How China Became The Big Winner Of The COVID Era

By Greg Miller, of FreightWaves,

When news first broke of the COVID lockdown in Wuhan, the initial prediction was: The virus will cripple the economy of China, which is the engine of global trade, and that will be terrible for the shipping business.

Eighteen months and 3.9 million deaths later, the pandemic has had the opposite effect. Ships are full and, ironically, the country where the outbreak began has seen the biggest and broadest economic upside.

Chinese exports are now much higher than they were before the outbreak, courtesy of pandemic-induced changes in consumer behavior and COVID-driven fiscal stimulus from the world’s governments.

The only major economy to grow in 2020 was China’s. GDP growth continued in Q1 2021. Business is at an all-time high for Chinese liner operators, shipyards and container-equipment factories.

U.S. demand for Chinese exports is increasingly urgent as sales continue to offset inventory rebuilds. Trade has revved up in the opposite direction, as well: China is buying more American soybeans, crude oil, propane and natural gas.

Pandemic boosts Chinese trade

Nerijus Poskus, vice president of global ocean at Flexport, recently told American Shipper, “Back in 2020, if you’d asked 100 economists what would happen when COVID first hit China, all of them would have probably said that economies will go down, consumption will go down and prices for shipping will fall. Well, all of them would have been wrong.”

Very wrong: China’s export value in January-May averaged $247.5 billion per month, up 29% from January-May 2019, pre-COVID, according to the country’s customs data.

As more goods are going out, supporting container-shipping demand, more raw materials and commodities are coming in, employing tankers, bulkers and gas carriers. China’s import value averaged $206.8 billion per month in January-May, up 25% from the same period in 2019.

Turning trade into even more business

When demand for ocean transport surges, so too does demand for shipbuilding, container manufacturing and global liner operations. The U.S. has virtually no presence in these sectors. China is the world leader in the first two and a major force in the third.

As of Jan. 1, 2020, pre-COVID, Chinese shipyards had commercial orders totaling 29.8 million compensated gross tons (CGT), according to U.K.-based valuation and data provider VesselsValue. At that point, China — which was already the world’s largest shipbuilding nation — accounted for 38.7% of the global orderbook.

The Chinese yards’ orderbook was 26.9 million CGT as of Thursday, according to VesselsValue. While that is down from pre-COVID (orders dropped worldwide in Q1-Q3 2020 and partially rebounded thereafter), China’s share of the global orderbook is now 40.5%, even higher than it was before the pandemic.

China’s dominance is far more extreme in container-equipment manufacturing. Over 96% of all the world’s dry containers and 100% of reefer containers are manufactured in China. Factories produced 2.66 million twenty-foot equivalent units (TEUs) of containers in the first five months of this year, according to data from U.K.-based consultancy Drewry.

“I would be surprised if the 5-million-TEU mark is not exceeded in 2021,” commented John Fossey, Drewry’s head of container equipment and leasing research. The previous record was 4.42 million TEUs in 2018. If 5 million TEUs were produced this year, it would represent a 61% increase compared to last year and a 77% increase versus 2019.

In the liner sector, China’s COSCO Group is the world’s fourth-largest container player, with a fleet capacity of 3 million TEUs, according to Alphaliner. Like all ocean carriers, COSCO is reaping historic profits from COVID-era consumer demand. The shipping division of COSCO posted a profit of $2.7 billion for Q1 2021, more than it earned in all of last year.

China is now the world’s second-largest shipowning nation, behind Japan, according to VesselsValue. During the pandemic, China passed Greece to move up from third to second place.

Containerized imports from China

The ships at anchor waiting to unload at California ports highlight the strength of demand for Chinese goods.

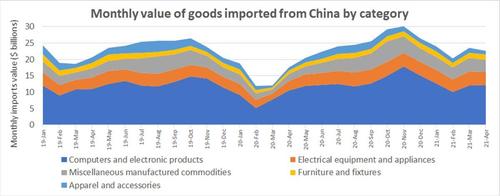

The value of America’s goods imports from China averaged $37.7 billion per month in January-April, up 8% from the same period in 2019, pre-COVID.

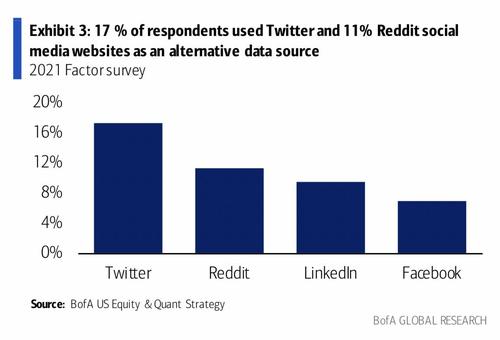

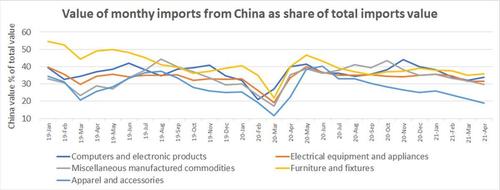

To gauge U.S. importer exposure to China, American Shipper analyzed Census Bureau data on five categories of imports from China transported by container: computers and electronic products, electrical equipment and appliances, furniture and fixtures, apparel and accessories, and miscellaneous manufactured commodities.

The combined value of imports in these categories rose 10% in January-April versus the same period in 2019. The computer/electronics segment — the largest of the five categories by value — was up 10%, electrical equipment 17% and miscellaneous manufactured commodities 40%. Furniture was down 11% and apparel was down 29%.

