Authored by Scott Galloway via No Mercy / No Malice blog,

On Wednesday, trading app Robinhood agreed to pay $70 million in fines and customer reimbursements to settle a FINRA investigation. That followed a $60 million fine in December to the SEC for failing to properly disclose its order-flow revenue, and a separate $1.25 million fine to FINRA.

These are record fines … that amount to less than 0.5% of the firm’s valuation.

On Thursday, the firm responded to regulatory bodies deeming them “reckless” by filing an S-1, initiating the IPO process.

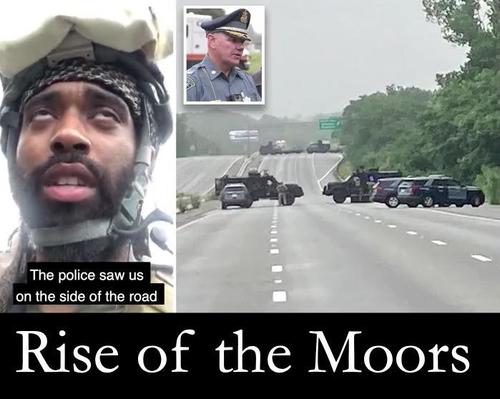

In sum, these aren’t fines but a validation of the company’s business model and evidence that, each day, there is (another) insurrection in D.C. However, this mob drives Teslas and is on Clubhouse.

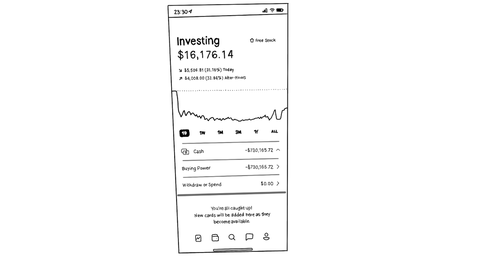

The S-1 reveals Robinhood’s revenue quadrupled in 2020, to nearly $1 billion, and the firm registered over a half a billion in revenue in just the first quarter of 2021. After eking out a small profit in 2020, the company incurred $1.5 billion in losses when meme-stock mania overwhelmed it.

The prospectus also discloses that Robinhood anticipates paying another $15 million fine to New York’s trading regulator, and that it’s currently under investigation by an alphabet soup of federal agencies and authorities in California, New York, and Massachusetts. Here’s a sentence you typically don’t find in an S-1: “[O]ur Co-Founder and CEO, Vladimir Tenev, among others, have received requests for information, and in some cases, subpoenas and requests for testimony, related to investigations….” And in the “surprising nobody” category, Robinhood will have a two-tier stock structure, with insiders (including Tenev) holding shares with 10x the voting power of shares sold to the public so they can continue to pursue a strategy of regulatory overrun regardless of what shareholders think.

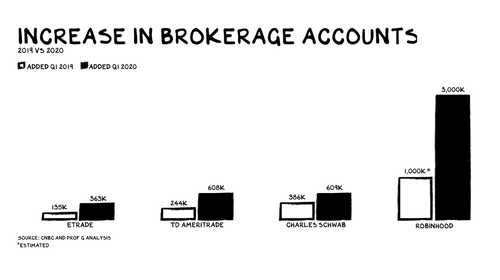

There are a lot of great things about Robinhood and online trading, including onboarding an entire generation into equity investing.

(Disclosure: I am an investor in rival investment firm Public, which does not sell order flow, but I was on record with my criticisms of Robinhood before I’d even heard of Public.)

My concern with Robinhood – i.e., I believe these guys are mendacious fucks – is more fundamental.

The company’s mission to “democratize finance for all,” is similar to Pablo Escobar saying his mission was to “democratize cocaine.”

Providing people access to the tools of finance is a worthwhile mission.

Just this week on the Prof G Pod, I interviewed Pierpaolo Barbieri, the CEO and founder of Ualá, an Argentine attempting to reach the 50%+ of Argentines who are unbanked.

