Russia Lines Up New Gold Buying Through Its Sovereign Wealth Fund

Submitted by Ronan Manly, BullionStar.com

In a significant and strategic development for monetary metals, the Government of the Russian Federation has just introduced legislation which will allow Russia’s giant National Wealth Fund (NWF) to invest in gold and other precious metals. The NWF is Russia’s de facto sovereign wealth fund, and has assets of US$185 billion.

Introduced as a resolution to the procedures for managing the investments of the National Wealth Fund and signed off by the Russian prime minister Mikhail Mishustin on Friday 21 May, the changes will allow the National Wealth Fund to buy and hold gold and other precious metals with the Russian central bank, the Bank of Russia.

Gold as Diversification and Protection

In a note accompanying the gold announcement, the Russian government refers to gold as a traditional protective asset, and says that the move to add gold will introduce more diversification into NWF’s investment allocation, while promoting overall safety and profitability for the fund.

The full resolution (Resolution of May 21, 2021 No. 765) can be seen here, in Russian, in pdf form.

Up until now, the National Wealth Fund, through its 2008 investment management decree has been allowed to allocate funds to all main financial asset classes, such as foreign exchange, debt securities of foreign states, debt securities of international financial organizations, managed investment funds, equities, Russian development bank projects, and domestic bank deposits. The latest amendment now adds gold and precious metals to that list.

While Russia’s National Wealth Fund is sizable (at US$ 185 billion), it is not that widely known internationally. So here’s a quick recap. In its current structure, the National Wealth Fund emerged in February 2008 when its precursor, the Stabilization Fund of the Russian Federation, was split into two parts, namely a Reserve Fund and a Future Generations’ Fund (later renamed the National Wealth Fund).

The original Stabilization Fund, which was established in 2004, was launched so as to stabilize the Russian federal budget and insulate it against the volatility of international oil prices and oil export earnings.

The Reserve Fund then grew into a general fund to top up the federal budget, while the National Wealth Fund was designated as a fund to support the Russian Federation pension fund, for co-financing the state pension fund, and to guarantee the long-term stable functioning of the pension system. Then in early 2018, the Reserve Fund was rolled into the National Wealth Fund.

When active, the Reserve Fund had an investment remit of investing in low-yield securities, while the National Wealth Fund then and now invests in a broader set of asset classes. While the National Wealth Fund is managed by the Russian Ministry of Finance based on investment procedures and terms established by the Russian Government, the operational investment of the NWF is carried out by the Bank of Russia.

The NWF is financed in the following way. Each year, the Russian Federation earns oil and gas revenues (from production taxes and duties on oil and gas), a portion of which are then applied to finance the federal budget, and the remainder of these oil and gas revenues are transferred to the National Wealth Fund. As its basically a multi-asset investment fund, the National Wealth Fund also increases in size based on positive returns from the existing assets that it manages.

Gold – More Sustainable than Financial Assets

As the NWF soon will begin to buy and hold gold as part of its investment remit, it will be interesting to watch the NWF’s asset allocation reports, which can be found in the statistics section of the NWF pages of the Russian Ministry of Finance website here.

If this recent news about the NWF investing in gold look familiar, that’s because it is. Back in November 2020, the Russian government proposed a plan to allow the NWF to buy and hold gold, at the time introducing draft legislation for that purpose. It is this draft legislation which has now been signed into law on 21 May by Prime Minister Mikhail Mishustin.

However, nearly a year earlier in December 2019, Russia’s Finance Minister Anton Siluanov had originally raised the idea that the National Wealth Fund should invest in gold, saying at the time that he saw gold “as more sustainable in the long-term than financial assets.”

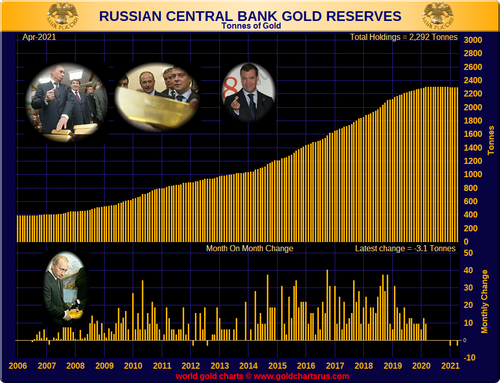

It’s therefore interesting that following more than a decade of aggressively buying of domestic gold mine production and boosting Russia to one of the largest sovereign gold holders in the world, the Russian central bank stopped buying gold in April 2020, saying that it had suspended gold purchases in the domestic market.

With the central bank stepping out as a regular gold buyer in early 2020, this left Russian gold miners (and the Russian commercial banks) to sell Russian gold on the export market, and Russian gold exports have ramped up since then, particularly Russian gold exports to the West via London. See here, here, and here for examples.

The last time the Russian central bank bought gold was in March 2020 when it added 18.7 tonnes to its gold reserves, to give a grand total of 2299 tonnes. Since then it has made no gold purchases, but has made two small sales, each for 100,000 ozs (in January 2021 and again in April 2021), leaving the Russians with 2292 tonnes currently.

Still, this leaves Russia as the fifth largest sovereign gold holder in the world (just behind the claimed gold holdings of France and Italy). Russia’s gold reserves also comprise 22% of total Russian reserve assets, and since 2020 gold has been a larger component of Russian reserve assets than US dollar denominated assets, as the Russian state continues to de-dollarize its exposure in light of sanctions risk.

Note also that Russia operates a “State Fund of Precious Metals and Precious Stones” called the Gosfund which is managed by state organization ‘Gokhran’ which reports to the Ministry of Finance. This Gosfund can also buy and hold gold, but it does not publish any details of what it holds, and they confirmed to BullionStar in 2016 that:

“Gokhran does not publish information about the amount of gold reserves in the Russian Gosfund and data about precious metal operations”.

But you can assume that the Gokhran is probably also buying gold.

Conclusion

When at the end of March 2020, the Russian central bank announced that it would suspend purchases of gold in the domestic market, it also said that “subsequent decisions on gold purchases will be made subject to financial market developments.“

One of these decisions now seem to be the Russian state / central bank putting on another ‘hat’ (of the National Wealth Fund), and returning to the gold market in tag team style (following a plan that began at the end of 2019), with the National Wealth Fund now able to continue where the Bank of Russia left off in early 2020. Any NWF gold buying will also mean less Russia gold for export, but maybe this is the intention, especially in light of heightened sanctions risk on Russia from the US and EU and the risks of overseas asset freezes.

Physical gold, as all gold owners will know, has no counterparty risk and no credit risk, so is the ultimate monetary asset for a national state to hold when worried about the sanctions risk of other countries.

As Dmitry Tulin, first deputy governor and board member of the Bank of Russia said in 2016 when commenting on the Bank of Russia’s gold purchases, “Russia is increasing its gold holdings because gold is a reserve asset that is free from legal and political risks.“

With the arrival of the massive Russian sovereign wealth fund NWF as a new gold buyer, it now looks like Russia is involved in a grand game of geo-political and monetary chess with golden pieces, and indeed a game of 4D chess.

This article was originally published on the Bullionstar.com website under the same title “Russia lines up new Gold Buying through its Sovereign Wealth Fund“.

Tyler Durden

Sun, 05/30/2021 – 09:00

via ZeroHedge News https://ift.tt/3vuPJ2p Tyler Durden