Goldman Flow Desk Weekly Recap

By Goldman’s Michael Nocerino, flow trader and vice president of multi-asset platform sales

GS Post Bell

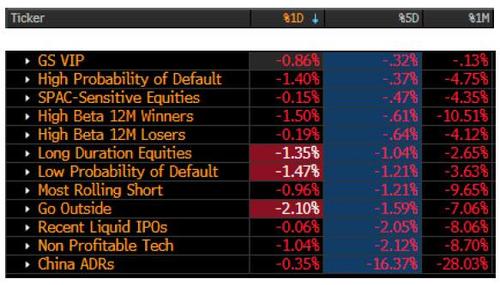

Quick Look…Best performers on the Week…

The Worst…

*DESK ACTIVITY…Markets ending the month in the red after a lackluster session dictated by the AMZN sales miss after the close yday and additional delta variant headlines hitting the tape. Albeit we are just a hair off ATH’s and despite ending in negative territory, all three indices ended July higher and it marks the 6th consecutive monthly gain for the S&P. According to Stat News’ Covid dashboard, the U.S.’ 7-day moving average for cases as of yesterday reached the highest number since April 19 and has been steadily increasing for the past month. Another pain point this week was the weakness in Chinese stocks as Beijing continues their crackdown on tech companies – KWEB capped off their worst 2 week performance since inceptive and FXI suffered worst month since Sept. 2011. We finished up the busiest earnings week in the history of the SPX (51% of the index reported) and solid prints continue to be unrewarded – another round of prints next week (12% of SPX). Have a great weekend.

*US DESK FLOWS…The desk finished the day with HF skewed better for sale 1.07x while LO skewed better to buy 1.13x. We were significantly active in info tech, and consumer discretionary names. In terms factors, we net bought value, and we net sold growth.

*ACROSS THE POND…Flows on the desk today ended up c.1.1x better for Sale. LOs were our most active group, amounting for the majority (c.50%) of flow actually skewed (c.1.1x) to buy. HFs kept their activity relatively high (c.30% of total flow) with a (c.1.2x) sell skew. Sector-wise, we saw net demand for Discretionary, Energy and Real Estate vs supply for Industrials and Financials.

*THEMES OF THE WEEK…China Crackdown…Delta Variant…Earnings…TMT Pain…Inflows and August Flows…Seasonals Shift…

–CHINA…More headlines hitting today: U.S. SECURITIES AND EXCHANGE COMMISSION CHAIR GARY GENSLER SAYS HAS ASKED STAFF TO SEEK CERTAIN DISCLOSURES FROM OFFSHORE ISSUERS ASSOCIATED WITH CHINA-BASED OPERATING COMPANIES…SEC CHAIR GENSLER SAYS NEW DISCLOSURES WILL BE REQUIRED FOR CHINESE COMPANIES BEFORE REGISTRATION STATEMENTS DECLARED EFFECTIVE

XI…Has stabilized…for now…

–DELTA VARIANT…*MORE THAN 110,000 VACCINE BREAKTHROUGH CASES IDENTIFIED IN U.S.: BBG…110K break through cases / 164M vaccinated = 0.0671% infection rate among fully vaccinated…

Global Health Basket (GSXUPAND)…continues to fade…sitting right on the 200dma of 137.22…

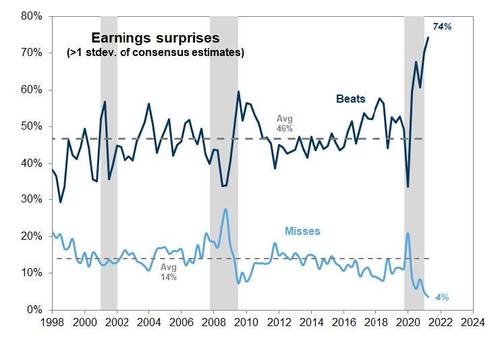

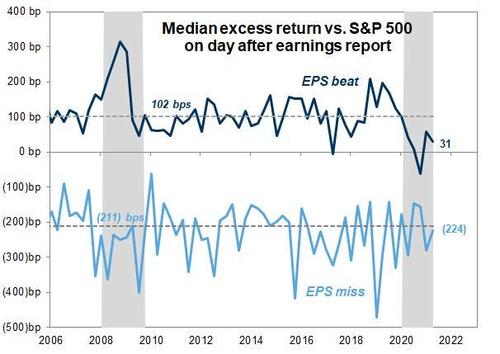

-Q2 EARNINGS…This week was the busiest earnings week in the history of the U.S. stock market with 51% of S&P’s cap reporting. Next week the action slows significantly with just 12% of cap reporting. We are STILL seeing the highest percentage (74%) of companies beat street wide earnings ests (by >1SD) in the 20+ years that we have tracked this data (well ahead Q121 which was previous best at 61%) . Very few (4%) companies are missing. However, beats are NOT being rewarded and the few misses we have seen are being punished. I will be keeping a close eye on AMZN today already down 7% pre mkt (clearly should weigh on overall mkt sentiment especially after FB closed down 4% yesterday).

-296 S&P500 companies have reported 2Q results (76% of total market cap). So far 74% of companies reporting have beat street wide earnings estimates by >1SD (significantly higher than 46% historical avg) whereas only 4% have missed estimates by >1SD (significantly lower than historical avg of 14%).