Despite all the talk of supply chain diversification over the years, American sourcing remains very China-centric. In January-April, China’s average share of total U.S. import value of furniture was 37%, computers 35%, electrical equipment 33%, miscellaneous manufactured goods 33% and apparel 22%.

U.S. importers reliant on Chinese sourcing face a new headache. The recent COVID outbreak hitting operations in the Chinese port of Yantian and surrounding ports in June will have a major impact on trade flows going forward. Yantian and surrounding ports handle about one-quarter of China’s containerized exports to America.

Ocean carrier Maersk told customers that “both the extended duration of the disruption and the sheer number of sailings that had to omit calling Yantian” mean that it will take “weeks if not months to recover.”

“What should not be understated is the sheer magnitude of the task ahead as peak season volumes continue to ramp up,” warned Maersk.

US commodity exports to China recover

Amid the trade turmoil initiated by the Trump administration, China retaliated by curtailing purchases of American agricultural goods and energy commodities such as propane, liquefied natural gas (LNG) and crude oil.

The good news is that China is buying more American exports again.

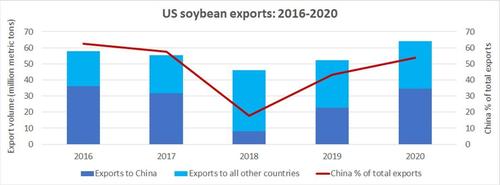

Soybeans — China’s most important role as a buyer is in the soybean market. U.S. soybean exports to China collapsed in 2018 due to trade politics and the African Swine Flu’s impact on China’s pig population (soybeans are used to feed pigs).

Data from the U.S. Department of Agriculture shows that Chinese buying recovered by 2020, when 54% of U.S. soybean exports went to China. Total U.S. exports jumped to a record 64.1 million metric tons last year. Chinese buying continues this year, with the country taking 47% of Q1 2021 U.S. export volumes.

U.S. soybean exports to China have recently helped propel rates for dry bulk ships in the Panamax class (bulkers with capacity of 65,000-90,000 deadweight tons) to decade highs.

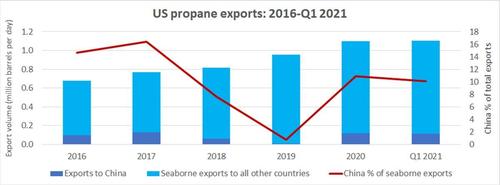

Propane — In the tanker markets, China is an important destination for American propane. The propane is transported aboard large 84,000-cubic-meter liquefied petroleum gas tankers and is used by China for residential consumption and as a feedstock for plastics manufacturing.

U.S. propane sales to China evaporated in 2019 during trade hostilities. But in full-year 2020 and Q1 2021, China came back to the market, taking 10% of U.S. seaborne propane exports, according to Energy Information Administration (EIA) data.

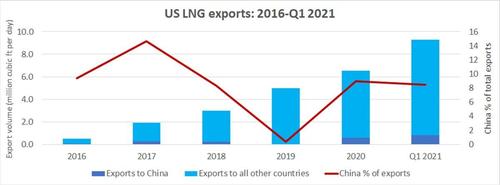

LNG — China overtook Japan last year to become the world’s largest importer of LNG. China stopped buying U.S. LNG in 2019 amid trade tensions, but accounted for 9% of America’s LNG exports last year. In Q1 2021, 8% of U.S. exports went to China, according to EIA data.

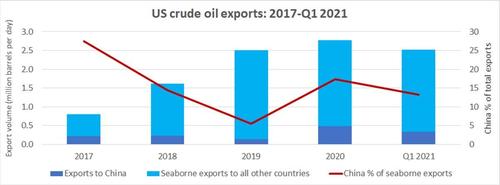

Crude oil — Chinese imports from America play a key role in demand for ships called very large crude carriers (VLCCs, tankers that carry 2 million barrels of oil). VLCC demand is measured in ton-miles: volume multiplied by distance. The sailing distance from the U.S. Gulf to China is more than double the distance from the Middle East to China. Thus, the more China imports from the U.S. instead of from the Middle East, the better for VLCC rates.

China accounted for just 5% of U.S. export volume deliveries in 2019, at the height of the trade war. Its share bounced back to 17% in 2020 and 13% in Q1 2021, according to EIA data.

Trade balance no better than pre-trade war

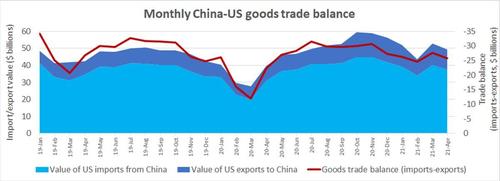

Overall, U.S. goods exports to China averaged $11.6 billion per month in January-April, up 38% from the same period in 2019.

The U.S.-China goods trade balance (exports minus imports) averaged minus $26.1 billion in the first four months of this year — slightly better than in January-April 2019, pre-COVID, due to the higher U.S. exports.

As for the effectiveness of the Trump administration’s tariffs, which have not been reversed by President Joe Biden, the average goods trade balance was minus $25.5 billion in January-April 2016, before Donald Trump’s election.

In the same period this year, the balance was 2% higher, in favor of Chinese exports to America.

Tyler Durden

Sat, 07/03/2021 – 20:30

via ZeroHedge News https://ift.tt/3jFgb6k Tyler Durden