Morgan Stanley: Yields Are “A Ways Off” Where They Should Be

By Guneet Dhingra, Head of US Interest Rate Strategy at Morgan Stanley

Citius, Altius,Fortius – the Olympic motto – which translates to Faster, Higher, Stronger, might as well be our current motto for Treasury yields. We think that the Treasury market will price in a faster pace of rate hikes, resulting in higher US 10-year yields, consistent with a stronger economy.

We think that 10-year yields are too low versus our fair value estimate at ~1.60%, in large part due to positioning unwinds in recent weeks that have magnified the impact of negative COVID-19 headlines. In our view, yields do not appropriately reflect the strong US economy, or the Fed’s stance. With cleaner market positioning, our economists’ expectations for strong labor market and inflation data, and our base case for a deficit-funded infrastructure package, we see yields rising in the coming weeks.

To take a view on Treasury yields, it is important to understand why yields fell in the first place. Our conversations with a broad range of investors,and our analysis of positioning data, confirm the important role of positioning in exacerbating the decline in yields. As 10-year yields fell last month, open interest – i.e., the number of open trades on 10-year Treasury futures – declined. This tells us that investors were not adding new positions based on a re-rating of the economy, or concerns about the Delta variant. Instead, they have been unwinding unprofitable older trades, originally positioned to play for higher yields.

We think that it is important to avoid the trap of forcibly fitting a narrative to lower yields, a trap investors dealt with merely four months ago: Treasury yields rose sharply in March, largely due to selling from Japanese investors, based on their fiscal year-end considerations. Yet, most investors mistook the rise in yields as validation for a super-hot economy, and the consensus bought into the idea that 10-year yields were headed above 2%. We cautioned investors that yields had overshot relative to the economic reality. Over the coming weeks, economic data in the US couldn’t keep up with unrealistic expectations, and 10-year yields started grinding lower.

Despite the lessons from March, July 2021 looks just like March in reverse. This time, investors are fitting a narrative of excessive pessimism to lower yields. Many of these narratives don’t stand up to scrutiny. Let’s take the concern about the Delta variant. In the UK – a reasonable template for the US – hospitalizations remained low as cases spiked, the economy reopened anyway, and ultimately cases have started receding, suggesting overstated downside risks from COVID- 19. Reassuringly, Fed Chair Powell concurred with this assessment at the July FOMC meeting.

Another misleading narrative is that the market is pricing in a Fed policy mistake. But this doesn’t match up with record-low real yields and very high inflation breakevens, or even strength in risk markets. Some cite a decline in the economy’s long-term equilibrium rate – the r* – to fit the price action, oddly at a time when both growth and inflation are running at multi-decade highs. With a lack of a credible narrative to explain the large decline in yields, and the demonstrable role of positioning, we see a good case for higher yields from here.

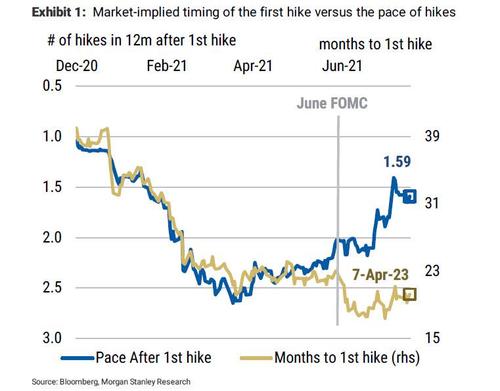

How high can Treasury yields go? One useful way to think about Treasury yields in the current environment is to link it to (1) the timing of the first rate hike, and (2) the pace of hikes thereafter:

Currently, 10-year yields imply that markets see the first rate hike in March 2023, and a pace of ~1.5 rate hikes per year thereafter. We think that this implied pace is too low, especially when one looks at the June dot plot, where six FOMC members pencilled in a pace of three or four hikes a year (two members at two hikes a year, and ten members unknown).

Even when we build in conservative assumptions with respect to the June dot plot, that the Fed starts hiking rates in June 2023, and at a pace of 2-2.5 hikes a year – lower than what the dot plot suggests – our analysis suggests that the fair value for 10-year yields should be at ~1.60% today.

Which catalysts will drive yields higher? We think that strong economic data, starting with the July payroll report, where our chief US economist Ellen Zentner expects just above a million new jobs, could kick-start a move towards higher yields. And a smooth start to school reopening in August could further the case for a strong labor market. To add, we expect strength in shelter inflation, which would support the sustainability of inflation. An infrastructure package, where our head of public policy, Michael Zezas, expects a ~US$2 trillion deficit-funded package later this year, would further support a push to higher yields.

As we head into August, the seasonality for lower yields comes to mind. Our analysis shows that when yields are at their local lows heading into August, seasonality seldom works. With a similar set-up, we saw yields rise in August 2020, and we think that yields will rise in August 2021 as well.

Tyler Durden

Sun, 08/01/2021 – 15:30

via ZeroHedge News https://ift.tt/37ewa3O Tyler Durden