AMC Explodes As Frenzied Retail Buying Makes It Most Traded Stock In The Entire Market

The recent retail buying euphoria has carried over into Friday with the original meme stocks, AMC and GME, soaring at the open amid unprecedented volumes.

AMC has soared 33%, trading at $35 at last check in a market where the bid/ask spread is approaching a dollar, rising as high as $36.72 after a burst of early buying, sending its market value above $16 billion…

… with Bloomberg reporting that it is now the most traded stock in the entire market based on value, and also the most traded in terms of volume (with pennystock HCMC the only name more actively traded).

… while GME is seeing a similar buying frenzy, if somewhat more subdued, rising as high as $268.8 or up 5.8%, and last seen around $263, the highest since March 15.

The gamma-driven meltup has seen a frenzy of deep out of the money call options in AMC being bought, with $50 calls expiring today being bought (and sold) hand over fist.

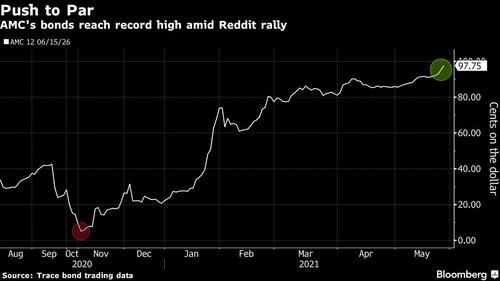

As Bloomberg notes, the WallStreetBets rally is also making waves in debt land as well, because while AMC shares have only returned to 2017’s heights, the company’s 12% junk bonds hit all-time highs this week as AMC debt due in 2026 rose to a record high 97.17 cents on the dollar Thursday after trading as low as 5 cents in November.

And while the FOMO is in fool, er, full force, the question is when does AMC take advantage of today’s buying frenzy and announce the next equity offering. As a reminder, in March CEO Adam Aron said that AMC “will carefully examine the raising of additional capital in whatever form we think is most attractive” and is focused on de-leveraging its more than $11 billion debt load. As Bloomberg notes, investors have suggested that the company should strike while the iron’s hot and sell more shares to either pay down or refinance that debt.

As a reminder, AMC raised $428 million by selling shares just two weeks ago at an average price of $9.94/share, which should give the movie-theater chain a “cushion through year-end to weather a $120 million monthly cash burn,” the pair wrote in a report this week. However, as Bloomberg Intelligence analysts add, AMC should capitalize on this moment and go even further, writing that “business fundamentals remain weak and uncertain at best as movie going is yet to kick off in a big way.”

The question is whether AMC management will surprise the Reddit army today or if it will wait until after the long weekend to unveil the latest dilution.

Tyler Durden

Fri, 05/28/2021 – 09:54

via ZeroHedge News https://ift.tt/34nbwx8 Tyler Durden