Exxon Rises After Beating Q2 Earnings On Blowout Chemicals Results

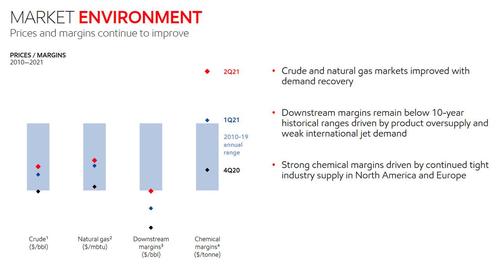

Earlier this week we said that Exxon will likely beat expectations largely thanks to surging plastic prices and that precisely what happened. As the company reported moments ago, while prices and margins for crude, nat gas and downstream were all in the from 2010-2021 range, chemicals were a major outlier and well outside the historical range largely thanks to the skyhigh price of petrochemicals.

What is also notable here is that while the vaccine rollout is helping improve global demand, this is being partially offset by persisting lockdowns and outbreaks, and as a result “Margins remain below 10-year lows driven by product oversupply and international jet demand.”

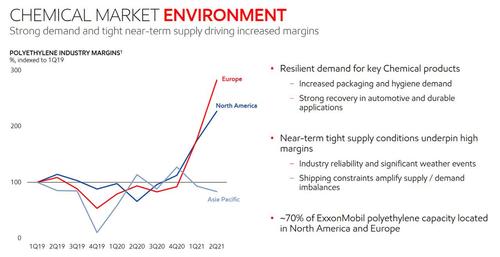

As the next chart from the company’s earnings presentation shows, PET industry margins in Europe and North America were between 200% and 300% higher compared to Q1 2019. The company said there were four big drivers behind the surge: “increased packaging” (that’s the Amazon.com e-commerce boom) and “hygiene demand” (that’s Covid-19 mask and other stuff), plus “strong recovery in automotive” (after sales plunged in 2020) and “durable applications” (more household items like TV screens bought with checks from the government).

Naturally, higher oil prices did not hurt and the company beat on the top and bottom line despite a continued slowdown in production. Here are the details:

- Q2 Revenue $67.74BN, beating Exp. $66.86BN

- Q2 Adj EPS $1.10 vs. Loss/Shr 70.0C Y/Y, and beating exp. of $0.99

- Q2 Capex $3.80B, beating exp. $3.31B, but looking ahead Exxon sees FY capex on the low end of its $16B to $19B guidance

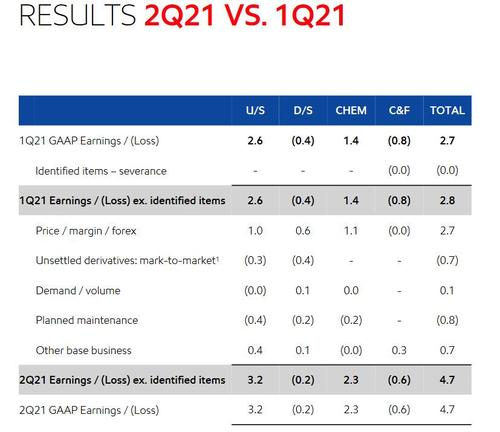

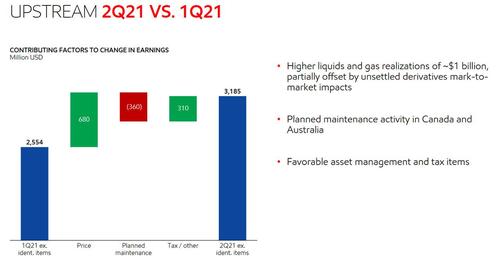

The company reported price and margin improvements across all businesses with continued demand recovery; this however was offset by unfavorable mark-to-market impacts on open trading strategies with higher prices as well as higher planned maintenance across all businesses. On the other side, the company benefited from lower corporate and financing expenses and favorable tax items

Some more details:

- Q2 Upstream Earnings $3.19B, Est. $3.05B

- Q2 Downstream Loss $227M, Est. Loss $155.6M

- Q2 Chemical Earnings $2.32B, Est. $1.94B

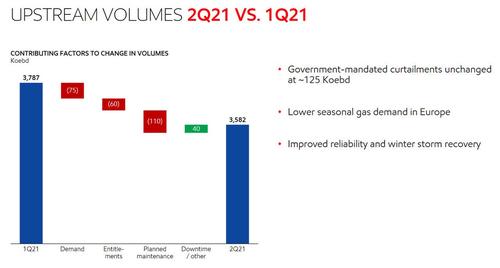

- Q2 Production 3,582 Mboe/D, Est. 3,683

Some more detail on upstream…

… and downstream….

