Zoltan Sees Reverse Repo Hitting $2 Trillion In Weeks: What Happens Then

Two weeks ago, in the aftermath of the Fed’s surprise hawkish FOMC announcement which also hiked the administered rates on the Fed’s overnight repo and IOER facilities by 5bps to 0.05% and 0.15% respectively, we quoted Credit Suisse repo guru Zoltan Pozsar who explained it best in his post-mortem, writing that “the re-priced RRP facility will become a problem for the banking system fast: the banking system is going from being asset constrained (deposits flooding in, but nowhere to lend them but to the Fed), to being liability constrained (deposits slipping away and nowhere to replace them but in the money market).”

What he means by that is that whereas previously the RRP rate of 0.00% did not reward allocation of inert, excess reserves but merely provided a place to park them, now that the Fed is providing a generous yield pick up compared to rates offered by trillions in Bills, we are about to see a sea-change in the overnight, money-market, as trillions in capital reallocate away from traditional investments and into the the Fed’s RRP.

In other words, as Pozsar puts it, “the RRP facility started to sterilize reserves… with more to come.” And just as Deutsche Bank explained why the Fed’s signaling was an r* policy error, to Pozsar, the Fed also made a policy error – only this time with its technical rates – by sterilizing reserves because “it’s one thing to raise the rate on the RRP facility when an increase was not strictly speaking necessary, and it’s another to raise it “unduly” high – as one money fund manager put it, “yesterday we could not even get a basis points a year; to get endless paper at five basis points from the most trusted counterparty is a dream come true.”

He’s right: while 0bps may have been viewed by many as too low, it was hardly catastrophic for now (Credit Suisse was one of those predicting no administered rate hike), 5bps is too generous, according to Pozsar who warns that the new reverse repo rate will upset the state of “singularity” and “like heat-seeking missiles, money market investors move hundreds of billions, making sharp, 90º turns hunting for even a basis point of yield at the zero bound – at 5 bps, money funds have an incentive to trade out of all their Treasury bills and park cash at the RRP facility.”

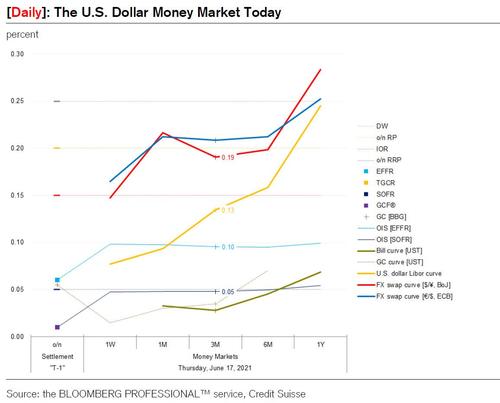

Indeed, as shown below, bills yield less than 5 bps out to 6 months, and money funds have over $2 trillion of bills. They got an the incentive to sell, while others have the incentive to buy: institutions whose deposits have been “tolerated” by banks until now earning zero interest have an incentive to harvest the 0-5 bps range the bill curve has to offer. Putting your cash at a basis point in bills is better than deposits at zero. So the sterilization of reserves begins, and so the o/n RRP facility turns from a largely passive tool that provided an interest rate floor to the deposits that large banks have been pushing away, into an active tool that “sucks” the deposits away that banks decided to retain.

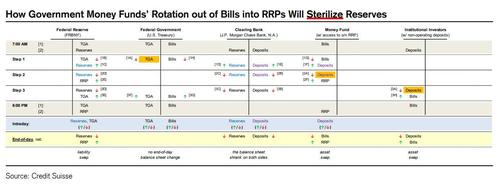

To help readers visualize what is going on, the Credit Suisse strategist suggest the following “extreme” thought experiment: most of the “Covid-19” deposits currently with banks go into the bill market where rates are better. Money funds sell bills to institutional investors that currently keep their cash at banks, and money funds swap bills for o/n RRPs. Said (somewhat) simply, while previously the Fed provided banks with a convenient place to park reserves, it now will actively drain reserves to the point where we may end up with another 2019-style repo crisis, as most financial institutions suddenly find themsleves with too few intraday reserves, forcing them to use the Fed’s other funding facilities (such as FX swap lines) to remain consistently solvent.

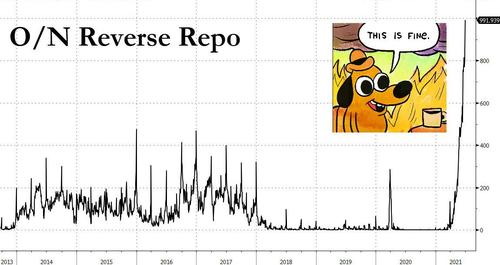

Finally, as we noted two weeks ago, this process is not overnight. It will take a few weeks to observe the fallout from the Fed’s reserve sterilization, and sure enough on the last day of the quarter, we saw a dramatic escalation as the total amount of reserves parked at the Fed exploded to just shy of $1 trillion, an increase of over $320 billion, of which half has come from a drop in pre-existing reserves, $80 billion came from the GSEs shifting cash from their unremunerated accounts, $40 billion from reserves freshly minted via QE since the rate adjustment, and the remaining $30 billion coming from a drop in the Treasury’s general account.

How much higher can this chart get?

For the answer we go to the most recent notes from Pozsar, who over the weekend was also finally discovered by the WSJ and from a niche name among a handful of high finance commentators, has now emerged a household name… inasmuch as discussing the most arcane aspects of modern monetary plumbing can ever be a topic of household discussion.

