ARK Invest Has Been Slowly Selling Its Roku Stake Despite Touting It On CNBC Just Weeks Ago

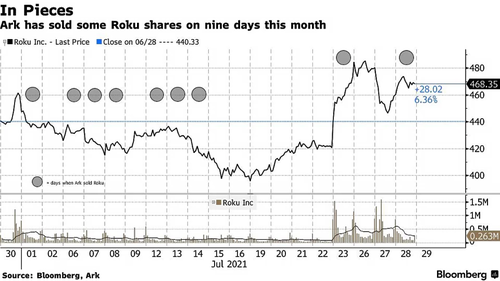

If you don’t look close enough, you may not notice that ARK Funds are slowly and quietly backing out of one of their hottest investments, Roku.

Ark Investment Management sold another 47,200 shares on Wednesday this week, according to Bloomberg, which brings their total number of shares sold since June 30 up to 520,000.

The sales could just be managing the size of ARK’s position, as Roku shares are up 69% from this year’s low in May. However, Wood had been “touting” Roku just two weeks ago. Wood “told CNBC in an interview in the middle of the month that it would be a mistake to sell stay-at-home winners,” the report noted.

She made the case on CNBC that the company was well positioned coming out of the pandemic, Insider notes.

In July, Wood said: “Roku is a very important name to us. What we believe is the coronavirus crisis changed the world dramatically and permanently, and when consumers and businesses find faster, cheaper, better, more productive, more creative – they’re not going back to the old world.”

Eric Balchunas, an ETF analyst for Bloomberg Intelligence, commented: “Wood’s process is to sell winners and buy losers in small daily doses. Roku has been the biggest contributor to ARKK’s returns this year so it would be consistent with her strategy to lock in some of those gains and buy into stocks she likes but have struggled.”

Roku is still one of ARK’s biggest holdings, making up 6.5% of the ARK Innovation ETF. The company is set to report earnings next week.

Tyler Durden

Fri, 07/30/2021 – 09:38

via ZeroHedge News https://ift.tt/3yhTZ6E Tyler Durden