22.4 Down, 14.7 Up, 7.6 To Go: “The Fed Faces A Difficult Decision”

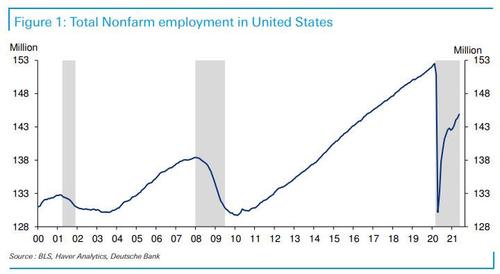

After today’s mixed US payrolls report, today’s Chart of the Day from DB’s Jim Reid shows we are still 7.6 million jobs away from where we were when the pandemic hit.

We lost 22.4 million in the first 2 months and have gained 14.7 million over the last 13 months. 2021 has “only” seen an average monthly payrolls increase of 478k though May.

And while some saw only disappointment in the May jobs data, it was a truly Goldilocks report: as Reid says, “there was clearly something for everyone in the report. The Fed will continue to suggest they are a long way from their employment goals and the inflationists will cite the higher earnings in the release as evidence that it’s hard to find employees at the right price.”

Meanwhile, according to BofA, the report leaves the Fed “to remain patient, slowly and carefully taking baby steps to set the stage for tapering but unlikely to send an explicit signal until the September FOMC meeting.”

Maybe, Reid asks, you can have a relatively slow jobs recovery and inflation.

“If that does happen then the Fed will have difficult decisions to make at some point.”

On that, the DB strategist concludes that “next week’s US CPI will be the most watched economic report of the year so far.”

Tyler Durden

Fri, 06/04/2021 – 14:15

via ZeroHedge News https://ift.tt/3fRfPHk Tyler Durden