Robinhood, on the other hand, is the Sith Lord of finance – monetizing the addictive nature of day trading. Day trading is gambling. And it doesn’t pay off. I wrote about this a year ago, when a 20-year-old Robinhood customer killed himself after the app mistakenly suggested he was down $730,000. We’re reprinting that post below because this leopard has not changed its spots, only becoming bigger, bolder, and more menacing.

In response to criticism, Robinhood removed the confetti animation “celebrating” each trade. And it claimed it was increasing educational support on the app and instituting more rigorous criteria for eligibility for options trading. The company now has 2,700 customer support staff, triple the number it had in March of 2020 … underwhelming, as the company has roughly the same number of reps per account it did last March. The Wall Street Journal didn’t mince words in a recent analysis: “Robinhood Has a Customer Service Problem.” (Speaking of tech addiction, Adam Alter, who wrote the bestselling Irresistible on that topic, is teaching Section4’s next Product Psychology & Strategy Sprint.)

Our analysis of the S-1 reveals that “addict” does not appear anywhere. The filing does mention the suicide, but only as a disclosure of litigation filed against the company. (Robinhood reached a settlement with the young man’s family.) “Protect” is used 37 times, compared to 87 times for consumer lender Affirm and 65 times for crypto exchange Coinbase. The phrase “compound interest” appears exactly zero times, while “trade” shows up 191 times. And then there are all those fines and investigations. “Fine” appears 47 times in Robinhood’s S-1, vs. 28 in Coinbase’s and 30 in Affirm’s.

Robinhood traders invest overwhelmingly in highly speculative assets: Dogecoin accounted for 34% of Robinhood’s cryptocurrency transaction-based revenue in Q1 2021, and 6% of the trading firm’s overall revenue in the same period. Dogecoin shed 30% of its value when “dogefather” Elon Musk took the SNL stage. Trades in the private market(s) reflect a valuation of $55 billion. That feels right. Pablo Escobar was believed to have amassed wealth of $64 billion.

* * *

[The following was originally published June 19, 2020.]

Addiction is the inability to stop consuming a chemical or pursuing an activity even though it’s causing harm.

I engage with almost every substance or behavior associated with addiction: alcohol, drugs, coffee, porn, sex, gambling, work, spending, devices, and social media. I’ve abused all of them, but don’t think I’m addicted. On a balanced scorecard, these substances and behaviors, abuse and all, have been a net positive in my life, even @twitter.

Most disease and hardship for our species has been a function of scarcity — too little salt, sugar, fat, approval, safety, opportunities to mate. As a result, when we find these things, our brain produces the ultimate reward, the pleasure hormone dopamine. And it makes sense. Nature rewards behaviors that ensure the propagation of the species.

The assembly line, processing power, and Amazon Prime have not only met the minimum thresholds for survival but created a new threat to our species: superabundance. Diabetes, income inequality, and fake news — all are a function of our belief that more is better. Jeff Bezos capturing and hoarding the GDP of Norway doesn’t make sense for the species, but his instincts (fear of starvation, wielding power) reign supreme.

Survival, propagation, and consumption should result in a next generation that’s smarter, faster, and stronger. Where things have come off the rails is a function of our innovation economy moving faster than our instincts. Historically, humans have engaged in activities that have natural stopping cues — the end of a chapter, the end credits. Platforms like Facebook, Instagram, and Netflix have systematically eradicated these cues. Just as casinos are deliberately laid out without hard angles: It’s all one continuous space and you keep moving through it, on to the next game.

Technological progress lapping the calibration of our instincts culminates in an endless scroll. We’re unable to find the off switch. Unlike our parents and grandparents, for us dopamine release no longer depends on sacrifice, engagement, or grit, but on sitting still, as in 15, 14, 13 seconds episode 5 of Killing Eve will begin. There are more filtered photos, more porn, more equities, more margin, more dopa — more time without the nuisance of needing to engage in … life.

