White House Faces “Tough Sell” Pushing Corporate Tax Reform Through Congress After G-7 Deal

Following news this afternoon that Amazon likely won’t be able to dodge a proposed new global minimum corporate tax being pushed by Janet Yellen and the Biden Administration. However, there’s a long road ahead for this plan, not just because to truly be effective it must be adopted by the entirety of the OECD, but also the Democrat-held US Congress.

Although the Dems control the legislative and executive branches of federal government power, the disagreement within their ranks has already resulted in one critical compromise: The negotiators have dropped the minimum rate for the international plan once already from 21% to 15%, and made other adjustments designed to make it more palatable to GOP lawmakers Id I

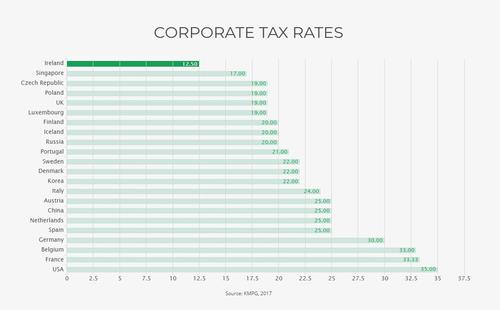

The G-7 committed to seek a global minimum corporate tax rate of “at least 15%.” That leaves a potential gap with the 21% rate that Biden has pitched to Congress for U.S. companies’ profits logged abroad. Any discrepancy could mean American firms effectively paying a surtax on profits in some nations.

“It’s very difficult, and maybe impossible, to call for 15% for an international standard and somehow convince lawmakers on Capitol Hill on 21%,” said Rohit Kumar, a principal at PwC’s Washington National Tax Services. “I would not want to be the person to convince Congress — that is a beyond heroic task.”

Biden’s tax plans also include a domestic corporate rate of 28%, up from 21% today. All three elements of the levies on businesses face strong opposition from Republican lawmakers, and even Democratic members have cautioned against any rush to legislate, pending a final global deal on a new corporate minimum rate.

Of course, as BBG reminds us, The G-7 pact is just a prelude to talks with the broader G-20, which Biden is hoping to make significant progress on by late this year. After all that, Yellen and Biden hope they can eventually push the deal through the OECD (several dozen members) and, finally, tailor a final agreement via the OECD that will be acceptable to some 139 nations, according to the FT (that’s larger than the OECD’s membership).

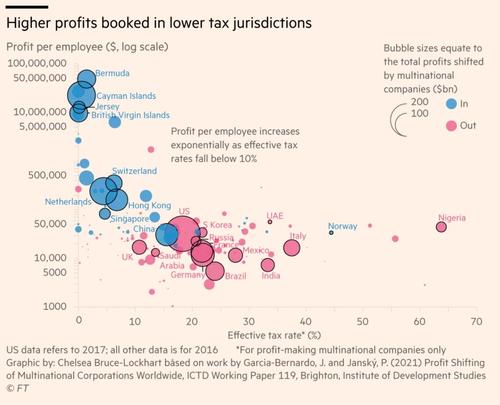

To successfully finance President Biden’s spending ambitions without further blowing out the federal budget deficit, Biden won’t only need to raise taxes on American corporations: he will need to block off their ability to flee the US. Back in Obama’s day, many of these deals were carried out via “inversions,” mergers that involved an American company and a foreign shell company.

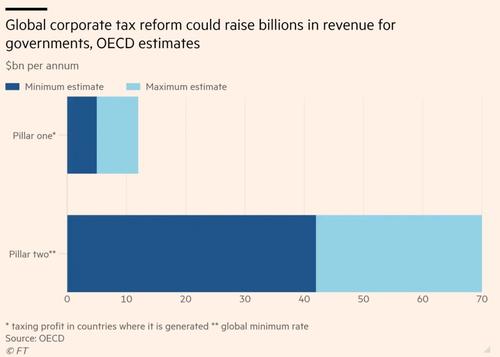

Should the deal succeed, it will lead to billions of dollars’ worth of new tax revenue raised by more than 100 countries.

Top GOP leaders from the Congressional tax-writing committees are already mobilizing to scupper the deal, or at least greatly limit any new taxes for American firms, indicating it might be a “tough sell” in Congress, as BBG put it.

Senator Mike Crapo and Representative Kevin Brady, the top Republicans on the congressional tax-writing committees, are already mobilizing their members to oppose a deal, and framing it as an issue they could talk about during an upcoming campaign.

“We continue to caution against moving forward in a way that could adversely affect U.S. businesses, and ultimately harm American workers and jobs at a critical time in our country’s economic recovery,” the pair said in a statement.

Louisiana Representative Steve Scalise, the second-ranking House Republican, called the G-7 deal “part of a flawed $3.5 trillion tax hike that will crush American jobs and embolden China and Russia, who would cheat if they even agreed to go along with this radical proposal.”

Finally, as the FT reminds us, there is still a long way to go before the deal becomes the new international corporate tax framework.

“This is a starting point,” said French finance minister Bruno Le Maire, pledging that “in the coming months we will fight to ensure that this minimum corporate tax rate is as high as possible.”

Remember, the essence of this deal involves Washington letting foreign governments in on a revenue bonanza in the form of spreading some of big tech’s tax dollars around. In the end, governments like Singapore and Ireland must give up one of their major competitive advantages – their low minimum corporate tax rates.

Though it’s not clear whether any enticements will be enough to convince countries like Ireland to abandon one of the biggest policy boons to GDP.

Tyler Durden

Mon, 06/07/2021 – 22:00

via ZeroHedge News https://ift.tt/3x6XlJ0 Tyler Durden