–Firms beating earnings ests by at least 1SD have only outperformed the S&P 500 by 31bps on the trading session directly after reporting (vs a historical avg of +103bps of outperformance). Companies missing earnings ests by at least 1 SD have underperformed the S&P 500 by -224bps, which is worse than historical avg of -211bps of underperformance.

–TMT (Callahan)…‘Where does Tech’ go from here? … a bit of a buzz / debate around the risk of Tech losing its leadership as soggy T+1 price action for the ‘FAAMG’ group (.. nothing new .. ) and NDX -75bps today leave the group without a catalyst & fresh off a torrid stretch (up ~20% in 6-wks) … to balance that nervous energy, it is worth noting that the backdrop should still prove supportive for ‘Big Tech’ (low rates, hybrid WFH/re-opening, moderating US growth, big cash balances, etc), though likely more ‘intra-FAAMG’ rotations and stock selections. To level-set on YTD moves: GOOGL +55%, FB +31% (vs EPS revisions up ~25% YTD), MSFT +29%, AAPL +10%, AMZN +5%. More TMT earnings to come Monday…

-WFH Theme as a theme has NOT aged well during earnings – AMZN, NFLX, CTXS to name a few .. next week, watch Video Games (px action today = indicative of positioning / what’s priced in?), streaming names (FSLY, AKAM, etc) and E-Commerce .. keep an eye on: GSTMTWFH / GSXUSTAY Index.

GSXUSTAY Index…Stalling at the top here…

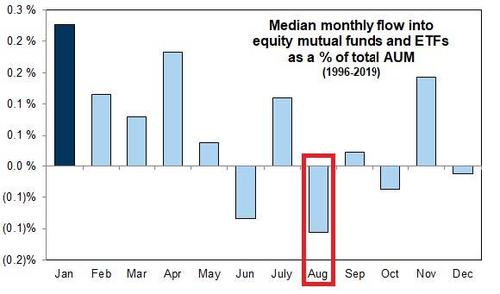

-INFLOWS CONTINUE (Rubner)…This week (week 30) global equities logged +$23.233 Billion worth of inflows ~ right in line with the YTD run rate. In 2021, there has been +$636.30 Billion YTD inflow into global equity funds, +$518 Billion inflows or 82% passively and +$118 Billion inflows or 18% passively. Global Equity inflows are annualizing +$1.10 Trillion for 2021. This is not small and on pace for the largest annual inflow on record by 2.5x. There have been 143 US trading days this year, which means daily equity flows of +$4.443 billion inflows everyday “buying dip alpha” or $21.21 Billion per week.

-BUT OUTFLOWS IN AUGUST? Over the last 30 years, money flows change in August. I expect this year to be no different. August typically sees the largest outflow of the year. Even if there are no outflows, but the inflows stop, this will change the #BTD dynamic in the market. Detailed analysis below. Its vacation time now that earnings (which were faded) are behind us. Stay nimble in August, I am focusing on liquidity.

-SEASONALS SHIFT…We are coming out of one of the strongest periods of the year and heading into one of the worst – no surprise given the historical outflow dynamic. This runs us right into Jackson Hole.

-CRYPTO been catching a bit of a bid into and post the US equity close. Since 15:45 NYC time, XBT has rallied almost 6%. Not sure if this is noise or signal but something to keep an eye on.

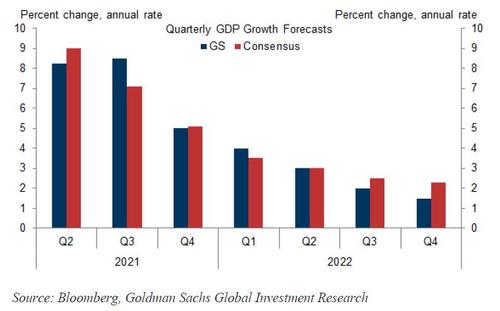

*NOTES IN CASE YOU MISSED…After Peak Growth: A Slightly Slower Service Sector Recovery (Walker) – Until a couple of months ago, GIR’s GDP growth forecast had been distinguished for the prior year by being well above consensus expectations, reflecting their optimistic view of the prospects for an early vaccination timeline and a strong economic recovery. But at this point, their forecast is instead distinguished from consensus expectations by the sharpness of the deceleration that they expect over the next year and a half, from 8.25%/8.5% during the Q2/Q3 mid-year boom all the way down to a trend-like 1.5-2% by 2022H2 (Exhibit Below).

After GDP Growth Peaks in Mid-2021, GIR Expects a Sharper Deceleration Than Consensus to a Trend-Like 1.5-2% in 2022H2

Corresponding to the downgrade to their growth forecast, they have also bumped up their unemployment rate forecast slightly from 4.2% to 4.4% at end-2021. GIR expects to learn considerably more about the prospects for labor market recovery from the July employment report, which should provide a test of the impact of seasonal adjustment irregularities and the early expiration of federal unemployment benefits in some states.

Tyler Durden

Sat, 07/31/2021 – 18:00

via ZeroHedge News https://ift.tt/3rJk6B0 Tyler Durden