As Reddit Rampage Began, Hedge Funds Unleashed Biggest Pile Up Into Shorts In 5 Years

We have a pretty good idea of what’s behind the latest reddit meltup.

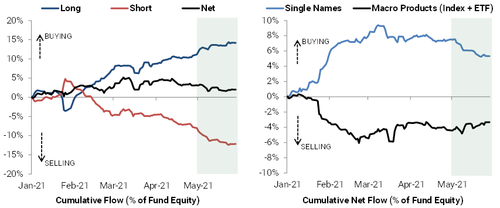

Unlike the March and April, when hedge funds remained largely inert on a net basis, still smarting from the bruising their short books suffered during the January and February meme stock meltups, May saw a renewed push to short beaten down names, with Goldman’s Prime Brokerage reporting that its book was net sold for a second straight month, driven by short sales outpacing long buys 1.3 to 1.

According to GS Prime, trading flows in Single Names remained especially active both long and short, and made up approx. 85% of the global gross activity, the balance going to ETFs. That said, while macro products (Index and ETF combined) were net bought driven by long buys and to a lesser extent short covers, selling activity dominated with Single Names net sold for the first time in six months and seeing the largest monthly dollars in net selling since Apr ’20, driven by short sales vastly outpacing long buys 1.8 to 1. As a result, single name shorts reached an almost one-year high relative to the overall equity holdings.

The punchline: in dollar terms, single Name flow saw the largest monthly short sales in more than five years.

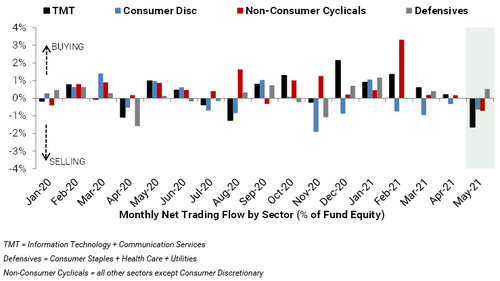

Looking at sectors, GS Prime reports that a whopping 8 of 11 global sectors were net sold in May, led in $ terms by Info Tech (short sales > long buys), Consumer Disc (short sales > long buys), Financials (short sales > long buys), Materials (long-and-short sales), and Comm Svcs (short sales > long buys). On the other hand, Health Care (long buys > short sales), Real Estate (long buys > short sales), and Utilities (long buys > short sales) were the only net bought sectors.

- TMT stocks were net sold for the first time in six months and saw the largest $ net selling since Apr ‘18, driven by short sales outpacing long buys 5 to 1. The GS Prime book is now O/W TMT stocks by 2.8% vs. the MSCI World (down from 3.5% O/W at the start of the year), which is in the 9th percentile vs. the past five years.

- Non-Consumer Cyclicals were net sold for the first time in eight months. Financials, Materials, Industrials, and Energy were all net sold in May driven by short sales, while Real Estate was net bought driven by long buys.

- Most net bought global industries ($) – Food Products, Biotech, Insurance, Hotels, Restaurants & Leisure, Diversified Telecomm Svcs, Multi-Utilities, Health Care Equip & Supplies, Pharmaceuticals

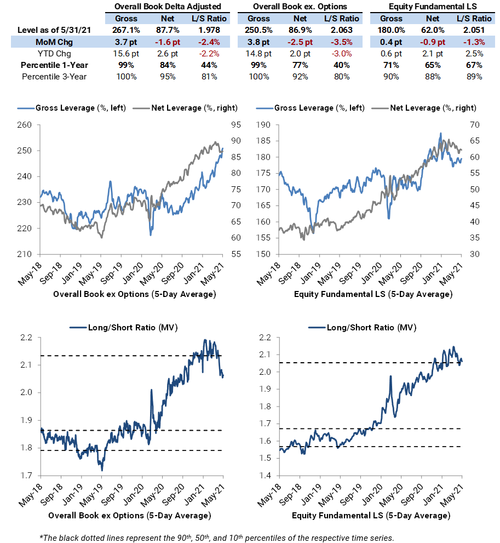

Naturally, as managers ramped up short exposure, net leverage and L/S ratio declined even as gross leverage hit new all time highs, to wit, Overall Book ex Options:

- Leverage: Gross +3.8 pts MoM to 250.5% (99th percentile one-year), Net -2.5 pts MoM to 86.9% (77th percentile one-year)

- Long/Short ratio (MV) -3.5% MoM to 2.063 (40th percentile one-year)

Equity Fundamental L/S

- Leverage: Gross +0.4 pts MoM to 180.0% (71st percentile one-year), Net -0.9 pts to 62.0% (65th percentile one-year)

- Long/Short ratio (MV) -1.3% MoM to 2.051 (67th percentile one-year)

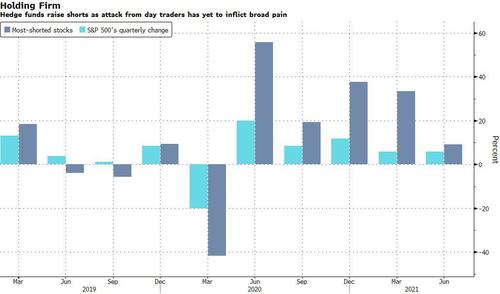

And yes, this means that hedge funds piled into shorts just as the reddit rebellion perked up again and sent meme names and the most shorted names soaring, steamrolling over hedge funds yet again, just as they did at the start of the year.

“This confirms that managers have felt more comfortable utilizing single names to express directional views or adjust exposures, as highly shorted stocks and high retail sentiment names broadly underperformed in the past two months,” Goldman prime analysts wrote. And despite a sharp rally in stocks favored by retail money, “shorts on the group only saw modest net covering.”

The good news is that for now, at least, the pain from the latest Reddit rampage has been mild and even though AMC has quadrupled this quarter, roughly half the members of Goldman’s most shorted basket’s are down. The group is up 2.4% in the span, trailing an advance of 6% for the S&P 500. That means gains for any trade that’s short individual companies and long the broader market, according to Bloomberg.

Meanwhile, short sellers – refusing to be spooked by GenZ daytraders, have boosted their bearish positions as some bets, like those against technology companies, paid off. A Goldman basket of the most-shorted tech stocks has tumbled almost 30% from its February peak. It is unclear, however, how long it will take this time before some semblance of reality returns.

Ultimately, the hope is that logic returns: “You might have the S&P trading sideways over the next month or two, but you have individual names going all over the place,” said Shawn Snyder, head of investment strategy at Citi Personal Wealth Management. “That’s an opportunity for them to make large profits.”

However, as Melvin Capital showed so vividly, a stimmy-fueled short squeeze army can march longer than even the best capitalized hedge fund can remain solvent.

Tyler Durden

Wed, 06/02/2021 – 17:45

via ZeroHedge News https://ift.tt/3wPsMHq Tyler Durden