Could Facebook’s Diem Become FedCoin By Default?

Submitted by Mark Jeftovic, Co-founder and CEO, easyDNA technologies.

Today’s post is an excerpt from the monthly edition of The Crypto Capitalist Letter. To learn more about TCC and receive a free copy of The Crypto Capitalist Manifesto, join the Bombthrower list here.

I had a reader ask me about Silvergate Capital. They’re a bank holding company with a lot of exposure to the crypto currency space. I hadn’t yet analyzed them deeply, but I did notice that they recently announced a partnership with Facebook on their DiemUSD stablecoin.

Diem is Facebook’s rebrand of Libra. Libra was a private crypto currency Facebook proposed to launch which in my mind was a transformative event for nation states and central banks. That was the moment when the establishment elites realized that non-state money had arrived and it posed an existential threat to the status quo.

They were able to hold off Facebook’s Libra, for awhile. They fought dirty. US Senators sent straight up extortion letters to members of Facebook’s Libra Consortium threatening to investigate them for ostensible ties to child pornography on Facebook’s platform if they went through with the project. They all dropped out.

My heart didn’t exactly bleed for Facebook, but the incident was instructive. I wrote about it at the time, but I will repeat the salient point here:

Should a gigantic platform like Facebook successfully launch their own digital currency, a person’s Facebook account will become more important in their day-to-day lives than their nation state issued passport. Especially if we’re entering an era of drastically curtailed travel for plebeians. The battle between the US, France, et al and Facebook over Libra was an early round in the struggle between waning Nation States and ascendent Network States.

Facebook kept working on their Libra, first under a wallet program called Novi and now as Diem, and Diem USD will be their stablecoin. One can only surmise that behind the scenes something has shifted so that Facebook thinks they can proceed with launching a new stablecoin.

This partnership with Silvergate, as well as relocating their Diem Association, which oversees their digital currency projects, from Switzerland back to the United States may be part of that calculus.

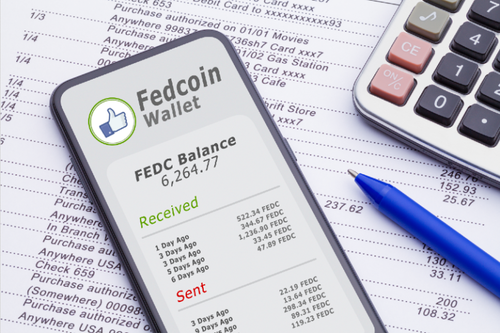

There have been some rumblings that the US is losing the Central Bank Digital Currency race and that one way to jumpstart a program would be to partner with a private entity who is already further down the road with it.

Who would be uniquely situated to provide a solution in some manner of public-private partnership? Facebook, for one.

When we think about what Fedcoin could reasonably be expected to do, my guess is:

-

Provide the rails for UBI and other entitlement programs

-

Be fully programmable (an example is Australia’s cashless Centrelink card which will provide welfare benefits that cannot be spent on booze, cigarettes or gambling)

-

Be fully trackable: with everybody walking around with Facebook installed on their smartphone, it’s already baked-in.

-

Ubiquitous: There are more Facebook users in the USA (190 million) than had voted in the last election (161 million).

Consider this, what everybody knows from all camps (pro fiat, pro Bitcoin, establishment, anti-establishment, et al), is that the days of the petrodollar are numbered. For an excellent summary of how the current petrodollar regime arose and has been enforced over the past 50 years, listen to “From the Petrodollar to a Bitcoin Standard” with Nic Carter and Alex Gladstein on a recent What Bitcoin Did episode hosted by Peter McCormick.

As pointed out in that episode, the US has a track record of militarily enforcing USD primacy when countries like Iraq or Libya wanted to sell their oil for some other currency than USD.

What is different between Facebook’s Libra and Facebook’s Diem? Libra was to be backed by a basket of currencies, Diem is a stable coin pegged to USD. US lawmakers moved swiftly to kill Libra in the crib. So far there’s been at least silent assent on Diem.

It may be that the US policymakers hope that USD stable coins may be the way for the US to preserve its Exorbitant Privilege and extend its run at the helm of a world reserve currency.

(But make no mistake: CBDCs will be pathways to dependancy and poverty by design. The antidote to being trapped in a system constructed to preclude wealth and capital formation are crypto-currencies. That’s our focus at The Crypto Capitalist, and you can read the overall thesis here).

Tyler Durden

Sat, 05/29/2021 – 19:30

via ZeroHedge News https://ift.tt/2TsGstD Tyler Durden