“Backdoor QE” Is Working As Expected, But It’s About To Be Replaced With “Stealth QT”

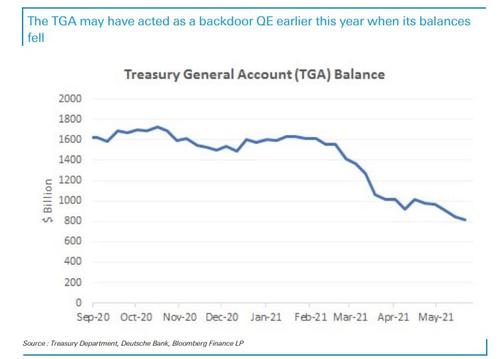

It was back in February when we first said that (almost) nobody was paying attention to the “mind-boggling liquidity” that was about to hit the markets in the form of hundreds of billions in cash released from the Treasury’s TGA account held at the Fed. This historic liquidity injection by the Treasury and not the Fed (which continues to this day to inject $120BN in liquidity monthly from its ongoing QE) was, as we put it, a form of backdoor QE, which would push asset prices higher and depress real rates.

And while everyone knows that stocks have galloped higher since then – the S&P is now effectively at its all time high of 4,200, up from 3,800 at the start of the year, how has this tidal wave of liquidity impacted rates?

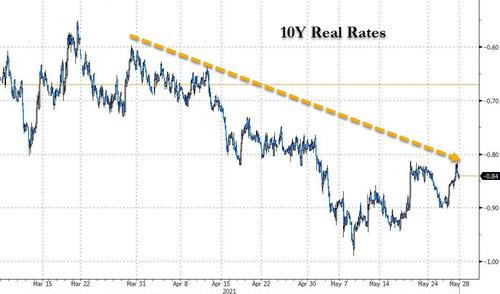

As DB’s Francis Yared writes in his “chart of the day”, while the US Treasury has disbursed significant amounts of its latest stimulus in March, a move which would be typically associated with higher real rates, US real rates have instead rallied ~20bp since early March in a move usually associated with additional Fed QE.

According to Yared, this apparent “puzzle” could be explained by what our readers already know: the US Treasury has massively drained its cash balance at the Fed. As shown below, the Treasury General Account has declined by USD640bn from USD1.5trn to USD866bn since March, a liquidity injection comparable to 5 months of QE.

Yared then explains something else our readers know: that “the decline in the TGA balance is an injection of liquidity in the system that will result in an increase in excess reserves. As some of the injected liquidity is likely to be reinvested in financial assets in general and US government bonds in particular, the liquidity injection could have a similar impact as QE“.

And that’s precisely what effect it is having, on both stocks and Treasuries.

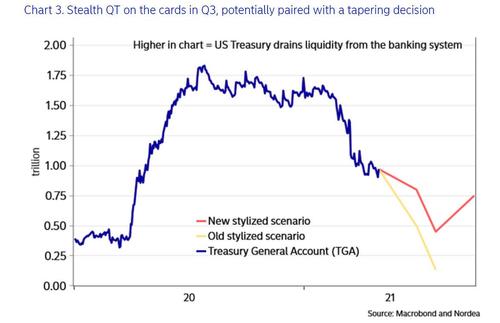

That said, the party is almost over and looking ahead, the TGA balance is expected to fall to around 450bn by the end of July from $778BN currently but then quickly rise after to settle in a $600-800bn range.

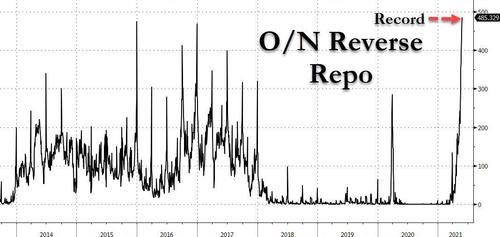

But first, there is just too much liquidity in the system, and is why Fed’s ON Reverse Repo Facility is working overdrive to drain record amounts of reserves amid a massive shortage of collateral, hitting an all time high of $485BN today…

… in the process neutralizing increasingly larger amounts of liquidity. But not for long: the Fed is expected to announce its tapering plans some time around, or just after, the late August Jackson Hole symposium – perhaps the September FOMC meeting.

