US Consumers Burn Through Almost All COVID ‘Excess Savings’ As Buying Intentions Crater

While most economists were keenly focused on today’s core PCE data in the Personal Income and Spending data, we were far more interested in the spending power left inside the dynamo that is responsible for 70% of US GDP: the US consumer. And unfortunately, there is very little left.

For much of the post-covid recovery period, the most bullish narrative was that the trillions in excess savings (the number $2.5 trillion had been generously thrown about) resulting from the trillions in Biden stimmy checks which Americans ‘prudently’ saved would provide a long enough runway to allow US consumers to offset transitory surging prices with money they had saved up.

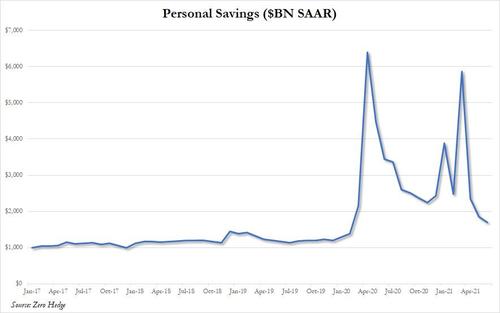

There is just one problem: according to the latest data from the BEA, excess savings are almost gone. In fact, as of June, there were just $1.7 trillion in annualized personal savings, a huge drop from the $2.5 trillion average observed for much of the post-covid period when Savings peaked predictable after the 1st, 2nd and 3rd stimulus hit America’s checking accounts. Alas, almost all of that is now gone, and as of the latest data, US consumers have just 30% more savings – or about $400 billion – compared to the pre-covid level of $1. 3 trillion.

Worse, at the current rate that Americans are burning through savings, this means that the entire fiscal stimulus tailwind from Biden’s trillions will be gone by August… just in time for emergency unemployment benefits to end.

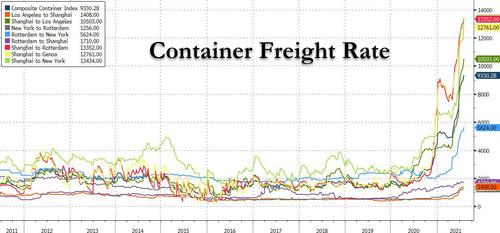

This is the worst possible outcome for the US economy because it means that US consumers will be hit by surging rent inflation and commodity pass through costs as well…

… at the end of 2021 and start of 2022, just as they realize they have spent all of their savings accumulated during the covid period, leading to a stagflationary spending depression, as the economy reverses even as prices continue to rise.

And the funniest thing: career economists may not understand any of this (until it is too late), but consumers sure do: as today’s University of Michigan consumer sentiment report showed, spending intentions on houses, vars and large household durable goods has crashed to the lowest level since the soaring inflation of the early 1980s forced Volcker to hike rates to 20%.

There is just one event that could short circuit what appears to be a near-certain recession heading into 2022 and mid-term elections which would be devastating for Democrats faced with an imploding economy: another multi-trillion stimulus, just enough to kick the can by another 4-6 months. But for that to happen, the US economy needs to be shut down again which will only happen only once there is enough covid Delta-variant fearmongering. Which should also explain everything that’s happening right now.

Tyler Durden

Fri, 07/30/2021 – 11:10

via ZeroHedge News https://ift.tt/3fbnL5u Tyler Durden