UK Secures Financial Sector Carve Out In Global Tax Talks To Protect Struggling Banks

In what’s being heralded as a major diplomatic victory for the UK, British diplomats have reportedly succeeded in securing an exemption for the financial services industry from the global corporate tax framework that’s being hammered out by the OECD. With talks set to end Thursday, the OECD is expected to soon publicize “Pillar 1” of what would be the most comprehensive overhaul of international corporate tax rules in a century.

But while Washington likes to talk about the new framework as a foregone conclusion, there’s plenty of reason to doubt that it will ever be implemented.

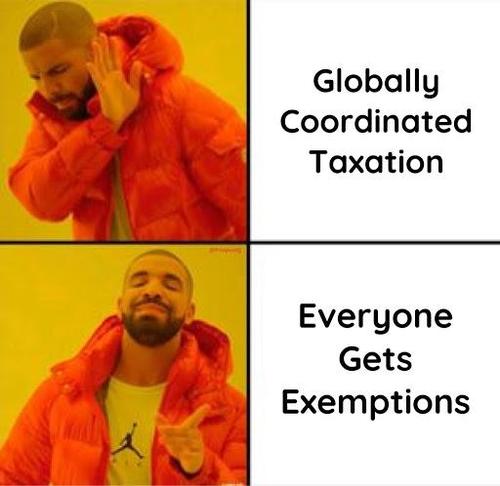

One reason is that countries like Ireland, Singapore, Indonesia and island island tax havens like Bermuda all oppose the new scheme. Why would these countries want to surrender a policy that has in almost every case been a tremendous boon for economic growth, just to accept whatever tax crumbs the Americans toss their way? Adding salt to their wounds, while these countries haven’t played much of a role in the talks so far, the UK has already succeeded a critical carveout, something that even Amazon hasn’t managed to accomplish.

Their biggest fear, of course, is that everybody gets an exemption but them.

Britain’s financial services industry has been left in shambles since Brexit. This exemption is an example of the UK scrambling to protect what’s left of its imploding banking sector. And as the FT reported, UK Chancellor Rishi Sunak only managed to secure the exemption by making a critical tax concession to the US.

The talks at the Paris-based OECD, which are due to conclude on Thursday, have accepted Britain’s case that the financial services industry be carved out of the proposed new global tax system, according to two people briefed on the negotiations.

But UK chancellor Rishi Sunak’s victory in haggling over the details of new corporate levies came at a cost, said these people. He had to make concessions to the US on dismantling Britain’s digital services tax that is focused on American technology companies.

Meanwhile, the FT also shared some new details from the negotiations. In the first part of the talks, the UK and France have pushed to ensure that American tech giants will pay more in taxes wherever they operate, in exchange for countries raising their minimum corporate tax to 15%. While Washington initially pushed back against the exemption for financial services, Britain manage to persuade the US with a commitment to “early removal” of the digital tax mentioned above. The timing of the removal would be “carefully choreographed.”

The US agreed to the focus on taxing multinationals more based on where they operate so long as other countries committed to removing their digital taxes, but shocked the UK by saying that the pillar one tax rules had to apply to all sectors including financial services.

“This was a pure game between the US and the UK and France,” said one person close to the negotiations.

The UK believed financial services would be carved out from the new global tax rules because regulation forces banks to be separately capitalised in every jurisdiction they operate in, so that they declare profits and pay tax in the countries in which they do business.

Without the exemption, the UK Treasury risked seeing City banks paying less tax to it and more to other countries.

Washington initially insisted that Italy, France, the UK and any other country with a digital tax targeting American tech firms abolish those levies as soon as a deal on a new global framework was struck. Ultimately, it appears even the UK refused immediate elimination. As Sunak said: “I think it’s a fairly obvious point the Americans want domestic digital services taxes removed. They will be, but the whole thing has to be looked at in the round.”

Tyler Durden

Thu, 07/01/2021 – 04:15

via ZeroHedge News https://ift.tt/3dwgdcV Tyler Durden