Nasdaq Dips, Russell Rips As Tail-Risk Insurance Costs Soar

The month of June started with a bang for Small Caps and a whimper for Big-Tech as Russell 2000 handily outperformed (Dow managed a tiny gain) while Nasdaq and S&P were unable to close green…

It went just a little bit turbo in the last 30 minutes…

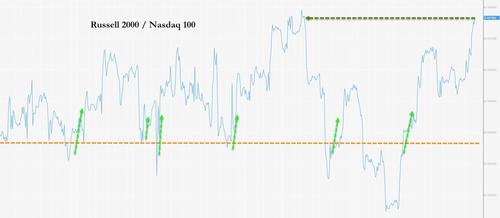

The Russell 2000 is back at a critical level relative to the Nasdaq 100…

Will it reach the upper end of the channel?

Source: Bloomberg

AMC was insane – surging on the back of a secondary… which the buyers of which then turned around and sold and told everyone else to sell… which sparked more buying (as everyone and their pet rabbit piled into deep OTM calls that expire Friday in the hope of sparking another gamma squeeze)…

VIX had a crazy day, mini-flash-crashing before the open to a 15 handle, before ripping back up above 18.5…

The cost of tail-risk protection has skyrocketed in the recent days – to its highest since late 2018 – just before The Fed sparked a plunge with its hawkish chatter…

Source: Bloomberg

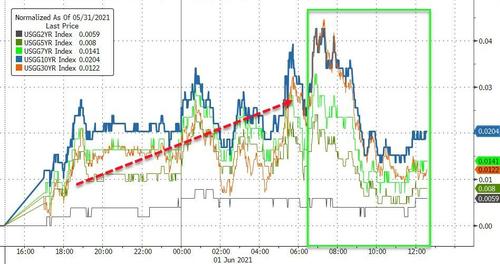

Bond yields were higher across the board but only modestly with 10-20Y up around 2bps. NOTE that bonds were bid during the US session…

Source: Bloomberg

Pushing 10Y back above 1,60%…

Source: Bloomberg

The dollar chopped around today (but remember, FX markets were open yesterday around the world) leaving the greenback lower from Friday’s close…

Source: Bloomberg

Cryptos gave back some of their long weekend gains today but bitcoin and ethereum managed to stay green (BTC fell back below $46k, ETH found support at $2500)…

Source: Bloomberg

Oil rallied to its highest since Oct 2018 (Brent topped $71). WTI closed around $68…

Lumber tumbled for the 6th straight day (limit down) and is down for 13 of the last 16 days…

Source: Bloomberg

Gold ended the day marginally lower but found support at $1900..

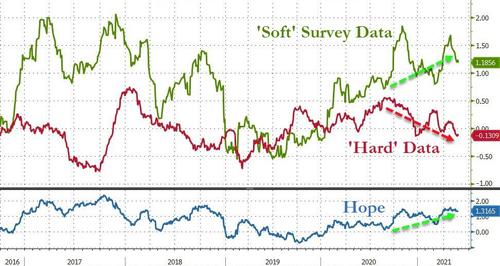

Finally, what will happen to the multi-year highs in hope – the spread between soft survey data and actual hard economic data is the widest since 2018…

Source: Bloomberg

As manufacturing surveys suggest stagflation is here…

Source: Bloomberg

Get back to work Mr.Powell.

Tyler Durden

Tue, 06/01/2021 – 16:01

via ZeroHedge News https://ift.tt/3c6yRqT Tyler Durden