US Pending Home Sales Unexpectedly Tumble In June “Due To Huge Spike In Prices”

After rebounding surprisingly strongly in May (despite weakness in new- and existing-sales), pending home sales were expected to be unchanged in June, but instead they dropped 1.9% MoM, pushing pending home sales down 3.29% YoY…

Source: Bloomberg

“The moderate slowdown in sales is largely due to the huge spike in home prices,” Lawrence Yun, chief economist at the NAR, said in a statement.

“Buyers are still interested and want to own a home, but record-high home prices are causing some to retreat.”

So in June, only existing homes saw sales rise and that was de minimus from a notably lower revision in May…

Source: Bloomberg

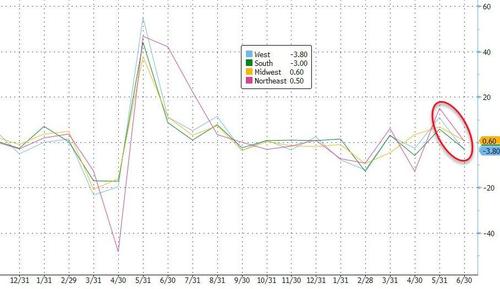

All regions saw sales slow as pending home sales decreased in the South and West, and rose 0.5% in the Northeast and 0.6% in the Midwest last month. The biggest drop was in the West, with a decline of 3.8%, the most since February. The South retreated 3%.

Source: Bloomberg

If housing data is starting to weaken now, imagine what happens when The Fed starts to taper… or, heaven forbid, raises rates?

Tyler Durden

Thu, 07/29/2021 – 10:05

via ZeroHedge News https://ift.tt/3iapU3q Tyler Durden