Futures Jump, Meme Stocks Soar Ahead Of Key Inflation Print

S&P futures rose on Friday after solid economic data and Joe Biden’s leaked $6 trillion federal budget plans spurred a Wall Street rally in cyclical shares ahead of a closely watched inflation report offsetting recent worries about a spike in prices put the S&P 500 on course for its smallest monthly gain since February. At 7:15 a.m. ET, Dow e-minis were up 177 points, or 0.5%, S&P 500 e-minis were up 16 points, or 0.38%, and Nasdaq 100 e-minis were up 48 points, or 0.35%. Treasuries were steady and the dollar strengthened. Markets will be shut on Monday for Memorial Day holiday

In a continuation of yesterday’s retail buying frenzy, meme stocks GameStop and AMC Entertainment were set for a fifth day of gains, soaring 4.1% and 21.8% respectively, extending gains on the back of a social media-led rally that helped double the value of AMC’s stock this week. Here are some of the other biggest U.S. movers today:

- HP shares (HPQ) drop 5% in U.S. premarket trading after beating Wall Street estimates but warning that the ongoing computer chip shortage could impact its ability to meet demand for laptops this year. This prompted concerns strong PC sales have peaked. Morgan Stanley sees the pullback as a buying opportunity, calling the supply chain risks “manageable.”

- Salesforce.com (CRM) rose 4.9% after raising its full-year forecast for revenue and profit, helped by increased demand for its cloud-based software during the pandemic.

- Iterum Therapeutics (ITRM) jumps 27% in premarket trading after saying the FDA doesn’t deem an advisory committee meeting as necessary as it reviews the co.’s new drug application for sulopenem etzadroxil/probenecid.

- Stocks exposed to cryptocurrencies such as Marathon Digital (MARA) and Riot Blockchain (RIOT) decline as Bitcoin falls as much as 5.2% against the dollar.

- Boeing Co fell 1% after reports said it halted deliveries of its 787 Dreamliners, adding fresh delays for customers following a recent five-month delivery suspension due to production problems.

- Salesforce.com Inc added 4.9% premarket after raising its full-year forecast for revenue and profit, helped by increased demand for its cloud-based software during the pandemic.

The Fed’s favorite inflation metric – the core PCE index – will be released at 8:30 a.m. ET, and is expected to have risen 0.6% in April after a 0.4% increase in March. A big beat could give credence to fears of an overheating economy and prompt the central bank to reconsider its accommodative monetary policy.

Biden is reportedly set to unveil a budget that would take federal spending to $6 trillion in the coming fiscal year. Investors will watch data on personal spending and the Federal Reserve’s preferred inflation measure later Thursday for further clues on the outlook for prices.

Global stocks are set to climb for a fourth month, supported by the frenzied economic rebound from Covid-19, while comments from Federal Reserve and global central bank officials have helped temper fears that inflation could spark a faster-than-expected reduction in stimulus. Treasury Secretary Janet Yellen said she sees the burst in prices as temporary, though likely to last through the end of 2021.

“Between now and year end, we see a little more room for stocks to move up from where they are today and the highs they already achieved earlier this year,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets LLC, wrote in a note. “But we don’t think that the path to get there will be smooth and think a short-term pullback before the year is up remains likely.”

European stocks reached a fresh record high, boosted by expectations that the European Central Bank won’t hit the brake on stimulus measures next month. The Euro Stoxx 50 rose 0.6% to best levels of the week. DAX outperformed slightly, with Insurance, financial services and industrial names the leading sectors, while miners and autos are slightly in the red. Here are some of the biggest European movers today:

- Marimekko shares jump as much as 14% to a record after the Finnish design company announced a debut collection with Adidas, “marking the first-ever sports apparel collaboration from Marimekko.”

- Cattolica gains as much as 12% and is the day’s second-best performer on the FTSE Italia All-Share Index after reporting 1Q results that Equita called “solid.”

- Solutions 30 advances as much as 30%, a third session of gains after the stock crashed 71% on Monday when the company said Ernst & Young couldn’t give an opinion on its 2020 financial statements.

