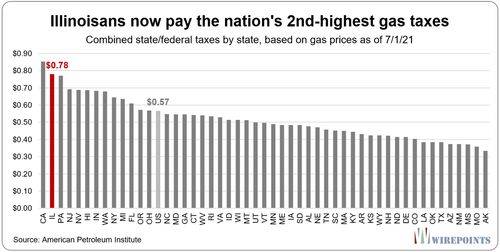

Higher Gas Prices Mean Higher Taxes: Illinoisans Now Pay The Nation’s 2nd-Highest Gas Taxes

By Ted Dabrowski of Wirepoints

As gas prices jump in Illinois, so do the gas taxes Illinoisans must pay. Illinois is one of just four states to impose a general state sales tax on gasoline, and that’s helped push Illinois’ gas taxes to the 2nd-highest in the nation, according to the American Petroleum Institute.

Illinoisans pay an additional 6.25% for every gallon of gas, on top of the standard excise taxes that were doubled in 2019. Hawaii, Indiana and Michigan are the only other states that apply their general sales taxes to gasoline.

Just over a month ago, Wirepoints reported that Illinois gas taxes were still the nation’s 3rd-highest, a position the state has held since lawmakers hiked the excise tax in 2019. But this summer’s higher gas prices have pushed Illinois to second place as of July 1st, surpassing Pennsylvania’s own sky-high taxes by about a cent.

Now Illinois is only behind California, whose residents pay both the highest gas prices and gas taxes in the nation. Illinoisans, meanwhile, paid the 11th-most for a gallon of gas as of July 30th, according to AAA.

For comparison, Wisconsin and Iowa’s gas prices are about 40 cents lower than Illinois’, while Kentucky and Missouri’s prices are about 50 cents cheaper. Indiana’s prices are 30 cents lower.

Chalk this up as another failed policy in Illinois that causes Illinoisans to cross the border to spend their money in neighboring states.

Tyler Durden

Sun, 08/01/2021 – 19:00

via ZeroHedge News https://ift.tt/3zZisOJ Tyler Durden