterday in shares and options.

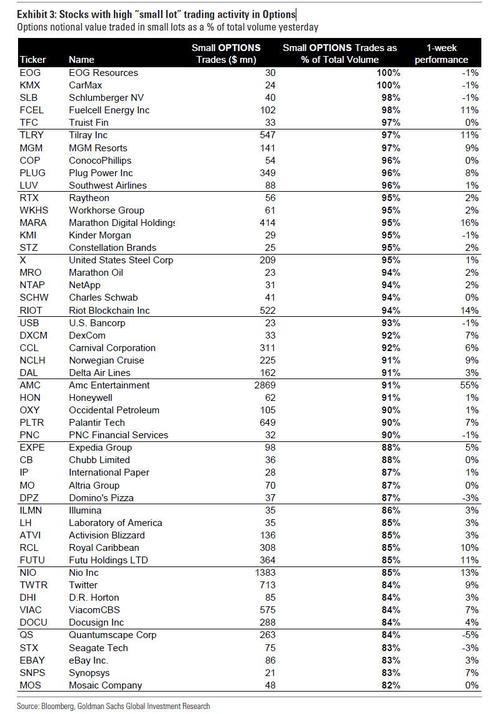

Not enough? Here are the stocks with high “small lot” trading activity in Options

Tyler Durden

Thu, 05/27/2021 – 15:43

via ZeroHedge News https://ift.tt/3fta3eW Tyler Durden