China On Verge Of Contraction After Sudden Plunge In Services PMI

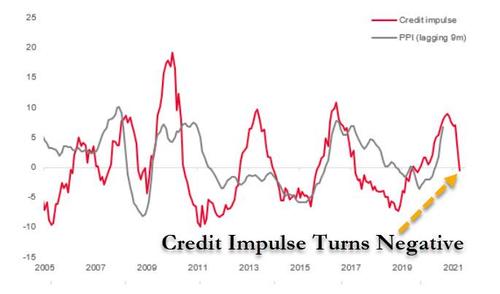

One month ago when observing the reversal of China’s all-important credit impulse to negative, its first red print in over a year, we warned that China was set to unleash a deflationary wave across the world…

… but first it would be China’s own economy that is impacted.

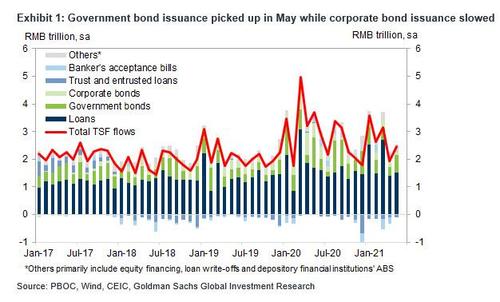

And sure enough, the country which first emerged from the covid pandemic it created courtesy of a tidal wave of new debt creation which saw a blowout in new Total Social Financing flows..

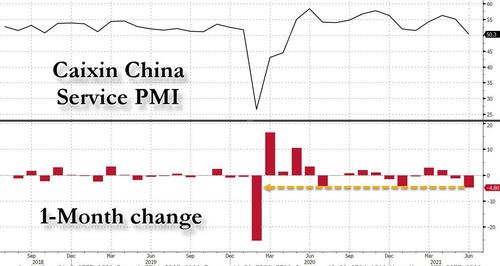

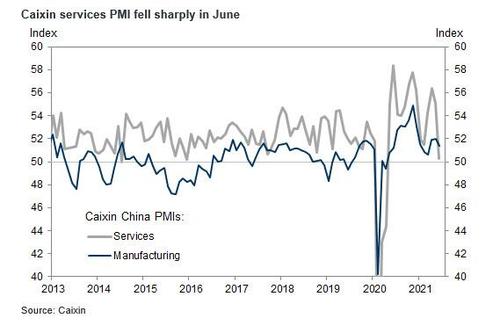

… is on the verge of contraction again, because overnight, the Caixin China General Services Business Activity Index (headline services PMI) fell sharply to 50.3 in June from 55.1 in May, badly missing the 54.9 Bloomberg consensus, and the largest one-month drop outside of the catastrophic February 2020.

And while the headline PMI remained just above 50 – or in expansion territory – another month of a similar decline and we will have the first Chinese contraction confirmation since last February.

The good news is that, for now, the manufacturing PMI still remains solidly in expansion territory, although absent another blast of credit across its economy, we expect it to catch down to its services peer in the coming weeks.

The growth slowdown was widespread as sub-indexes suggested growth of new business plunged in the services sector, employment contracted, and inflation pressure eased.

Digging into the numbers, here are some more details:

- The new business index fell to 50.5 from 54.7 in May, weighed by the resurgence of COVID-19 infections in the Guangdong province, while the new export business sub-index edged up to 50.3 in June from 49.7 in May, implying significantly weaker domestic demand growth. As the growth of new business moderated sharply, the pace of new hiring slowed notably to below 50. The employment sub-index was 49.0 in June (vs. 52.5 in May). The outstanding business index fell to 49.7 in June (vs. 51.3 in May).

- Price indicators suggest both input and output price inflation pressures eased markedly in the services sector, confirming our observation 6 weeks ago when looking at the sharp drop in China’s credit impulse which is now hitting China’s PPI, and will then move rapidly across the globe. Indeed, the input prices sub-index fell to 50.9 from 56.6 in May, the lowest since last September. However, cost burden is still high due to increased prices for raw materials and high labor costs, according to the survey. The output prices sub-index fell to 49.0 from 52.9 in May as surveyed companies tried to attract new businesses by lowering prices.

- The business expectation index declined to 61.2 in June (after seasonal adjustment) from 64.0 in May, a nine-month low. Some companies still reported “concerns over the COVID situation at home and abroad”, but remained optimistic about future business performance.

And while the latest China credit – and now PMI – data is flashing a bright red alarm light that the global reflationary wave is not only over but is going into reverse, the good news is that anyone harboring any expectation that the PBOC may tighten to frontrun the Fed’s tapering or hiking, is now crushed.

Tyler Durden

Mon, 07/05/2021 – 09:05

via ZeroHedge News https://ift.tt/3hhA6qn Tyler Durden