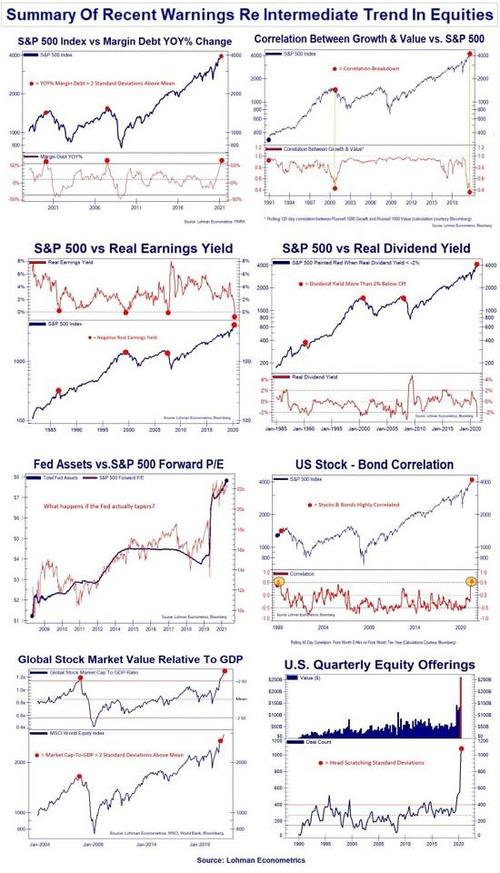

Systemic Risks Abound

Authored by Charles Hugh Smith via OfTwoMinds blog,

If you wanted to design a system guaranteed to collapse in a putrid heap, you’d make moral hazard ubiquitous and you’d make the system 100% dependent on a hubris-soaked faux savior.

For the past 22 years, every time the stock market whimpered, wheezed or whined, the Federal Reserve rushed to soothe the spoiled crybaby. There are two consequential results of the Fed as savior:

1. The Fed has perfected moral hazard.

Everyone from the money manager betting billions to the punters gambling their stimmy money is absolutely confident I can’t lose because the Fed will always push the market higher.

What happens when participants are confident they can’t possibly lose? They make ever-riskier and ever-larger bets. The entire nation is in the grip of a moral hazard mania, all based on the confidence that the Fed will always push every market higher–always, without fail.

2. Organic (i.e. non-manipulated) market forces have been extinguished.

There is now only one consequential force, the Fed. All markets are now 100% dependent on the Fed responding to every bleat from every punter who’s recklessly risky bet is about to go bad.

The Fed is now the perfect union of quasi-religious savior and Helicopter Parent:

oh dear, our little darling got high and crashed the Porsche? Quick, let’s save our precious market from any consequences!

Every day, Fed speakers take to the pulpit to spew another sermon about the Fed’s god-like power and wisdom.

The true believers soak up every word: golly-gee, the Fed is better than any god–it’s guaranteeing I can get rich if I just leverage up any bet in any market!

The financial media obediently bows and scrapes to their savior, the Fed.

With a savior like the Fed, you don’t need a real economy or a real market–all you need is the assurance that the Fed will save every market from every consequence.

All this hubris is jolly while it lasts, but since risk cannot be dissipated, it can only be transferred, the Fed has transferred decades of fast-rising risk to the entire system.

The entire system now rests on the Fed, a dependency that raises its own risks. By imposing moral hazard and crushing consequences, the Fed has stripped the entire financial system of self-correcting mechanisms. This is a surefire recipe for systemic failure and collapse.

There is no way to wean the system off its dependence on the Fed, and no way to restore organic market functions.

The slightest reduction in the Fed’s spew of trillions will crash the market, because there is literally nothing holding it aloft but Fed spew–monetary and verbal.

The problem with becoming 100% dependent on the Fed is any wobble will crash the system– and diminishing returns guarantee a wobble.

Consider this analogy: as the human body loses sensitivity to insulin, this triggers increasing overproduction of insulin, a feedback loop which eventually breaks down.

The system’s sensitivity to the Fed’s spew of trillions of dollars and claptrap preaching is diminishing, which is why the Fed has moved from spewing hundreds of billions to trillions, and why Fed speakers who we once heard from once a month are now out in force every single day.

Remarkably, few anticipate any consequence from the Fed’s perfection of moral hazard and the system’s 100% dependence on the Fed’s spew even as diminishing returns gnaw away at the efficacy of the Fed’s ever more grandiose policies and pronouncements.

If you wanted to design a system guaranteed to collapse in a putrid heap, you’d make moral hazard ubiquitous and you’d make the system 100% dependent on a hubris-soaked faux savior. Hey, that describes America’s economy and financial system perfectly.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Thu, 05/27/2021 – 06:30

via ZeroHedge News https://ift.tt/2RSUDHM Tyler Durden