Writing in his latest Global Money Dispatch note, Pozsar picks up on the reserve sterilization theme he first brought up two weeks ago following the FOMC IOER/RRP rate hike, and says that there are two ways a “generously re-priced RRP facility” can sterilize reserves:

- money funds increase their net yields (by passing on the “gift” from the Fed), and

- pull money away from banks and into the RRP facility, or money funds rotate out of Treasury bills as bills mature and into the RRP facility, in which case someone with a bank deposit will have to buy bills instead.

Both examples lead to a decline in reserves and an increase in o/n RRP usage (what Zoltan defines as “sterilization”), but the former is accompanied by a higher AuM at money funds and the latter isn’t – the latter shows up only as a rotation from bills to RRPs.

So looking ahead, where reverse repo usage is likely to surpass $1 trillion in short notice, the Credit Suisse repo guru asks which of these two flows will dominate in coming weeks, and answers that – in his view – it will be the latter, as money funds don’t seem to be passing on the spoils of the re-priced facility – “net money fund yields are practically zero still” – so if money moves from banks, it will chase higher bill yields, not higher money fund yields.

This is schematically shown by the Pozsar chart below which shows how reserves will get sterilized through the rotation from bills to RRPs.

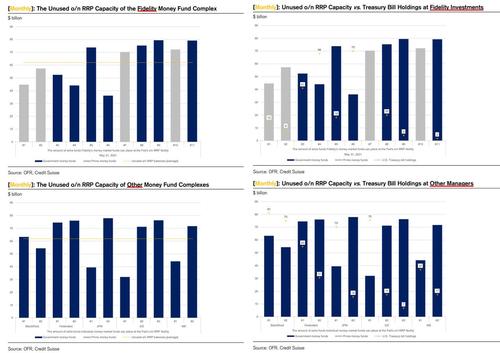

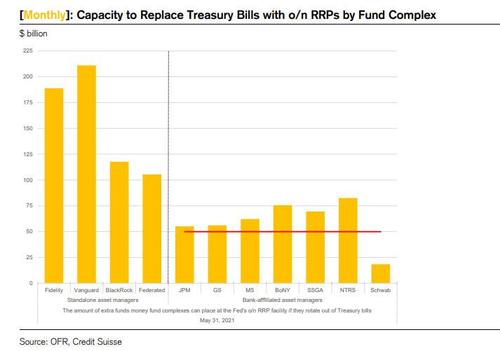

The next step to determine the coming surge in RRP usage is to figure out how much “space” money funds have to rotate out of bills into RRPs. To answer this, Pozsar starts with data on money fund holdings as of May 31st , which show the use of the RRP facility by individual money funds. Knowing their use, one can also calculate how far each fund is from the $80 billion per counterparty cap, i.e. how much “space” they have to rotate out of bills into RRPs.

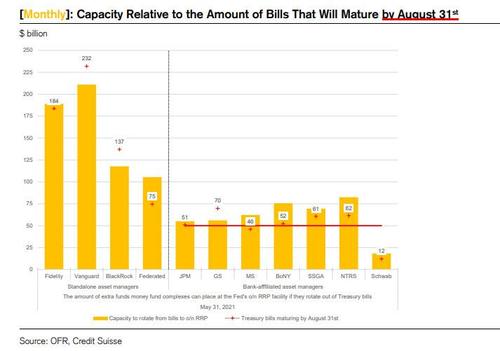

Next, one compares the available “space” to the amount of bills each money fund holds, and choose the smaller of the two (as a reminder, we are trying to calculate the maximum RRP usage without any inflows).

The first chart below shows the results for the largest fund complexes – as of May 31st, the largest money funds had capacity to rotate out of $1 trillion of bills and place that much more money in the o/n RRP facility, which as Pozsar puts it, is “a lot.”

More importantly, the next chart shows that the bill holdings of these money funds will mature by August 31st – that’s a lot in a short period of time.

As an aside, not included in these charts are second-tier money funds that hold $350 billion in bills, some $300 billion of which they have capacity to replace with o/n RRPs.

Putting it all together, Pozsar calculates that we’re looking at $1.3 trillion of flows from bills into RRPs by the end of August.

A quick note: as these estimates use data as of May 31st, but today is July 4, can we calculate how much rotation money funds have already achieved during June? Well, according to Pozsar, the Fed’s o/n RRP data – ignoring the June 30 surge in use, which was driven by quarter-end flows – tell us the use of the facility is up by about $300 billion since the RRP rate hike, of which as noted above, only half came from a decline in reserves and deposits – i.e. a rotation from bills to o/n RRPs and from deposits to bills.

This means there is about a trillion more to go from a level in the $800-$900 billion range, or in other words, this time in August, the Fed’s reverse repo facility rise to just around $2 trillion, meaning that a mindblowing $2 trillion in reserves will have been drained in from the system. And while that is to be expected at a time when the financial system is burst with too much liquidity which continues to be added at a pace of $120BN per month, the question is what happens once too many reserves are drained? After all, as Pozsar puts it, the impact of this “sterilization” is that bank will lose deposits and reserves “which is what happens when rates on collateral-providing facilities are set above rates that are available in the bill market.” Ominously, Pozar notes that “we saw this before when the foreign repo pool was priced too generously relative to bills in 2019.” Everyone remembers how catastrophically that particular episode in repo mispricing ended.

To this the only question we can add is that happens when – after another repo market tantrum as the Fed drains too much reserves as it likely will in just a few weeks – this liquidity drain goes violently into reverse and the Fed injects $2 trillion in inert reserves into the market: how high will risk assets rise then?

Tyler Durden

Mon, 07/05/2021 – 10:00

via ZeroHedge News https://ift.tt/2UYttAv Tyler Durden