- Banco Sabadell drops as much as 4.3% after unveiling its new strategic plan that includes cost savings that “may require additional convincing,” according to Jefferies.

- Corbion falls as much as 6.3% after Barclays downgrades to equal-weight from overweight, citing cost headwinds in raw materials.

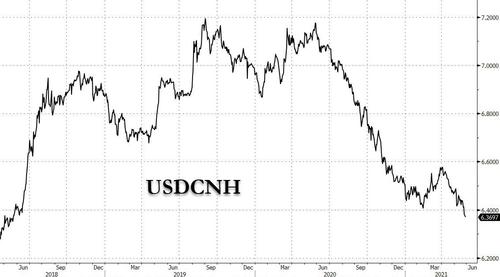

Earlier in the session, the MSCI Asia Pacific Index added 0.8% while Japan’s Topix index closed 1.9% higher. Chinese stocks fell for the first time in five days, as foreign investors ended their buying spree after the nation’s central bank signaled the yuan’s recent gains have been too fast. The CSI 300 Index shed 0.3%, driven by declines in healthcare and technology firms. Still, the benchmark recorded its best week in more than three months with a 3.6% advance, mainly fueled by Tuesday’s jump that was the most since July last year. The People’s Bank of China set a weaker-than-expected daily reference rate for the yuan Friday, following its statement the previous day warning against one-way bets. The Chinese currency hit a five-year high against a basket of trading partners this week, prompting overseas investors to pile into local assets including stocks.

Foreigners became net sellers of mainland shares for the first time this week, reflecting jitters caused by the PBOC’s latest moves on the currency. They trimmed 526 million yuan worth of holdings Friday, paring net purchases this week to 46.8 billion yuan.

In Australia, the S&P/ASX 200 index rose 1.2% to 7,179.50, surpassing its previous record from May 10. The benchmark was supported by gains among miners and energy stocks. The gauge climbed 2.1% for the week, its best since April 9. Inghams was the best performing stock on Friday after saying its forecast earnings may exceed current consensus for the FY21 period. Nuix was the biggest laggard after ending a consultancy pact. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,182.25. The benchmark dipped back into technical correction territory after dropping over 10% from its Jan. 8 record.

In rates, the 10-year U.S. Treasury yield hovered above 1.60% amid growth optimism and concerns of more debt supply to fund spending. Yield curves bear steepen, long end gilts underperform, trading ~1bps cheaper to bunds. Following a slate of U.S. economic data including April personal income and spending, focus is likely to shift to month-end rebalancing, at 2pm ET for Bloomberg Barclays Treasury Index, conforming to Sifma’s early close recommendation ahead of U.S. holiday weekend. In Europe, semi-core and peripheral spreads are mixed, BTPs are steady despite softer auction metrics. Cash USTs hold a narrow range ahead of a round of economic data and an early close at 2pm New York ahead of Monday’s Memorial Day holiday.

In FX, Bloomberg Dollar index was little changed, trading near the best levels of the week. The yen fell as Japan recommended extending a state of emergency that includes Tokyo to curb infections. The euro was steady around $1.22 after earlier dipping to a one- week low. The pound inched lower, retreating from Thursday’s rally, with concerns growing that the U.K. won’t be able to fully re-open its economy later in June; traders were also reconsidering a speech from Bank of England policy maker Gertjan Vlieghe on Thursday, which pushed up the pound and gilt yields. Sweden’s krona fell, paring some of yesterday’s gain, but stayed within its recent range versus the greenback. The Australian dollar rose over its New Zealand peer on short- covering from funds ahead of Tuesday’s RBA policy meeting. China signaled the yuan’s recent appreciation is too rapid, with a weaker-than-expected reference rate. NZD and SEK were the worst G-10 performers. TRY weakens to a record low against USD.

In commodities, crude futures drift off the lows, WTI regains a $67-handle, Brent holds above $69.50. Spot gold holds a narrow range, finding support around Thursday’s lows near $1,890/oz. Most base metals are in the green with LME tin rallying sharply on production concerns.

