Fed’s “Favorite” Inflation Indicator Explodes At Fastest Rate Since 1992 As Incomes Crash By Record

While Americans’ income and spending is normally the headline-making data, this morning’s release will focus all eyes on The Fed’s favorite inflation indicator – the PCE Deflator.

The headline PCE Deflator rose 3.6% YoY, the fastest rate or price increases since 2008.

Even more notably, the Core PCE Deflator soared 3.1% YoY (hotter than the +2.9% YoY expected) and the hottest print since May 1992…

Source: Bloomberg

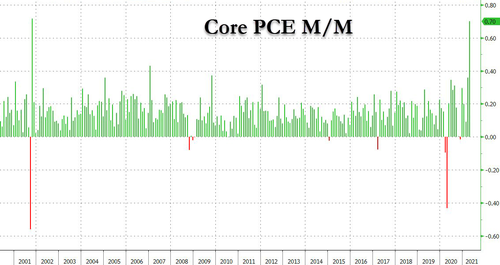

With the highest MoM rise in the core deflator since 9/11…

Source: Bloomberg

However, back in income and spending land, the picture was very mixed with incomes crashing 13.1% MoM and spending rising just 0.5% MoM after the stimmies run dry …

Source: Bloomberg

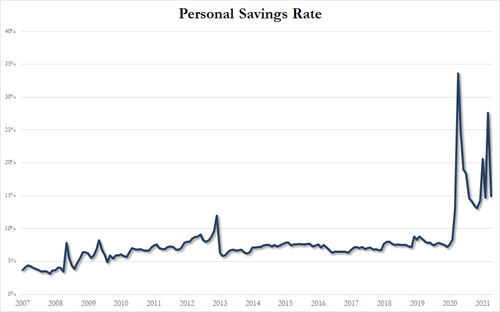

That is the biggest MoM crash in incomes ever which sent the savings rate plunging…

Source: Bloomberg

The consumer buffer is almost gone: personal savings rate plunges by 50% as Americans do what they do best: spend their savings.

So – let’s summarize – prices are rising at their fastest pace in almost 30 years and incomes just plunged by their most ever!

We’re gonna need more stimmies!

Tyler Durden

Fri, 05/28/2021 – 08:39

via ZeroHedge News https://ift.tt/3vzfQFA Tyler Durden