4 Reasons Why The Market Doldrums End With Next Friday’s Op-Ex

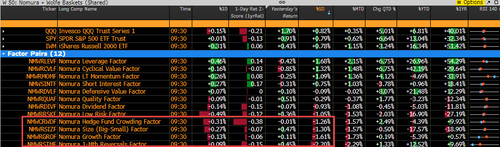

While stocks remain rangebound ahead of Thursday’s CPI print which according to Deutsche is “the most closely watched data release so far this year“, the real action remains below the surface where the continuation of last week’s big story in Equities is the acute underperformance of Longs relative to the Squeeze in Short Books led by the Retail “Meme,” SPAC and Bankruptcy plays. As Nomura’s Charlie McElligott shows, this appeared in risk-premium HF Crowding Factor which dropped -1.3% on the week, along with Size Factor (Large over Small) -1.3%, Growth Factor -1.6% and 1m Reversal -2.2%

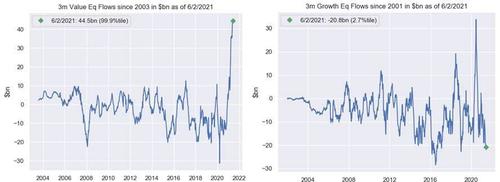

Yet while the return of the short-squeeze is a closely watched if transitory phase, the big picture “renormalization reflation” narrative remains alive and well, with the 3 month Value inflow now surging to $44.5 billion (99.9%-ile since 2003) compared to a 3-month outflow from Growth stocks of -$20.8BN (2.7%-ile).

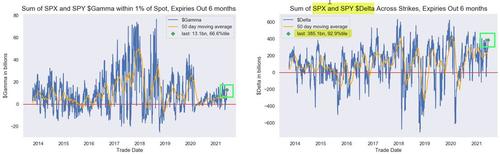

McElligott also observes a “critically important” shift in index/ETF option positioning which is currently in a substantial Delta-accumulation phase “as funds are using upside options as cheap beta”, with Delta for SPX/SPY options now at an extreme 93%-ile since 2014 and QQQs at an 85%-ile.

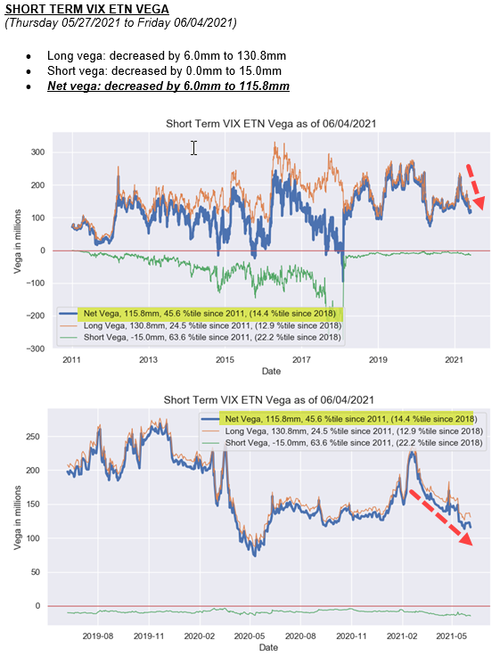

Which brins us to the infamous summer Doldrums, which according to McElligott are a function of 1) this “long gamma/long delta” option market stabiliziation (at least until next week’s op-ex, more below), which is also boosted by 2) a “full-throttle” corporate buybacks ahead of the upcoming earnings season “blackout” period, as well as the 3) red hot overall inflows into global equities, which soared to $71BN over the past month (97%-ile), all of which pairs off with 4) a continued slow bleed in VIX ETN Net Vega where the previously discussed long vol positions which had initially hoped to monetize on last month’s CPI overheat “shocker” have given up, thanks to what McElligott calls “the Fed’s “transitory” Jedi mind-tricks messaging and increasingly “goldilocks” US data—particularly the disappointment surrounding Labor prints.”

And yet, the doldrums may not last too long, as the current period of peace sets-up for something “real” into the Friday of next week’s Op-Ex cycle turn, where the Nomura quant expects potential “window for a pivot” as a result of massive amounts of Gamma and Delta which expire and are de-risked, with front-month being 82% of the SPX / SPY Delta and 90% of the QQQ Delta

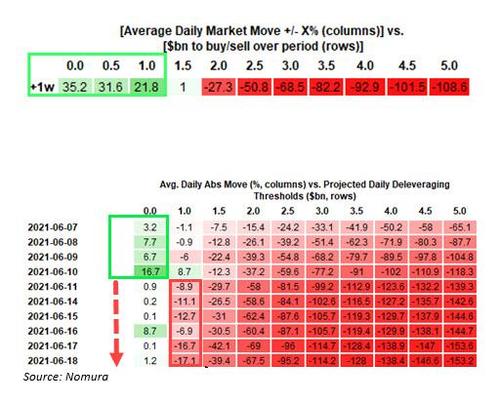

Add to this the expectation of Vol Control flows peaking this week into what should continue being an insulated “long Delta, long Gamma” trade (Nomura estimates that a 50bps daily change would see vol-control buy +$31.6BN SPX, while 100bps daily change would add another +$21.8BN), it is likely that shortly after Friday’s Opex — into any sembalance of options de-risk around Op-Ex and greater ability to move thanks to reduced Dealer hedging flows— that we could see “Vol Control” funds turn a mechanical seller, only requiring a smaller incremental daily change as catalyst.

Finally, it is around this time when the corporate buyback blackout period also begins (heavily owned “Banks” kicking-off as always June 14th with 75% into blackout by July 1st), which sets the stage for at least a short-term reversal in supply/demand flows, i.e., some downside market action.

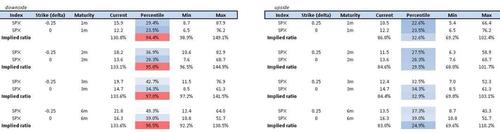

Nonetheless, as McElligott concludes, should this sell-off materialize, it would be par for the course with what the Vol market has been saying for weeks. Specifically, the Nomura quant references the SPX Put Skew which remains extreme on the “inflation tail” (as it acts to “pull forward” Fed tightening / QE Taper), while SPX index-level Call Skew continues to only see negligible demand (levels are well below the put skew, in the 20%-30%iles) with all the “crash up” being held via “cyclical reflation overshoot” usual suspect plays in SMH, FXI, EEM, XME, XLF, USO and XLB.

In short: expect continued melt-up for two more weeks, meme stocks turmoil notwithstanding, before next Friday’s op-ex opens a trapdoor into what will likely be a shallow selloff, as most traders are already hedged for it.

Tyler Durden

Tue, 06/08/2021 – 08:14

via ZeroHedge News https://ift.tt/2T9Icrs Tyler Durden