Tesla Is “Paying In Advance” For Semiconductors And “Actively Considering” Buying Their Own Foundry

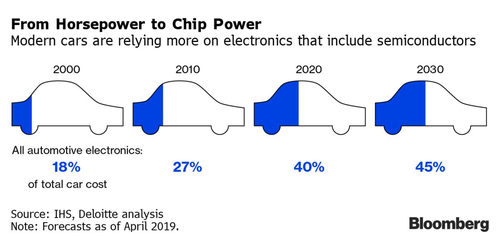

Tesla is taking what is being called an “unusual step” to secure its supply of semiconductor chips for its vehicles in the midst of a global shortage. The company is going to be “paying for advance” for the semis it needs and is also considering “buying a plant”, according to a new report by FT.

The company is reportedly in talks with semi companies in Taiwan, South Korea and the US. The chips that Tesla uses for its vehicles are mainly made in Taiwan and South Korea. Tesla’s interest in buying a plant is still preliminary, sources noted.

Some chipmakers have been allowing large customers to make upfront deposits to secure orders at fixed prices. While that practice is outside the norm generally, it has come to prominence once again due to the supply shortage.

Ambrose Conroy, founder and chief executive of Seraph Consulting, a supply chain consultancy, of Tesla, told FT: “They will buy capacity at first, but they are actively considering buying their own foundry.”

Velu Sinha, a partner at Bain in Shanghai, added that he didn’t think Tesla would buy their own factory: “They see the price tag for the factory and they go back and get in line.”

CW Chung, an analyst at Nomura, noted that companies like Samsung can change contracting arrangements with companies like Tesla who seek specialized chips: “Given the current capacity shortage, Samsung may give dedicated capacity to companies like Tesla, which uses chips with a longer life cycle.”

One European auto advisor told FT that carmakers would have “more direct dealings” with chip manufacturers. “That means they have to invest in in-house expertise and it also means dedicated buying agreements,” they said.

But dedicating lines to individual customers has its drawbacks for semi companies. “The moment you block out certain capacity for one customer, that flexibility disappears,” one semi company exec commented.

We noted earlier this month that automakers like Nissan are leaving navigation systems out of “thousands of vehicles” that would typically have them due to the shortage and that Dodge’s Ram no longer offers its 1500 pickups with an “intelligent” rearview mirror. Renault has stopped offering an oversized digital screen behind the steering wheel of its Arkana SUV.

We also pointed out “thousands” of Ford trucks sitting along the highway in Kentucky, awaiting semi chips for completion of assembly weeks ago. We noted when, earlier this month, Stellantis said there would be “no end in sight” to the shortage and that the company was making changes to its lineup, including changing the dashboard of the Peugeot 308, to try and adapt to the crisis.

Intel’s CEO, speaking on 60 Minutes several weeks ago, said: “We have a couple of years until we catch up to this surging demand across every aspect of the business.”

Meanwhile, Tesla currently has an astounding $6.6 billion in accounts payable, per its last 10-Q.

This has us begging the question about “paying in advance”: was this a decision prompted by Tesla decision making, or was this suppliers finally saying to the company: “The games are over. Time to pay up or shut up”?

Tyler Durden

Thu, 05/27/2021 – 11:05

via ZeroHedge News https://ift.tt/3oX1psj Tyler Durden