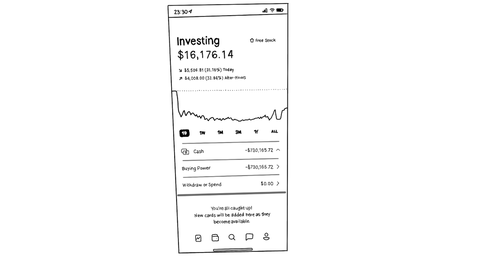

The most recent crack dealers are online trading platforms (OTPs). What does endless scroll look like on a trading platform?

-

Confetti falls to celebrate transactions.

-

Candy Crush interface.

-

Gamification: Users can tap up to 1000x per day to improve their position on the waitlist for Robinhood’s cash management feature (essentially a high-yield checking account on the app).

The Ratio

Our institutions (courts, Congress, the SEC) are supposed to slow our thinking so our reflexive instincts are checked and we can decide not to discriminate, not to pour mercury into the rivers, and not to let a bankrupt car rental firm (Hertz) issue shares bound to be worthless. You lose, they win.

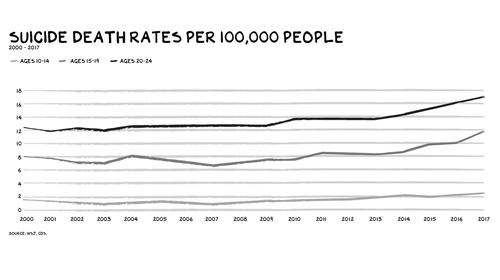

Technological change is vastly outpacing our species’ ability to adapt to an endless barrage of stimuli. This discrepancy in modulation has exploded our levels of teen depression and social chaos. We’re in a Supermarine Spitfire, accelerating every day, hoping the fuselage holds together as we approach the sound barrier — streaming 31 seasons of The Simpsons, lifelike video games, ubiquitous porn of increasing extremes, high-def documentation in real time of the party your 15-year-old daughter wasn’t invited to, social media algorithms fueled on emotion vs. veracity, and immediate approval of margin for a “bull put spread.”

A Mess

I was a fu**ing mess yesterday after learning of the suicide of Alexander Kearns, a 20-year-old from Naperville, Illinois, who was interested in the markets and began trading stocks. Alex mistakenly believed he was down $730,000 after trading options on the Robinhood app and took his own life. We don’t know what other factors were at play here, and young men taking their own lives after losing money in the market is not a new phenomenon.

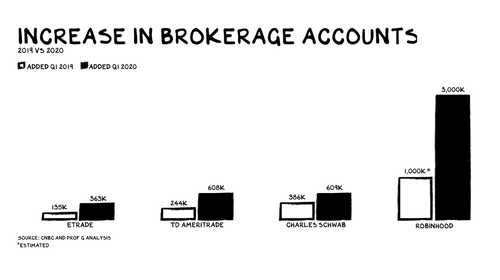

Facebook and Twitter do what CNN and Fox have been doing for decades, but better. I’m afraid Robinhood might become an addictive platform — Instagram for trading. Robinhood users skew young (32% of visitors are between 25 and 34). The firm reported 3 million new accounts in Q1 2020. Half were first-time traders. In addition, with Vegas and sports wagering all but shut down, OTPs have become the place where an emerging gambling addiction can take root and/or a rehab facility where your sponsor is a dealer.

Learning to invest and understanding the markets are good things, as is connecting with friends online … to a point. Social media and gambling have the same addictive psychological mechanism: variable rewards — when you keep performing an action in hopes of getting a possible but unlikely reward. This is the type of behavior that’s the most addictive and hardest to stop. Robinhood’s management and investors have taken cues from Big Tech and made a conscious decision to disregard the well-being of our youth for personal enrichment.

Some additional data on the surge in online trading:

-

Excessive trading may be triggered by an addictive process.

-

12% of all trading activity is from day traders, yet day traders are only 1.6% of all profitable traders.

-

Men trade more than women, and unmarried men trade more than married men.