Bitcoin slipped toward the $35,000 level, wiping out most of this week’s advance as Bank of Japan Governor Haruhiko Kuroda warned about token’s volatility and speculative trading. The digital currency lost 7% to trade around $35,700, recalling levels seen in last week’s crypto meltdown. Bitcoin is now flat for the week after a run that’s seen prices swing between $33,000 and $39,000.

Looking at the day ahead now, additional data highlights from the US include April’s data on personal income and personal spending, the MNI Chicago PMI for May, and the preliminary wholesale inventories for April. From central banks, the ECB’s Villeroy will be speaking, while there’s also a virtual meeting of G7 finance ministers and central bank governors.

Market Snapshot

- S&P 500 futures up 0.3% to 4,212.25

- STOXX Europe 600 up 0.43% to 448.36

- MXAP up 0.9% to 208.34

- MXAPJ up 0.5% to 698.91

- Nikkei up 2.1% to 29,149.41

- Topix up 1.9% to 1,947.44

- Hang Seng Index little changed at 29,124.41

- Shanghai Composite down 0.2% to 3,600.78

- Sensex up 0.7% to 51,497.16

- Australia S&P/ASX 200 up 1.2% to 7,179.51

- Kospi up 0.7% to 3,188.73

- Brent Futures little changed at $69.49/bbl

- Gold spot down 0.2% to $1,892.44

- U.S. Dollar Index little changed at 90.02

- German 10Y yield rose 0.2 bps to -0.170%

- Euro little changed at $1.2197

Top Overnight News from Bloomberg

- ECB Executive Board member Isabel Schnabel played down concerns over rising borrowing costs as policy makers prepare for their next meeting, saying that higher bond yields reflect an improving economy

- The latest repricing in currency volatility skews shows how investors are placing their bets on which central bank moves first away from extraordinary stimulus. Leveraged and institutional names alike have added positions lately that use the likes of the euro, the yen and the Swiss franc as funding currencies in carry trades versus emerging market and cyclical ones, a Europe-based trader says

- The Bank of Japan will consider climate change in its monetary policy discussions, Governor Haruhiko Kuroda said in his clearest signal yet that the central bank is looking to support the battle against global warming

- France’s statistics agency cut its estimate of economic output at the start of the year, showing the euro area’s second largest economy slipped into a recession for the second time in the Covid pandemic

- China has dialed up its rhetoric about surging commodity prices and a strong currency with almost daily commentary by officials and in state media in the past two weeks, a sign authorities are becoming more uncomfortable with recent gains

- China is signaling that the yuan’s recent appreciation is too rapid, with steps that are likely to slow — but not reverse — its gains after the currency soared tomulti-year highs against that of trading partners

- U.K. firms are more upbeat about the economy than at any time since 2016, buoyed by a further easing of coronavirus restrictions in May, the Lloyds Bank Business Barometer shows

- Gold stored at the Bank of England has been selling for unusually high premiums recently, signaling that central banks may be back in the market buying

- The Japanese government recommended extending a state of emergency that includes Tokyo and other major cities, in a last-ditch effort to rein in Covid infections ahead of the capital hosting the Olympics in less than two months

Quick look at global market news courtesy of Newsquawk

Asian equity markets traded mostly higher as the region improved upon the slight positive tilt seen on Wall St. and US equity futures also marginally extended on the prior day’s late ramp-up on what was otherwise a choppy session following mixed data releases and heading into month-end. ASX 200 (+1.2%) was underpinned by continued outperformance in the mining-related sectors amid strength in underlying commodity prices and with risk appetite also spurred by potential M&A reports including BetMakers Technology’s proposal to acquire Tabcorp’s wagering and media business for AUD 4.0bln, while KKR and Domain Holdings partnered on a surprise AUD 3bln bid for PEXA that boosted shares in Link Administration which the largest shareholder in PEXA with a 44% stake. Nikkei 225 (+2.1%) outperformed as exporters cheered the recent currency weakness and with the BoJ said to consider a 6-month extension to the September deadline for the pandemic-relief program as soon as the next policy meeting on June 17th/18th. Hang Seng (+0.1%) and Shanghai Comp. (-0.2%) were mixed with focus in Hong Kong on JD Logistics which jumped over 10% on its debut and which was the 2nd largest IPO for the city so far this year, although the mainland lagged following the recent strengthening of the CNY to a 5-year high against a basket of currencies and amid lingering tensions with the US after the bipartisan bill to counter China received enough support to advance in the US Senate. Finally, 10yr JGBs tracked the recent declines in T-notes with demand hampered by the outperformance of Japanese stocks which pressured prices in the 10yr benchmark beneath 151.50, while the central bank’s presence in the market for over JPY 1.1tln of JGBs heavily concentrated in 3yr-10yr maturities did little to spur a rebound.