This means that the impact of the backdoor QE should wane in the months ahead, and that peak liquidity momentum is just around the corner. Indeed, one can say that we are about to go from generous backdoor QE to “stealth “QT in Q3, as the US Treasury expects to rebuild the TGA to levels around 750bn by the end of September, in the process zapping liquidity by around 300bn in Q3 along the way according to Nordea, which paired with a potential tapering announcement from the Fed in September could prove to be a trigger for a surge in volatility and an important turning point for USD liquidity.

And speaking of Nordea, the bank expects a limited impact of the liquidity additions the rest of Q2, since the surge in overnight RRP (assuming there is no major crisis in the repo market now that half a trillion dollars in inert reserves are rolled over every night) usage acts as a counter-weight to the added liquidity and if the Fed decides to relax the criteria for the ON RRP facility even further in June, then it only adds to this point.

How to play it?

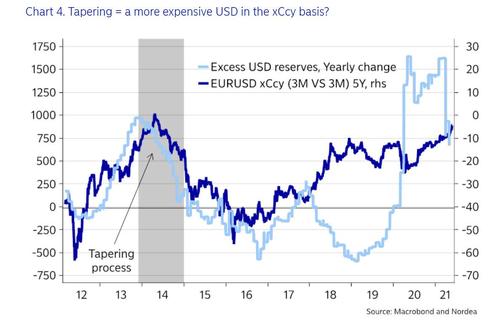

According to Nordea, the cross-currency basis swap “is probably the most “naked bet” on a reversal of USD liquidity trends (OIS/OIS xCcy would be the clearest bet). The recent positive repricing of the entire EURUSD xCcy basis curve is a consequence of the abundancy of USDs and it is starting to look almost historically cheap to receive the EURUSD xCcy curve. When the Fed finally launched tapering in late 2013, it proved to be the first warning signal of a reversal of the trend in the xCcy basis as well, which a subsequent year-long repricing of USD liquidity following the decision (see chart 4).”

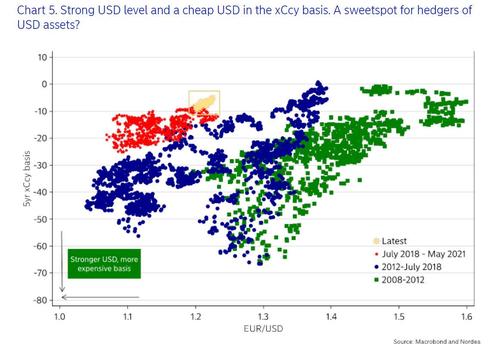

The bank goes on to note that the combination of a fairly strong USD and a cheap USD in the xCcy basis is historically a rare phenomenon – as shown by the yellow dot in the next chart – hinting that the current combination of levels is a kind of sweetspot for hedgers of USD assets.

Furthermore, Nordea notes that the xCcy basis is clearly correlated to global equity trends, and is currently 75% correlated to MSCI World on a running yearly basis, which leaves receiving the 5yr xCcy basis as a decent macro hedge from a portfolio perspective.

Why note just short stocks? Well, that’s possible – but remember that should markets crash, and they well might if there is a major liquidity regime shift, it will only invite the Fed to immediately step in and potentially go all in, buying up ETFs (like the BOJ) or even single name stocks. Impossible? Well, before March 2020 10 out of 10 very serious finance professionals also said it was impossible that the Fed would be buying corporate bonds and junk bonds ETFs in the open market. See how that worked out for them…

Tyler Durden

Fri, 05/28/2021 – 14:40

via ZeroHedge News https://ift.tt/34yrnJ3 Tyler Durden