Ackman’s SPAC Nears Deal To Take World’s Largest Music Business Public

Bill Ackman’s massive SPAC is reportedly nearing a transaction to take public Universal Music Group, the world’s largest music business, at a valuation of about $40 billion, the WSJ reported citing sources.

Back in July, Ackman’s special purpose acquisition company, called Pershing Square Tontine Holdings Ltd., raised $4 billion in an initial public offering – a record amount for a SPAC to this day, as Ackman said that his firm was on the hunt for a “mature unicorn”:

“We’re in a unicorn mating dance and we want to marry a very attractive unicorn on the other side that meets our characteristics,” he said in a Bloomberg Television interview at the time. “And we’ve designed ourselves to be a very attractive partner.”

Ackman has now found his target. While it is unclear if Universal is a “mature unicorn”, the company has benefited from a jump in revenue from music streaming on services such as Spotify Technology SA. Universal had about €7.4 billion in revenue last year, accounting for nearly half of Vivendi’s total.

The deal, which was hinted at last month when Vivendi said it was considering selling 10% of Universal’s shares to a U.S. investor without naming one, would have a €33 billion ($40 billion) equity value and a €35 billion enterprise value, which also accounts for net debt. A $40 billion deal for Universal Music would be the largest SPAC transaction on record, exceeding the $35 billion that Singaporean ride-hailing company Grab Holdings was valued at in a similar deal recently. It would have a so-called enterprise value, taking into consideration Universal’s debt, of about $42 billion.

Universal, which is a subsidiary of French media conglomerate Vivendi SE, is the record label behind artists including Lady Gaga, Taylor Swift, Billie Eilish and the Weeknd. Its stable also includes classic acts such as Queen and the Beatles, and last year it bought Bob Dylan’s entire publishing catalog. China’s Tencent owns about 20% of Universal after the Chinese internet conglomerate doubled its stake last year in a deal that valued the business at about €30 billion.

A merger with Ackman’s SPAC would mean that Vivendi current plans to monetize its sub would be scrapped. In February the French media conglomerate planned to spin off the business and list it in the Netherlands later this year, with 60% of Universal’s shares distributed to the French company’s investors. As the WSJ notes, it isn’t clear how the Pershing Square transaction affects that plan, and other details couldn’t be learned.

Going public also could give UMG more financial clout to compete with rivals Warner Music Group Corp. and Sony Music Entertainment. Vivendi had originally planned a 2023 IPO for UMG, but said earlier this year that it was now aiming for the business to go public by the end of 2021.

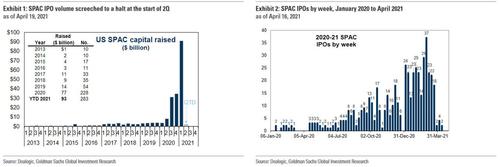

While SPACs, or empty shells that raise money with the sole purpose of looking for a target to merge with and bring public, exploded in popularity in the second half of 2020 and early 2021 as companies sought alternatives to a traditional IPO, in recent months they hit a brick wall with deal flow slowing to a trickle amid a regulatory crackdown on vehicles that have come under fire for appearing to enrich sponsors at the expense of other shareholders. While so far in 2021, at least 330 SPACs have raised $104 billion, blowing through last year’s record of more than $80 billion, most of this activity took place in the first quarter with virtually no new SPACs in recent weeks. They typically have two years to find a target.

As the WSJ notes, Ackman made a splash in July when he raised his SPAC and said he was on the hunt for a large private company to take public. Since then, one of the biggest guessing games on Wall Street has been predicting which company might strike a deal with him. He initially told investors a deal could be made public by the end of March, before recently telling The Wall Street Journal that he had been working on one transaction since November, but needed more time.

It isn’t guaranteed Universal and the SPAC will reach a deal. If they do, it could be completed in the next few weeks and isn’t subject to any additional due diligence.

While the deal may still be in doubt, Ackman’s expertise in the sector isn’t: the hedge fund billionaire is a veteran at using blank-check companies to do deals. He previously co-founded Justice Holdings which raised $1.44 billion in a 2011 listing in London. It merged with Burger King Worldwide Inc. in 2012.

When discussing potential targets for his current SPAC last year, Ackman said he wanted “a simple, predictable” cash-flow-generating company. “We’re looking for the super durable great growth business that we can own for the next decade,” he said.

That said, the news appears to have disappointed the market as the stock price of PSTH – Tontine’s publicly traded stolck – tumbled as much as 10% after hours as the unveil of Tontine’s “unicorn” was seen as less than exciting.

Tyler Durden

Thu, 06/03/2021 – 19:59

via ZeroHedge News https://ift.tt/34Iz53y Tyler Durden