From Fed To ECB, Red-Hot Housing Costs May Bring Taper Closer

Authored by Wes Goodman via Bloomberg,

Soaring housing prices may be what bring central banks to start tapering stimulus.

Policy makers over the world are expressing concern.

Some of the highlights:

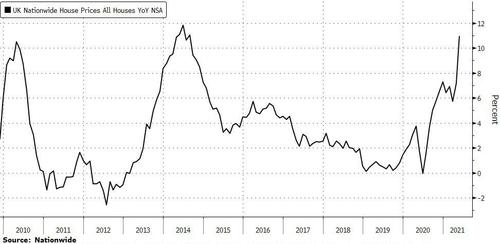

The BOE officials are indicating unease about the U.K. housing market as prices growing at the fastest rate since 2014.

ECB Executive Board member Isabel Schnabel said, “Rising housing costs are a burden for many people and may give rise to financial stability risks.”

She added, “We discuss how to better capture housing costs in our inflation measure. But we do not target asset prices.”

BOC Governor Tiff Macklem said recent gains in home prices aren’t sustainable and warned households against taking on too much mortgage debt because interest rates will eventually rise.

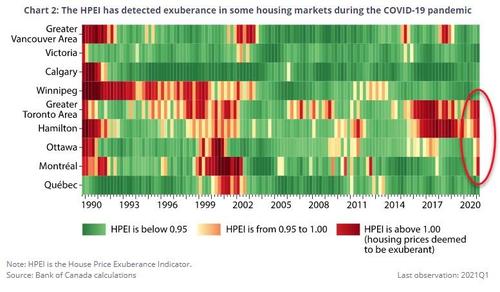

The Bank of Canada published a new house-price exuberance indicator that found Toronto, Hamilton and Montreal are experiencing episodes of “extrapolative expectations,” with Ottawa nearing that threshold. This means that more Canadians are buying homes with the expectations prices will continue to rise and so they are more willing to bid above the asking price.

At the Fed, some policy makers have said that when the central bank does start scaling back purchases, it should start with mortgage-backed securities, arguing that record-high housing prices are a sign that market no longer needs the central bank’s support.

As economies improve, central banks may have surging housing prices in mind if rising inflation leads to some tapering.

Tyler Durden

Thu, 06/03/2021 – 06:30

via ZeroHedge News https://ift.tt/3ieIvvO Tyler Durden