Gen Z Is Spending At 125% Of Pre-Covid Levels, Amex CEO Says

No sooner did we just get done detailing how the time to build wealth was passing millennials by quickly than we find out that Gen Z is also doing everything they can to prevent themselves from building wealth.

Notably, they’re spending themselves into oblivion, a new Bloomberg report notes.

In fact, Gen Z is spending more now than they were before the pandemic. This is notable because Gen Z has less saved than older Americans, the report notes, meaning the increased spending likely hits their ability to build wealth over the long term harder than it would for other generations.

American Express Co. Chief Executive Officer Steve Squeri said on Friday: “We assumed there was such pent-up demand — not only for travel, but such a pent-up demand for consumer goods — that the U.S. recovery would be like it is right now.”

He continued: “When you look at your millennials and your Gen Zs right now,” they’re at “125% spending of what their pre-Covid levels were in 2019.”

The spending has been a boon for American Express, despite the company believing that corporate travel still won’t return to pre-pandemic levels until 2023.

And to the extent that there is still a small space where the company can offer credit to literally anyone with a shred of a credit score, the company said it was considering a debit card – a risk for a company whose prestige and brand name carry its weight with its customers.

“It really didn’t work for us — the unbanked was really not our customer, and the prepaid market was not our customer, and we learned that,” Squeri said. “But is there something in between our everyday credit card and the prepaid card? And that potentially could be a debit card. That all needs to be worked out.”

While AMEX figures out ways to plunder new customers, its worth recalling that we recently noted how millennials have also spent themselves into oblivion.

We wrote that the Covid recovery could be the last chance for those around the age of 40 to build the wealth they will need for their later years.

Most millennials, instead of basking in an incredible recovery and acutely focusing on re-bulding (or building for their first time) their finances, feel like 40 year old Kellie Beach, a real-estate attorney. She rode out the pandemic like most Americans: “I stayed afloat with credit cards. I was just used to swiping and overspending.”

Now that the government dole is running out and the Covid scapegoat is working its way (albeit, slowly) out of the discourse, it has become clear that it’s time to pay closer attention to her finances. She told Bloomberg: “Now I have this feeling — like this fire — of urgency. I’m not going to be in this place again. I can’t wait to get out of this debt. I can’t wait to save up for my emergency fund and invest again.”

40 year old Dustin Roberts was similarly situated – he had $38,000 remaining in student debt when finally put together what he could to buy his first house in April.

He said: “My dad had always tried to tell me how important it was to buy a house, how that was a mode of financial security for him. I’m making more than my dad did, but am I better off? I don’t know that I can say yes.”

Millennials were 27 years old when Lehman went bankrupt and are now about 40 years old coming out of the Covid crisis. They have ridden out two major recessions during peak saving and investing years, the report notes. William Gale, senior fellow in the Economic Studies Program at the Brookings Institution said: “The Great Recession knocked everyone for a loop. It caused unemployment. It caused slow wage growth. It made it harder to accumulate wealth.”

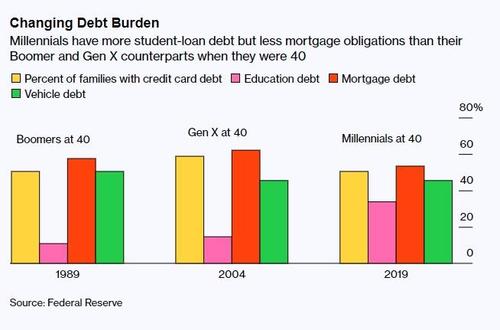

Like Roberts, more millennials borrow to finance college that previous generations. “Millennials, who started college in 1999, paid an average of $15,604 per year for undergraduate tuition, fees and room and board,” Bloomberg wrote. “When Gen Xers and Baby Boomers started college, that number — adjusted for inflation — was about $10,300 for each of them.”

40 year old Summer Galvez went to Clark Atlanta University in Georgia for a couple of semesters before pulling out because it cost too much. She now “relies on her own skills and hustle,” working two jobs and still paying off loans from 20 years ago.

“There are always economic factors that could happen that could just really upend your life,” she said.

Lowell Rickets, data scientist for the Institute for Economic Equity at the Federal Reserve Bank of St. Louis commented: “That’s one of the stark evolutions of the job market, where education has become a greater predictor of success.”

Buying homes has been a scramble coming out of the pandemic, forcing prices higher and contributing to why millennials have a lower home ownership rate than previous generations at the same point in their lives: 61% for millennials versus 68% for Gen Xers and 66% for baby boomers.

Millennials pay a median of $328,000 for homes while boomers only had to pay $216,000, the report notes.

Richard Fry, a senior researcher at Pew Research Center, noted: “The basic way that middle American households build wealth is through their homes. Millennials have been less likely to be homeowners. Fewer of them have begun the process of building home equity.”

Tyler Durden

Mon, 06/07/2021 – 05:45

via ZeroHedge News https://ift.tt/3vU82hH Tyler Durden