Stocks Storm To 7th Straight Record High, First Time Since 1997, After Goldilocks Jobs Report

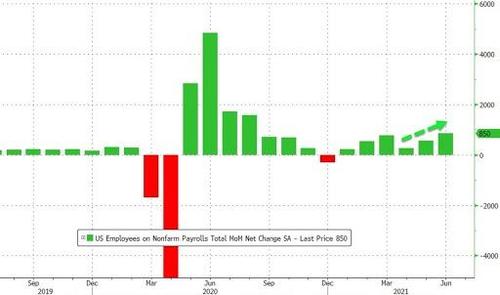

In our preview of today’s jobs report we said it would be hot but not too hot, and that’s precisely what happened when the BLS reported that June’s payrolls data was strong (850K) but not too strong (wages eased, unemployment rose).

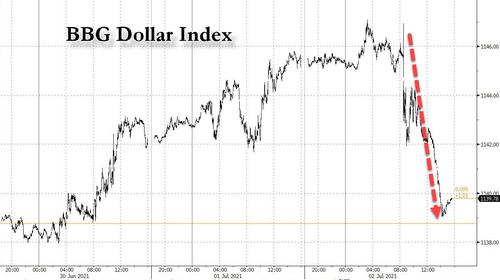

And as Bloomberg recaps in its intraday wrap, namely that “stocks climbed on speculation the economy is recovering at a pace that won’t make the Federal Reserve imminently take away the liquidity punch bowl that has helped push the market to a record”, we can conclude that today’s jobs report was goldilocks: “just right” to propel virtually all risk assets – including stocks, treasuries, gold and oil – higher, while the dollar tumbled as all those recent shorts who decided to close their positions and go long the greenback in recent weeks, were again stopped out.

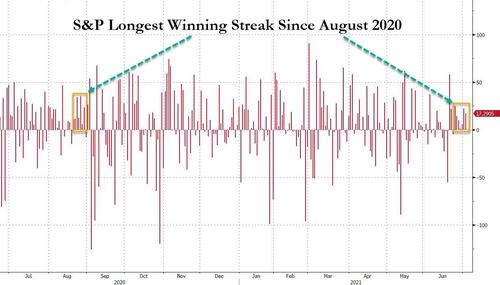

Speaking of stocks, the S&P 500 rose for a seventh consecutive day, its longest winning stretch since last August when SoftBank was ramping stocks courtesy of a marketwide gamma squeeze…

… and one which has pushed it to seven consecutive record highs, for the first time seen since 1997!

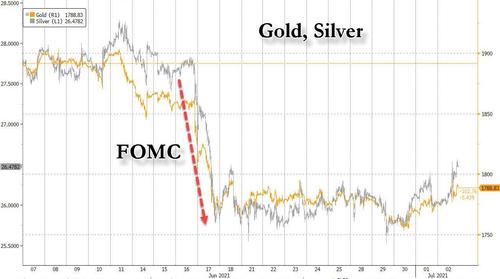

Which of course, is remarkable considering the panicked freakout we observed in the immediate aftermath of the June FOMC when risk assets tumbled as the Fed previewed not one but two rate hikes in 2023. To think all that was needed to “fix” this sentiment was for Joe Biden to meet with Powell and Yellen…

…. sending stocks non-stop higher for the next two weeks.

Helping the low-volume was the latest plunge in the VIX, which tumbled to just above 14, the lowest level since the covid crisis…

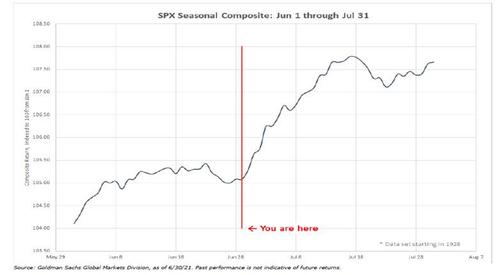

… before rising modestly. And if Goldman is right in pointing out that stocks are entering the best 2-week period of the year …

… then we have much more downside in the VIX to go.

With the Nasdaq rising 1%, obviously rates did not surge after today’s payrolls report, and sure enough after a few kneejerk moves lower and higher, 10Y yields proceeded to drift to session lows with the bond market gradually agreeing with BofA’s view that the US economy is heading for stagflation in the second half.

This was the result of declining real rates while breakevens remains stubbornly high around 2.34%

We doubt stocks will get the memo any time soon.

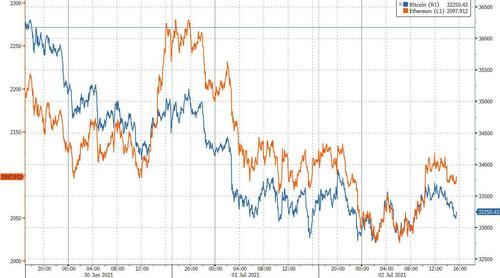

In other news, cryptos were generally flat on the day, with bitcoin trading just around $33,000 while ethereum was caught in a range between $2000 and $2100…

… even as the dollar tumbled thanks to the “goldilocks” jobs report.

Meanwhile, gold benefited from the dollar plunge, rising to the highest level since mid-June although it has a long way to go before reclaiming its pre-FOMC levels.

Finally, despite the chaos in today’s OPEC+ meeting where UAE has emerged as a vocal objector to a deal that sees only modest increases in output, oil recovered much of of its earlier losses and was last trading just shy of the highest level since 2018.

At some point the Fed will need to stop oil’s ascent or as we noted earlier, the unstoppable oil surge could be a nail in the coffin for stocks.

Tyler Durden

Fri, 07/02/2021 – 16:00

via ZeroHedge News https://ift.tt/3hL7pkT Tyler Durden