Ford And General Motors Are Blowing EV Sales Out Of The Water

Someone should put Elon Musk on notice: the legacy automakers have officially entered the EV sales fray.

And domestic U.S. automakers have officially hit the ground running.

Ford announced on Thursday that U.S. sales were up 4.1% to 161,725 units in May, while YTD sales were up 11.3%. The “everything bubble” created by Central Banks helped truck sales rise 11.6% over the same period and SUV sales to rise 48.6%. These numbers were despite the auto industry continuing to grapple with a semiconductor shortage – one that had even left Ford trucks stranded on the side of the road, waiting for parts, earlier this year.

But the standout in Ford’s report? EV sales were up 184% to 10,364 units. The company also sold 1,945 Mustang Mach-Es and 3,617 electrified Escapes.

Meanwhile, General Motors also delivered a positive outlook to the market on Thursday, saying it was anticipating “significantly better” results for the first half of 2021. The company said:

“As a result of GM’s ongoing efforts to prioritize semiconductor usage, its success engineering solutions that maximize the utilization of chips as well as the pull-ahead of some projected semiconductor deliveries into the second quarter, the company now expects its first-half financial results to be significantly better than the first-half guidance previously provided. GM is optimistic about the full year and expects to share additional information during its second-quarter earnings conference call on Aug. 4.”

The company also said it is taking steps to “increase deliveries to dealers and customers in the United States and Canada to meet strong consumer demand for Chevrolet, Buick, GMC and Cadillac,” in a press release.

Despite addressing the semi shortage, stating the situation “remains complex and very fluid”, GM says it has still found “creative ways to satisfy customers”. Phil Kienle, GM vice president, North America Manufacturing and Labor Relations said: “Customer demand continues to be very strong, and GM’s engineering, supply chain and manufacturing teams have done a remarkable job maximizing production of high-demand and capacity-constrained vehicles.”

The automaker said it is working on developing long-term solutions to its supply issues, and says it is officially “focused on advancing an all-electric future that is inclusive and accessible to all”.

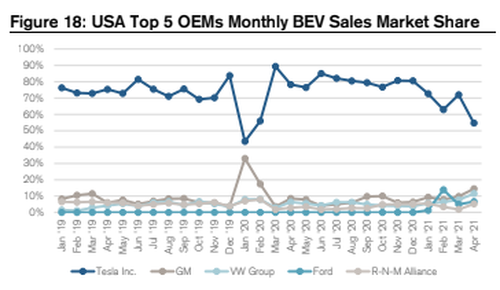

And while these legacy automakers are making huge strides, Tesla’s market share is collapsing, as we noted earlier this week. Tesla’s global electric vehicle market share plunged to 11% in April from 29% in March, Credit-Suisse analyst Dan Levy wrote in a note Wednesday morning. It marks Tesla’s lowest monthly global market share since January 2019. The “greater than usual drop” came between the last month in Q1 and the end of the first month of Q2.

We may have a race on our hands.

(via @piplsayofficial) $F $TSLA #F150 https://t.co/8YoJEMo2Vg pic.twitter.com/Zv4BLw1tdd

— Carl Quintanilla (@carlquintanilla) June 3, 2021

The company’s market share in the world’s largest auto market – China – collapsed to 8% in April from 19% in March. That drop should be no surprise given the collapse in sales numbers we reported for Tesla in China last month. “GM remained the share leader in China in April, with a 20% share, driven by continued volume traction of the low cost Wuling HongGuang Mini,” Levy’s note, summarized by Bloomberg, pointed out. In Europe, the company posted EV market share of just 2% compared to 22% in March.

Finally, in the United States, where it goes head to head with Ford and GM, market share fell to 55% versus 72% in March.

Tyler Durden

Thu, 06/03/2021 – 17:20

via ZeroHedge News https://ift.tt/3wSmsyU Tyler Durden