Of note, Exxon said it cut Permian drilling and fracking costs by 40% while taking more than a third out its lease-operating expenses. The company hired hands of the oil patch have been on an efficiency tear over the past few years, able to do more for less. Explorers are able to get the same amount of output with less rigs compared to a few years ago. Additionally, due to growing activist pressure from the ESG army, the company said it achieved record-low flaring intensity in the Permian in the second quarter. Flaring intensity was down 30% compared with 2020.

Exxon also reported upstream production of just 3.58 million barrels a day due to “government mandated curtailments” and lower seasonal gas demand in Europe, which while higher than the 3.395 million b/d expected, was the lowest in at least 15 years, according to Bloomberg data.

“Margins remain below 10-year lows driven by product oversupply and international jet demand.”

As Bloomberg notes, the oil giant definitely appears to be in harvest mode, sacrificing production growth for up-front cash flows today. Given its debt situation, that’s understandable.

Elsewhere, Exxon guided to the lower end of its $16-$19BN capex range. As Bloomberg notes, like many of its peers Exxon is planning to boost spending in the second half of the year amid higher oil and natural gas prices. But the budget will be focused on key projects, including in Guyana, Brazil, the Permian and the chemical segment, with full-year spending toward the lower end of the $16 billion-$19 billion guidance range.

Also looking ahead, drawing from the boost in chemicals earnings Exxon is moving ahead with a bunch of projects mainly in the U.S., according to its slide presentation. Three of those are in the Gulf Coast, including the startup of its new Corpus Christi site in 4Q.

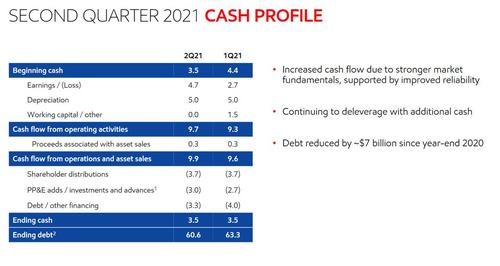

How about the balance sheet? Well, after the aggressive debt issuance in 2020, the company is in deleveraging mode, reporting $2.7 billion in debt reduction in the quarter, which was just below the $3.7 billion paid out to shareholders as dividends. This was thanks to a whopping $9.7 billion in cash from operations. While the debt paydown was significant it was lower than the $4 billion cut in 1Q. As a result, net debt now stands at about $57.1 billion, down $7 billion from year end 2020.

Finally, here is the company’s plan on how to grow the stock price further:

Echoing what we said above, RBC analyst Biraj Borkhataria pointed to chemicals as being the “standout performer again” while poor refining margins are weighing on downstream earnings. Still, the bank expects the market to look past this given that at $10 billion, its cash flow from operations “is a strong underlying result.” The bank continues to see Exxon as underperforming with its low free cash flow yield lagging its peers.

RBC’s Borkhataria also notes that Exxon’s slide presentation shows it plans to grow its low-carbon business aggressively, and that it expects the unit to be both strategic and money-making. Investors and analysts are likely to question that claim, he said.

“For the majors, investments are typically strategic, or financially accretive, but generally not both,” Borkhataria writes in a note to clients. “As it relates to low-carbon investments, XOM has historically noted that these ‘lower return’ investments do not fit its criteria, so with the change in board and management, it will be interesting to see what has changed.”

In response to the earnings, which came shortly after an impressive result from Exxon’s biggest competitor Chevron which also topped estimates and resumed its buyback, XOM stock rose by about 2%, and was trading just shy of $60.

The company’s earnings presentation is below.

Tyler Durden

Fri, 07/30/2021 – 08:25

via ZeroHedge News https://ift.tt/3BXhyEk Tyler Durden