Top Asian News

- Traders Grapple With Grief While India’s Markets Keep Rising

- Survivors Tell a Harrowing Tale of Lapses in India Sea Disaster

- Vaccine Progress, Weak Yen a Reprieve for Japan’s Lagging Stocks

- Japan Widens Vaccine Center Access as Thousands of Slots Remain;

- Kuroda Says BOJ Will Mull Climate in Monetary Policy Discussions

Equities in Europe hold onto the modest gains seen at the cash open and some more (Euro Stoxx 50 +0.5%), following on from mixed trade seen across APAC and on Wall Street, with the tone somewhat tentative ahead of US PCE and looming month-end. As a reminder, US and UK markets will be closed on Monday due to public holidays. US equity futures meanwhile have been grinding higher since the start of European trade despite a distinct lack of news flow as markets approach the summer period, whilst global central bank officials continue to stress the need for current levels of support and hold the view that inflationary pressures are transitory and not secular. Back to Europe, sectors are mostly positive with the earlier cyclical bias fading to a more broad-based/themeless picture with some idiosyncratic outliers. Banks top the chart amid the favourable yield environment, whilst Autos and Basic resources lag, with the latter seeing renewed pressure as China continues to jawbone commodity prices. Individual movers are relatively scarce, but SAP (+0.3%) has ultimately failed to glean much tailwind from its US peer Salesforce rising +4% post-earnings. Airbus (+2.4%) meanwhile remains firm following yesterday’s production upgrade alongside a positive broker move by JPM today.

Top European News

- Europe’s Top Stock in 2015 Stakes Revival on Payment Cards

- U.K. Considers Carbon Border Tax to Protect Domestic Industry

- Germany Plans to Expand Coronavirus Vaccinations to Children

- Danske Bank Veteran Chief Analyst Leaves for Banking Circle

In FX, far from all change or hero to zero, as the Kiwi remains firmly on track to record healthy gains vs the Greenback and Aussie on diverging Central Bank policy outlooks following the hawkish RBNZ shift to signal a September 2022 OCR lift-off on Wednesday. However, Nzd/Usd has retreated through 0.7250 from around 0.7317 at best and Aud/Nzd has bounced just over 50 pips from a whisker above 1.0600 amidst what appears to be profit taking and a technical correction more than anything fundamental given that Aud/Usd remains heavy after failing to retain hold of the 0.7800 handle and subsequently not sustaining momentum beyond the half round number below. Meanwhile, the Buck is also struggling to build on recovery gains even though month end factors are mildly supportive/constructive, especially against the Yen and US Treasury yields are off recent lows ahead of potentially key data and surveys, like PCE inflation, advanced trade and Chicago PMI, on top of President Biden’s Budget presentation. Indeed, the DXY has not extended much further having regained 90.000+ status before waning again within a 90.163-89.987 band and falling fractionally short of the w-t-d high posted yesterday.

- EUR/GBP/JPY- The Euro got a somewhat unexpected boost from ECB’s Schnabel delivering a more upbeat assessment of the Eurozone economic recovery, and crucially no concern whatsoever about the recent leg-up in yields as in her view this reflects the improving outlook and is desirable. She also believes that financing conditions remain favourable, in contrast with distinctly dovish midweek commentary from Panetta and others of late. Hence, Eur/Usd is still keeping 1.2200 in sight and averting attempts to test/trigger stops that are anticipated to be sitting circa 1.2160 (double bottom from last week), though may find it hard to revisit 1.2250+ peaks as heavy option expiry interest resides between 1.2200-10 (1.6 bn), 1.2215-25 (1 bn) and 1.2265-75 (1 bn). Similarly, Sterling has continued its revival from worst levels in wake of hawkish BoE vibes from Vlieghe on Thursday, albeit with less impetus via Haldane who is also due to leave the MPC shortly and already dissented this month in favour of a Gbp 50 bn APF Gilt reduction – see 10.00BST and 9.27BST posts on the Headline Feed for more. Nevertheless, Cable has peered over 1.4200 again and Eur/Gbp remains sub-0.8600. Elsewhere, the Yen may actually rescued from a worse fate by option expiries at the 110.00 strike (2 bn) as its strives to contain losses and arrest a slide into month end, and with some market observers also flagging the prospect that Japanese exporters could be buyers at the level for hedge purposes to offset the tide of rebalancing flows.

