ByteDance Abandons Plans For New York Listing Despite Lower Valuation

Didi’s staggering selloff just days after its IPO (in which it skyrocketed higher initially, sucking in a crowd of retail traders, only to plunge on news that Beijing was bringing it’s antitrust smackdown to Didi’s doorstep) was the talk of Wall Street on Tuesday, beginning with last night’s selloff in SoftBank and continuing through the close, where Didi finished up only slightly above its session low.

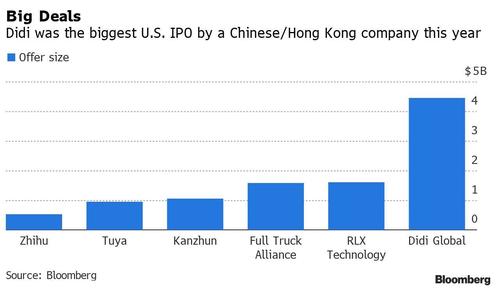

Even as stunned institutional backers dispatch analysts to parrot the bullish line – that Didi is already taking steps to address the crackdown and that it remains a dominant player in the international ride share market – reports that Beijing is sending a message to domestic firms that listing in NY is now off limits have triggered speculation that Didi might be the last major US IPO of a Chinese tech giant for a very long time.

To support this, CNBC reported Tuesday afternoon that ByteDance, owner of popular social media platform TikTok, is now reconsidering plans to list in the US – and is looking at Hong Kong instead.

DEIRDRE BOSA: Hey Kelly. Well for Didi, those risks should have been well known, 15 pages in the IPO prospectus relating specifically to doing business in China. Before Didi, there was a crackdown on Ant Group, Alibaba and other tech giants, including Didi itself. Now Xi Jinping is sending a message that control and data protection, national security, more important than having global champions for tech companies. Now that theme has already been hitting the performance of other Chinese companies listed in the US, you just saw that from Dom, but the fallout could be even broader, the story isn’t done. Shares of SoftBank, Didi’s largest shareholder, they were off 5% Monday in Tokyo, they recovered a little bit yesterday. Uber holds the second largest stake, it’s down today that, though, there could be a tradeoff here since it competes with Didi in markets like LATAM as well. Meanwhile though, several sources are telling me that the crackdown could also affect TikTok parent, ByteDance, one of the most anticipated IPOs this year and the first Chinese company to really succeed in the West. I’m told that its listing could be delayed until 2022 and its valuation in the private market may take a haircut, an evaluation that I’m hearing was as high as $450 billion. Back to Didi though, there is now a key question that investors are asking and that is, did the Chinese authorities ask the company to delay its IPO and if so, as the Journal reported today, why weren’t investors notified, early investors as well as ones that bought in through the IPO. Kelly, lots of questions surrounding and we’re trying to get to the bottom of it.

According to CNBC, ByteDance has accepted the fact that its change of venue will likely result on a lower valuation…but defying the CCP would almost certainly lead to BD being made an example of. And Beijing has repeatedly exhibited its skill at sabotaging IPOs.

EVANS: So Deirdre, did you just say that TikTok, ByteDance’s valuation was as high as $450 billion, half a trillion dollars for a private company, you know, a pre IPO company has to be almost unheard of, I guess that’s just a side note. But on this issue itself, what do you think we watch for, for the next shoes to drop?

BOSA: That’s a good question. I think you see how Didi handles this and we did get a statement from them sort of saying thank you to the Chinese regulators because they’re going to emerge stronger from this but I think you also watch what the Chinese authorities do now, does the crackdown continue. We saw three more companies publicly listed newly IPO Chinese companies on US exchanges targeted over the weekend so is there going to be more? What happens with the big, big giants like Tencent and Alibaba and Meituan, there was this thinking that when Tencent received that huge fine in the billions of dollars that maybe it could move forward. Does that still apply or does the crackdown continue so those are all things to watch for as well as commentary from the CCP. We heard Xi Jinping’s comments last week, which, you know, some might say could have been writing on the wall. They said that they wanted to protect their own, you know, sovereignty and their own companies and it was very nationalistic so we’ll continue to monitor what comes out of the party.

Beijing has already made clear to dozens of firms that American IPOs are no longer acceptable. Instead, they can list domestically, or in Hong Kong. After all, with Beijing’s natsec crackdown making Hong Kong an increasingly inhospitable place for foreigners, if domestic firms don’t list in Hong Kong, who will?

Tyler Durden

Tue, 07/06/2021 – 18:20

via ZeroHedge News https://ift.tt/3ACj5i8 Tyler Durden