Bonds & Bitcoin Bounce-Back As Stock Market ‘Complacency’ Reaches 20-Year High

And stocks flip-flop again as Small Caps lag (after leading yesterday) and Nasdaq outperforming (after lagging yesterday), even though late-day ugliness took everything red…

A late day surge of selling hit the entire market around 1525ET..

Source: Bloomberg

The biggest short stocks continued to run (squeeze) higher…

Source: Bloomberg

But some of the best known meme stocks were maimed…

GME was higher for most of the day, but was sold hard into the close ahead of earnings after the bell…

10Y Yields tumbled today (and a very strong auction helped)…

Source: Bloomberg

Leaving 10Y yield at its lowest close since March 2nd (and back below 1.50%)…

Source: Bloomberg

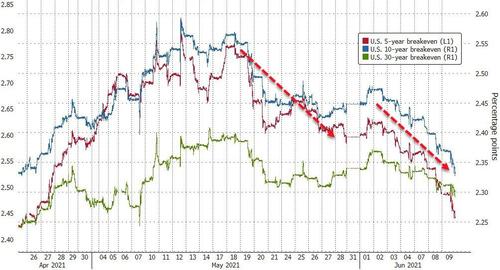

Breakevens continue to plunge as the reflation bet fades fast

Source: Bloomberg

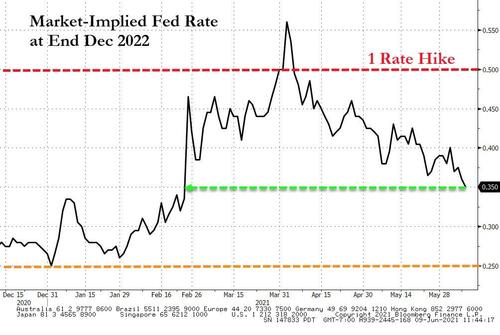

And as yields tumble, so do the odds of a rate-hike by the end of Dec 2022…

Source: Bloomberg

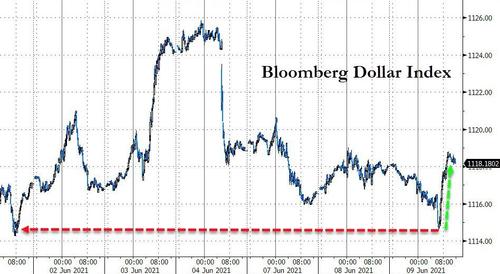

The dollar bounced back from weakness overnight to end unchanged…

Source: Bloomberg

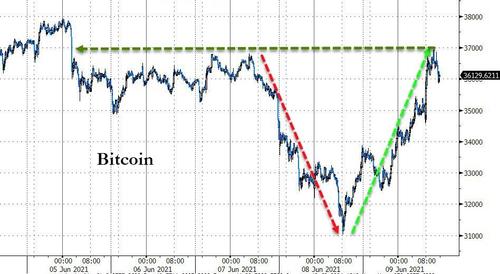

Bitcoin saw a big BTFD bid today, erasing yesterday’s losses back up to $37000 (from $31000)…

Source: Bloomberg

Gold ended the day unchanged, unable to hold earlier gains above $1900…

WTI fell back below $70 today after bigger than expected product inventory builds…

Copper was lower on the day buit managed to hold above $4.50…

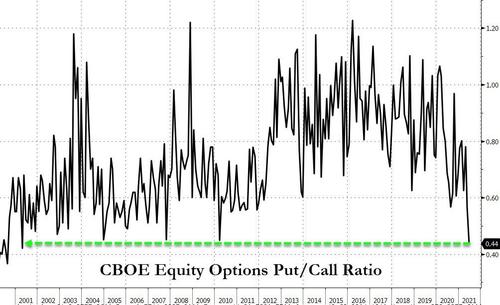

Finally, we note that the CBOE equity options put-call ratio is at its lowest level since 2001… is that complacent enough for you?

Source: Bloomberg

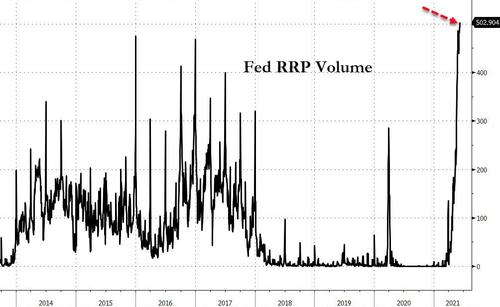

And in the meantime, Banks threw over half a trillion dollars into The Fed’s reverse repo today as they are just too fucking full of liquidity…

Source: Bloomberg

This won’t end well.

Tyler Durden

Wed, 06/09/2021 – 16:01

via ZeroHedge News https://ift.tt/2Sl6Bdu Tyler Durden