- CHF/CAD – Both on the backfoot against their US counterpart, with the Franc not drawing much encouragement from a significantly stronger than expected Swiss KOF indicator as it hovers near 0.9000, while the Loonie seems equally unimpressed with a firm revival in crude prices, but may be cushioned by unusually large option expiries running off at the 1.2100 strike later (1.5 bn for the NY cut).

In commodities, WTI Jul and Brent Aug trade relatively flat with an upside bias, in line with the cautiously positive risk tone, with the former on either side of USD 67/bbl (vs 66.74-67.45 range) and the latter just north of USD 69/bbl (vs 69.01-64 range). News flow for the complex has remained light after the gains seen yesterday as Biden’s USD 6tln 2022 budget proposal energised the bulls, with eyes still on the Iranian nuclear deal discussions – with the noise surrounding this much quieter this week vs the last. “However, if and when there is a breakthrough, we would expect it to lead to some immediate downward pressure on the market. We expect any weakness to be short-lived, however, given that the medium-term fundamentals are still supportive.” ING suggests, whilst also citing the upcoming summer driving season. Elsewhere, spot gold and silver have been uneventful and mildly pressured by the firmer Buck and yields. Spot gold has dipped back below USD 1,900/oz with the level acting as overnight resistance. Turning to base metals, Dalian iron ore continued to recover overnight from its recent losses, but the focus remains on Beijing’s commodities crackdown with China’s Securities Journal re-running similar reports to last week regarding the crackdown of speculatively driven price fluctuations. Further, sources note that several Chinese commodity firms pared back their bullish futures bets at the request of the government. LME copper has been subdued but holds onto its USD 10,000/t. Goldman Sachs said the fundamental path for key commodities including oil, copper and soybeans remains oriented towards incremental tightness in H2 with scant evidence that supply response is enough to derail the bull market, while it added that the bullish thesis in commodities is not about Chinese speculators nor is it growth in Chinese demand, but is about scarcity and a DM-led recovery.

US Event Calendar

- 8:30am: April Personal Spending, est. 0.5%, prior 4.2%

- 8:30am: April Personal Income, est. -14.2%, prior 21.1%

- 8:30am: April PCE Deflator MoM, est. 0.6%, prior 0.5%; PCE Deflator YoY, est. 3.5%, prior 2.3%

- 8:30am: April PCE Core Deflator MoM, est. 0.6%, prior 0.4%; PCE Core Deflator YoY, est. 2.9%, prior 1.8%

- 8:30am: April Retail Inventories MoM, est. -2.0%, prior -1.4%

- 8:30am: April Wholesale Inventories MoM, est. 0.7%, prior 1.3%

- 8:30am: April Advance Goods Trade Balance, est. -$92b, prior -$90.6b

- 9:45am: May MNI Chicago PMI, est. 68.0, prior 72.1

- 10am: May U. of Mich. Current Conditions, prior 90.8

- 10am: May U. of Mich. Sentiment, est. 83.0, prior 82.8; 1 Yr Inflation, prior 4.6%; 5-10 Yr Inflation, prior 3.1%

DB’s Jim Reid concludes the overnight wrap

Yesterday was the first day in about 6 weeks that I ventured outside in just a short sleeve shirt. Summer is arriving at last and now looks pretty set fair for the next couple of weeks. Famous last words. I’m celebrating tomorrow by playing a 36 hole golf tournament, then an 18 hole one on Sunday, Legoland on Bank Holiday Monday and then I’m taking a day’s holiday on Tuesday to play another 36 hole golf tournament. Any guesses as to which one of those days I’m looking forward to least? My aim is to go on as few (preferably zero) stomach churning rollercoasters as possible.

