Will Wall Street And Main Street Join Forces To Short Robinhood’s Newly Listed Stock

If there’s one thing meme-stock mania has taught us, it is that Main Street can be a powerful force when pinned up against Wall Street. But what if the two factions decided to work together on something?

That’s something that Robinhood investors need to ask themselves. The controversial brokerage that is “gamifying” the market has drawn ire not just from Main Street for its mishandling of the GameStop fiasco, but also from Wall Street, who sees the company as a competitor.

Following Robinhood’s lackluster IPO yesterday, where the stock barely had a pulse above its IPO price of $38 per share, the idea of the two forces joining hands to short the company’s stock has made its way onto the popular WallStreetBets forum on Reddit, the New York Post notes.

In fact, Ihor Dusaniwsky, managing director at S3 Partners, told the Post: “Brokers are preparing for a lot of short sale demand. There’s a lot of talk about retail and institutional investors – like hedge funds – shorting the stock.”

He continued, noting that once short sales become prominent, sentiment from those negative on the name may be better reflected in Robinhood’s stock price: “Brokers have a limited capacity to approve short sales on IPO day but shorting can ramp up following the IPO. Because it will have a high percent of retail holdings there will be less short selling approved on the first day.”

One Reddit user posted yesterday: “Based on what we have learned over the past year as a result of the Robinhood inability to effectively manage it’s capitalization to remain solvent during periods of volatility and volume, I believe the Robinhood IPO provides a fantastic short opportunity.”

The user noted his “distrust” for Robinhood CEO Vlad Tenev as part of his thesis.

Sources also told The Post that “major institutions are also considering the possibility of shorting Robinhood”.

Another Reddit user, according to Bloomberg, wrote: “Is it me or does anyone else get pleasure from watching Robinhood’s stock burn to the ground?”

26 year old Julian Barrios commented: “With the whole GameStop and AMC stuff, I’m guessing the CEO said he needed to step his game up but it’s too late for that. I won’t be buying any Robinhood shares — they don’t deserve my money.”

Vivian Tu, a 27 year old investor and Tik Tok creator, also commented: “There’s a lot of negative sentiment and a ‘retail grudge’ from GME/AMC meme stock history. The way HOOD has traded today, especially against the overall market ticking higher, means that there are more Robinhood naysayers than previously thought.”

One thing that S3’s Dusaniwsky didn’t note is the effect of options eventually trading on the name. Just as the WSB crowd helped boost names like GameStop and AMC by buying deep out of the money call options and manufacturing a gamma squeeze, they may very well have the capability of doing the same on the put side for Robinhood once derivatives start trading.

While the idea is being passed around on forums online, there isn’t a consensus just yet. Some users are even warning others against the practice.

One user wrote: “You short Robinhood, you’re the one getting your ass squeezed.”

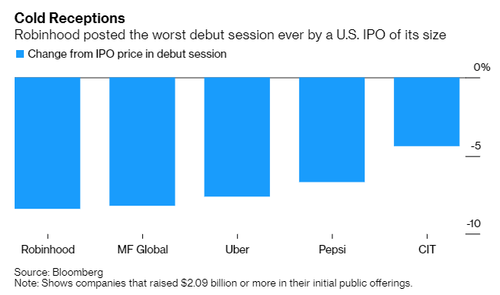

Robinhood plunged more than 8.4% at one point below its IPO price in its first day trading. It marks “the worst debut on record among 51 U.S. firms that raised as much cash as Robinhood or more”, according to Bloomberg. It took the title from the infamous MF Global Holdings Ltd., which fell 8.2% in its first day trading.

Tyler Durden

Fri, 07/30/2021 – 08:06

via ZeroHedge News https://ift.tt/3j5KoJL Tyler Durden