Goldman’s Top 10 Takeaways From July

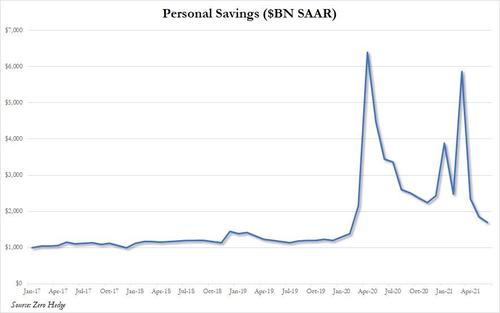

Despite Friday’s modest pullback in the market, stocks managed to close higher for a sixth consecutive month, the longest such stretch since 2018, as investors digested another slew of earnings (despite near record beat, the adverse price reaction for most companies showed that stocks had been priced to perfection, if not beyond), a continued rise in virus cases in the US, a benign Fed, and a growth outlook that has now clearly created in the post-pandemic era, and will soon require another major fiscal stimulus (and/or lockdowns) as US consumer have now burned through most of their post-covid savings.

The month of July has been an active one as corporate earnings have taken a backseat to another surge in COVID cases, a policy shift from China, and a quick fade of inflation fears.

Here, courtesy of Goldman’s Chris Hussey, are the top 10 takeaways from July:

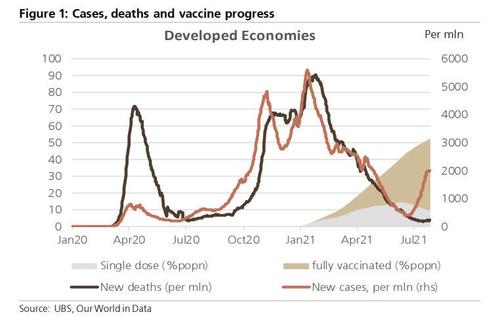

1. The vaccine didn’t kill the virus but it has kept people out of hospitals. The vaccine didn’t kill the virus but it has kept people out of hospitals (so far).

The undercurrent of rising COVID cases and its implication for mobility, the services sector recovery, and global growth sustainability was prevalent throughout the month of July — although it did little to suppress the appetite for risk assets. As shown above, new case growth has already peaked in the UK and Spain (where the delta variant emerged in the spring) and Goldman analysis confirms that vaccinations have been a key factor that has kept hospitalizations low.

2. Peak growth may still be ahead of us (or already occurred). As the service sector is slowed by rising cases of the virus, the remainder of the global economic recovery will be more gradual writes Daan Struyven in “Global Reopening: Slower, but Not Slow.” Notably, since the emergence of the Delta strain in early April, the gap between our 2021 global growth forecast and the median consensus forecast has narrowed from 1pp to 0.3pp, reflecting consensus upgrades and GS downgrades. And our economists lowered our US 2H21 consumption growth forecast as it is becoming apparent that the service sector recovery in the US is unlikely to be as robust as we had expected in “After Peak Growth: A Slightly Slower Service Sector Recovery.” We also see this sluggishness continuing into 2022 to a trend-like 1.5-2% by 2H22, a sharper deceleration than consensus expects. The drivers: fewer people returning to work in the office and rising concerns around the Delta variant. Finally, we saw evidence of this slower growth trajectory Thursday when 2Q GDP growth came in well below expectations.

3. China has other priorities. This month also saw China ramp up its regulatory oversight of businesses. Recent regulations have signaled that the Chineseauthorities are prioritizing social fairness and stability over the capital markets inareas that are deemed public goods or important to strategic policy goals writes Kinger Lau in “Investing under a new regulation regime” (see also Goldman Downgrades China Stocks After Clients Ask If They Are Even “Uninvestable” Any More)

4. Corporate profitability remains robust. 2Q earnings season has been largely positive so far. The big banks posted unsurprisingly strong results. And this week, the market’s premier mega-cap Tech stocks all reported with most posting solid results although the market reaction was not particularly positive (4 of the 6 FAAMG+T stocks are down on the week).

5. Inflation may indeed be temporary and not 1970’s style. On the back of the 2Q21 GDP report, Goldman economists actually lowered our sequential inflation forecast for the first time in a long time as they are “seeing signs of fading inflation pressures already as the recovery ‘matures’ (see And Now The Hangover: Goldman Sees Sharp Deceleration In US Economic Growth In 2022). And indeed, core PCE inflation reported Friday came in at+0.45% for June, down from +0.54% in May. For many investors, inflation pressures likely pose a greater headwind to risk assets than rising cases of the virus, making Friday’s report a bit of a “welcome relief” according to Goldman.

6. There’s no place like stocks. And against this mix of catalysts, the S&P 500 returned ~2.5% for the month and ~17.5% ytd (before dividends). Goldman’s David Kostin wrote in last week’s “US Weekly Kickstart” that the combination of vaccinations, equity demand from households and corporations, and attractive relative valuations will support equity inflows and prices. Goldman recommends tactical positions in virus-exposed cyclicals alongside longer-term investments in high-quality secular growth stocks.

7. There’s no place like Treasuries. Yields on 10-year US Treasuries have settled into a new lower range around 1.25%, driven there following the Fed’s June meeting and rising market sentiment, perhaps, that the Fed will successfully suppress any long-term inflation impulses in the economy before they get out of hand.

8. There’s no place like Commodities. July started off with an OPEC+ meeting that didn’t end but eventually the world’s biggest producers reached an agreement. And then the market sold off sharply as concerns around rising virus cases dominated sentiment. Goldman’s commodities team sees oil reaching $80/bbl in 4Q. Meanwhile, copper is up over 5% for July but and Goldman sees even more upside as China production restrictions should curtail supply without an offsetting adverse impact on demand from the virus.

9. Credit is a bit more complicated. The current combination of tight spreads, low yields and the low level of implied volatility warrants a dose of hedges in credit portfolios writes Goldman credit strategist Lotfi Karoui in “Where We Stand in the Credit Cycle.” Corporate fundamentals are unusually strong at this point in the cycle but valuations are also far more stretched.

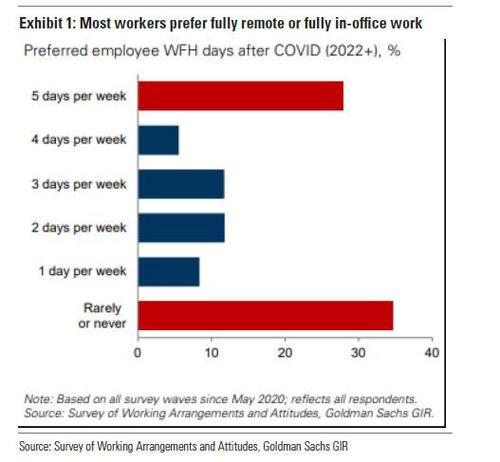

10. Back to work meets back to the kitchen table. Allison Nathan highlights how a hybrid model of some days in the office and some days working from home is likelyto emerge across most office-based sectors in Friday’s Top of Mind, “The Post-Pandemic Future of Work.” Surveys currently indicate that employers are on pace to allow employees to work from home 20% of the time from now on. And interestingly, a recent survey revealed that the two biggest categories of people are those that want to come back to the office every day (30%) and those that rarely or never want to return to the office (35%).

A realization that the work-adjacent economy is likely to recover at a slower pace than we originally anticipated is behind Goldman’s lower US GDP growth forecasts as well (see above).

Tyler Durden

Sun, 08/01/2021 – 16:45

via ZeroHedge News https://ift.tt/3rUGyHG Tyler Durden