With the sun out at least in this little corner of the world, global cyclical equities posted a decent performance yesterday after generally positive data releases and further good news on the pandemic helped to support risk appetite. Next week’s ISM numbers and US jobs report will be more important to sentiment but for now optimism has edged the S&P 500 (+0.12%) back to within 0.8% of its all-time high. Meanwhile Europe’s STOXX 600 (+0.27%) advanced for a 6th successive session to a new record.

US capital goods (+1.86%) and banks (+1.45%) led the moves higher for the S&P, while small-cap stocks also performed strongly as the Russell 2000 index advanced +1.06%. Pandemic outperformers lagged once again with tech hardware (-0.93%) and software (-0.68%) among the poorest performing industries. In Europe it was much the same story of cyclicals leading the charge, which included the STOXX Banks index rising +2.18% to another post-pandemic high.

In term of the catalysts, the weekly initial jobless claims from the US proved to be better than expected for the week through May 22, coming in at a post-pandemic low of 406k (vs. 425k expected). In turn, this raised hopes further that next week’s jobs report will prove that the underwhelming April release of just a +266k increase in nonfarm payrolls was a blip rather than a trend. Our own economists are expecting a decent bounce back with an +800k increase in nonfarm payrolls, which would be the best number since last August given the revisions to the previous data. Other numbers also proved stronger than expected, with core capital goods orders rising by +2.3% in April (vs. +1.0% expected), even if the broader headline durable goods orders unexpectedly fell -1.3% (vs. +0.8% expected).

One additional notable data highlight was US Q1 core PCE, which was revised up two tenths to 2.5%, which in turn lifted the YoY estimates for Q1 to 1.61% from 1.55%. That is the second highest quarterly uptick in core PCE since 2012, with only Q3 of last year (the initial reopening) being higher. This will have inflation-watchers even more focused on today’s April core PCE deflator print and the final reading on the University of Michigan May consumer sentiment. Our economists expect an large increase (+0.77% forecast vs. +0.36% previously), given the outsized strength in the April CPI and PPI data. If their expectations bear out, it would bring the YoY growth rate up from 1.8% to 3.1%, with half of that due to base effects rolling off of the calculation. For the University of Michigan’s consumer sentiment index (83.0 final vs. 82.8 preliminary), the attention will be on revisions to the median 5 – 10 year inflation expectations series. The preliminary release showed a 40bp surge to 3.1% – the highest since August 2008. This number can be heavily revised so definitely one to watch as we think expectations are going to be key to whether inflation takes a foothold.

Another reflationary headline was regarding President Biden’s budget for fiscal year 2022, which is set to be unveiled today. The New York Times reported that it would include a call for $6tn of federal spending in the 2022 fiscal year. Furthermore, over the decade it would take federal spending to its highest sustained levels since WWII according to the report, with the government spending more each year as a percentage of GDP than at any time since WWII, with the exception of 2020 and 2021 during the coronavirus recession and response.

Though US budgets are more aspirational documents that still have to be worked out in Congress, Treasury yields moved higher, with the 10yr yield up +3.1bps to 1.606%. The increase was as a result of a mix of higher real yields (+1.7) and inflation expectations (+1.2bps), with the latter only rising twice in the last eight sessions now. The 7yr auction seemed to go ok which took yields off their highs (1.623%) for the day. Remember it was a bad 7yr auction at the end of February that led to one of the biggest intra-day moves higher in yields we have seen for some time.

European yields also moved higher, with those on bunds (+3.4bps), OATs (+3.1bps) and BTPs (+1.5bps) all rising. Meanwhile the spread of 10yr Greek debt over bunds fell yet again to 104.8bps, its tightest level since 2008.