-

Stock market crashes have been linked to upticks in suicide.

-

Investors with a large differential between their existing economic conditions and their aspiration levels hold riskier stocks in their portfolios.

Most articles will focus on what we, Americans, view as the profound risk with the surge in rookie online traders … that the markets might go down. Most market tops coincide with retail investors entering. We haven’t, to my knowledge, seen the scale of a market crash driven by twentysomethings investing government rescue funds, levered up via preapproval on their smartphones.

Our elected officials and gross idolatry of money and innovators have overrun the institutions charged with slowing our thinking and keeping our kids safe. Joe Scarborough put it well: “Mark, Sheryl, and Jack, you have revealed yourselves to be vapid vulgarians who put at risk Americans’ health, racial justice, fair elections, and basic truths.”

Where do we turn? The bulk of the pressure to protect kids from device addiction falls on parents — limiting use (severely) and getting other parents at school to limit use as well, so kids don’t feel they’re an exception. It’s difficult, and it needs to be done. An “electronics fast,” perhaps for the whole family, can allow the nervous system to reset. Lowering your dopamine threshold allows a smaller amount of pleasure to be satisfying.

The threat of addiction has been slowing our household down. One of our sons demonstrates behavior consistent with device addiction. It’s terrifying. Everything he does, says, and works toward, is in pursuit of the dopa hit waiting on his iPad. His mom and I are doing what most parents would do — reading, seeking outside help, limiting use. But more than anything, we’re trying to slow things down. Time with him, especially outdoors or with books. Time in bed with him telling him stories about his grandfather becoming a frogman in the Royal Navy. Slowing everything down. It appears to be working.

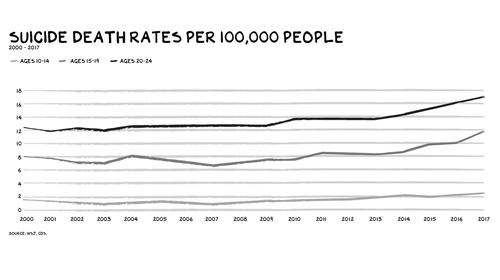

I see Alex Kearns, and I see my oldest son. A nerd, with a big smile, fascinated by the markets and seeking dopa hits. I can’t imagine the pain of that family. I can’t imagine how we’ve lost the script, letting the meaningful, innovation and money, trump the profound, our kids. The youth suicide rate has increased 56% in a decade. Girls between 10 and 14 had a tripling of self-harm episodes between 2009 and 2015. Teens who are on social media for 5+ hrs a day are twice as likely to be depressed than those who are on for less than an hour.

Is it any wonder Tim Cook doesn’t want his nephew on social media? If he wasn’t Tim Cook, would he also say, I don’t want him to have an iPad either?

The weapons are our phones and tablets, and the bullets are social media firms headed by sociopathic oligarchs. And now, we may have a new menace preying on young men: online trading platforms.

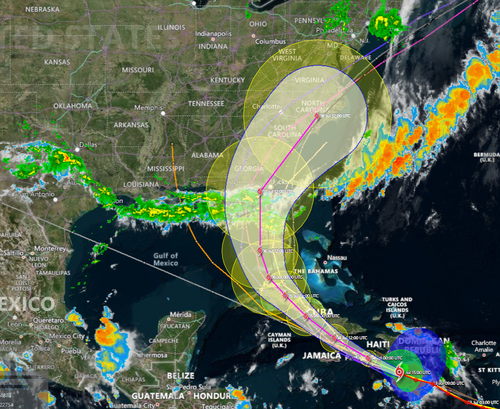

We are a virus-ravaged nation where curfew alerts are sent to our phones. Innovation has become synonymous with exploitation. We find solace in the market being high. But the market is not a reflection of the economy or progress — it is increasingly driven by a few firms’ ability to arbitrage the gap between the pace of technology and regulation. It’s depressing. What to do? I’ll check my likes, mentions, and stocks.