Most Shorted Stocks Update: Here Come The Microcaps… Again

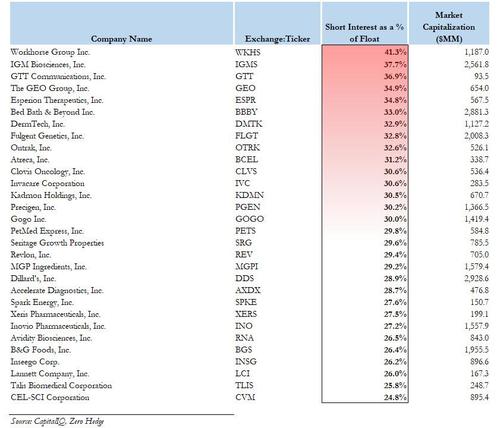

Last Wednesday, in what could be our second most profitable post in our 12 year history, (the first of course being the post that sparked much of the meme stock insanity), we hinted (since we are not “advisors”) to our readers to look at all the other most shorted small cap companies in the Russell 2000 – specifically those with a short interest at 20% or more of float listed below…

…… and buy an equal-weighted basket of these, to wit:

If the performance of our previous most shorted index is any indication, going long a market cap-weighted basket of these names – and especially the smaller, less liquid ones – could turn out to be the trade of the year, if not a lifetime.

Less than a week later, this basket is up more than 15% in value. To all those who put it on, congratulations.

But in a world where there is now over $100 trillion in central bank liquidity, and where no logic or fundamentals make sense, the short squeeze insanity appears to be accelerating with every passing day: and while AMC is positively dormant today, it is GME that has taken its spot and is surging as much as 25%…

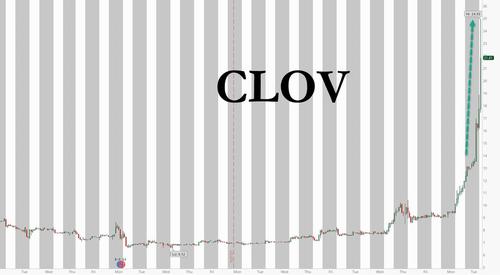

… while another most shorted name we flagged previously, Clover Health, has exploded more than 100%.

But in a notable shift from previous days, it now appears that even the microcaps are starting to run. Case in point, German microcap Windln.de, a German online retailer for baby and toddler products, which soared as much as 104% on Tuesday, following a 133% jump on Monday, as the company’s massive short interest was the topic of discussion on various message boards. The ramp was accelerated when German newspaper Bild also highlithed the gains in Monday’s edition.

While the company’s fundamentals are garbage – with Windeln.de’s market value falling about 95% since listing shares in 2015, as the company undertook a restructuring in 2018 and a reverse stock split in 2019 – that did not matter as th squeeze busters sniffed out its massive 200% SI and limited float, which according to Bloomberg is just 30% of the shares outstanding.

The move in WDL, whose market cap was about €10MM at the start of the surge, suggests that the shorthunters have again expanded their universe of squeeze candidates, which brings us back to our post from late January, when we looked at the most shorted microcap stocks, those which in many cases traded in the subpenny range and are lucky to have a $1 million market cap.

So in the name of market efficiency, we decided to recreate our screen of most shorted microcap/pennystock names, using Bloomberg data.

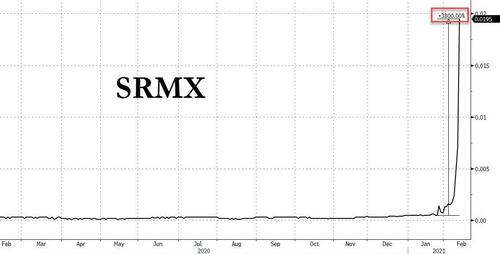

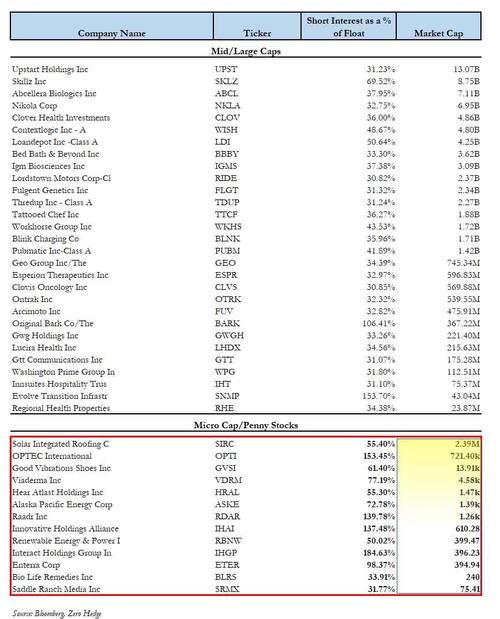

The screen, shown below, captures not only the popular meme/Reddit stocks such as Bed Bath, Workhorse and Clover Health which we first profiled last week, but also expands into those stocks that have a substantial short interest as a % of float – in some cases with a potentially large naked short overhang as their SI as % of float is above 100% – in the microcap space. The list includes such names as Solar Integrated (SIRC) with a 55% short interest; OPETC International (OPTI) with 153% of the float shorted, the strategically named Renewable Energy And Power (RBNW) which is 50% shorted and even includes such old favorites as Saddle Ranch Media (SRMX), which we first profiled in January, and which then went on to generate a 3,800% return in two weeks!

And so, without further ado, here is the latest and greatest list of most shorted US-listed companies, including both the mid/large caps such as NKLA, CLV, BBBY and WKHS, but also the pennystocks such as SIRC, OPTI, GVSI, VDRM, HRAL, ASKE, SRMX and others.

As usual, for those who believe that the best way to beat the prevailing market madness is to simply join it, the easiest way will be to create an equal-weighted basket of these names and to just wait until the short-squeeze brigade comes in hot. Because if the performance of our previous most shorted indexes is any indication, going long a market cap-weighted basket of these names – especially the smaller, least liquid microcaps – could turn out to be the trade of the year, if not a lifetime.

Tyler Durden

Tue, 06/08/2021 – 11:24

via ZeroHedge News https://ift.tt/2TdR67a Tyler Durden