One of the more outsized moves came from gilts yesterday, with 10yr yields up +5.8bps following comments from Gertjan Vlieghe of the BoE’s Monetary Policy Committee. He said that his “central scenario” was that the economy evolved similarly to the MPC’s May projections, but with “somewhat more slack”. Under this scenario, his view was that “the first rise in Bank Rate is likely to become appropriate only well into next year”. Nevertheless, a 2022 hike was more aggressive than markets were previously pricing, and he also said that under an upside scenario, then it would be in Q1 2022 that there’s “a clear view of the post-furlough unemployment and wage dynamics, so a rise in Bank Rate could be appropriate soon after”, so an even quicker pace potentially. The comments also helped sterling to be the top-performing G10 currency yesterday, strengthening +0.59% against the US Dollar.

Asian markets have largely taken Wall Street’s cyclical lead this morning with the Nikkei (+2.23%), Hang Seng (+0.63%), and Kospi (+0.88%) all up with Japanese equities boosted by a weaker Yen. Chinese bourses are trading without any direction though with the Shanghai Comp flat, the CSI (-0.09%) down and the Shenzhen Comp (+0.22%) up. In Fx, the Chinese yuan is up +0.23% to 6.3688, to the strongest level since May 2018 and is now up +2.89% since March 31st. Elsewhere, Australia’s 10y yields are up +6.5bps to 1.688% as markets begin to price in a more hawkish RBA outlook following the RBNZ meeting on Wednesday. Outside of Asia, futures on the S&P 500 are up +0.34% while metal prices have also gained with DCE iron ore up +3.33% and SHF steel rebar up +3.42%.

On the pandemic, the improving picture at the global level has seen the rate of new weekly case growth come down by more than a third since its peak a month ago, according to data from John Hopkins University, though we’re still some way above the recent trough in mid-February. Nonetheless, the Covid-19 related concerns remain with the Japanese government indicating overnight that the state of emergency would be extended in Tokyo and other regions to June 20, a little more than a month before the Tokyo Olympics start. PM Suga is expected to announce the formal decision later today and the decision to extend the state of emergency will affect almost half of Japan’s population. In the UK, there were continued concerns over the spread of the Indian variant, as cases rose to a fresh 6-week high of 3,542 yesterday, and Health secretary Hancock said to MPs that the lifting of restrictions on June Y21 would only take place “if it’s safe.” The hope is that the relatively advanced vaccination programme in the UK will help to blunt the link between cases to hospitalisations and deaths, with more than 73% of the adult population now having received a first vaccine dose, and more than 45% having had a second one. The German government announced that the country will start vaccinating children 12 and older starting June 7 on a voluntary basis. Lastly there was good news in the US, where a Quinnipiac poll showed 72% of Americans have either gotten a vaccine shot or are planning on getting one, this up from a mid-April iteration of the survey which measured it at 68%. Those who said they would not get vaccinated dropped 4pp to 23%. This comes as vaccination rates have slowed in recent weeks as over 50% of the adult population is now fully vaccinated according to the White House. On the topic of returning to normality, 73% of those polled said their Memorial Day Weekend plans (this weekend for our non-US readers) are similar to those pre-pandemic.

Looking at yesterday’s other data, the second estimate of Q1 GDP for the US maintained the annualised rate of growth at +6.4%, contrary to expectations for a +6.5% reading. Meanwhile pending home sales for April unexpectedly fell -4.4% (vs. +0.4% expected), and the Kansas City Fed’s manufacturing activity index for May also underperformed with a 26 reading (vs. 30 expected). In Europe, the German GfK consumer confidence for June underwhelmed at -7.0 (vs. -5.2 expected), though Italy’s consumer confidence index from Istat increased to a post-pandemic high of 110.6 in May (vs. 104.0 expected).

To the day ahead now, and additional data highlights from the US include April’s data on personal income and personal spending, the MNI Chicago PMI for May, and the preliminary wholesale inventories for April. Over in Europe, there’s also the preliminary French CPI reading for May, as well as the Euro Area’s final consumer confidence for May. From central banks, the ECB’s Villeroy will be speaking, while there’s also a virtual meeting of G7 finance ministers and central bank governors.

Tyler Durden

Fri, 05/28/2021 – 07:56

via ZeroHedge News https://ift.tt/3p0FQqY Tyler Durden